Blank W 147Q PDF Template

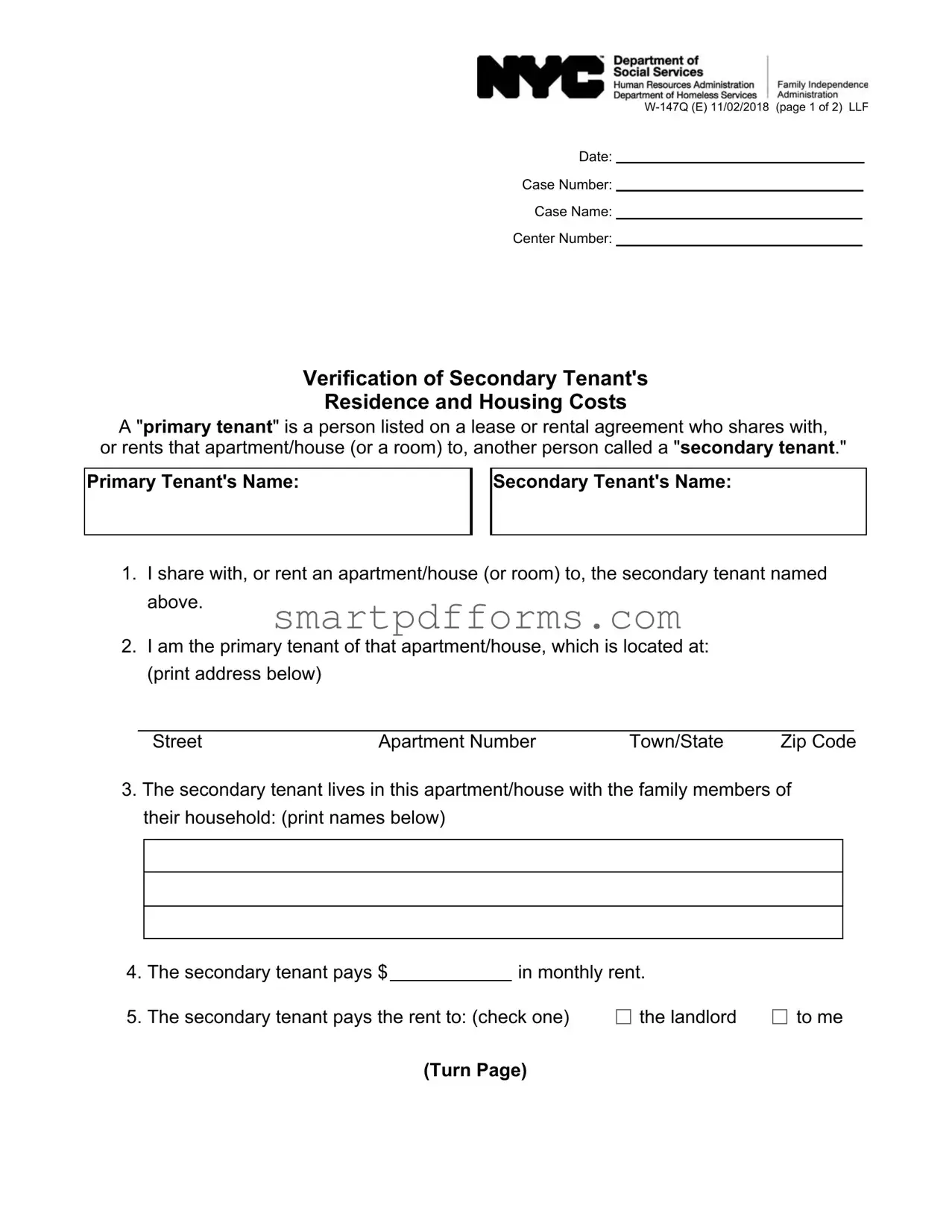

In the landscape of housing arrangements, the dynamics between primary and secondary tenants hold particular significance, especially when navigating the legal and financial responsibilities inherent in shared living spaces. The W-147Q form, introduced on November 2, 2018, serves as a crucial document in officially verifying the residence and housing costs of a secondary tenant, who lives with or rents from a primary tenant listed on a lease or rental agreement. This form meticulously catalogs essential information, starting from the acknowledgment by the primary tenant of their arrangement with the secondary tenant, to the location of the shared property, and down to the specific details concerning the rent amount and payment directives, including if utility payments are separate from the rent. Furthermore, it emphasizes the responsibility of the primary tenant to provide proof of their status through lease documents or similar, while also affirming the accuracy of the information under the weight of perjury. As a bridge connecting the personal agreements between tenants to the formal recognition by housing authorities, the W-147Q form encapsulates the vital aspects of shared housing agreements, ensuring clarity, legality, and fairness in these often complex situations.

Preview - W 147Q Form

Date:

Case Number:

Case Name:

Center Number:

Verification of Secondary Tenant's

Residence and Housing Costs

A "primary tenant" is a person listed on a lease or rental agreement who shares with, or rents that apartment/house (or a room) to, another person called a "secondary tenant."

Primary Tenant's Name:

Secondary Tenant's Name:

1.I share with, or rent an apartment/house (or room) to, the secondary tenant named above.

2.I am the primary tenant of that apartment/house, which is located at: (print address below)

Street |

Apartment Number |

Town/State |

Zip Code |

3.The secondary tenant lives in this apartment/house with the family members of their household: (print names below)

4.The secondary tenant pays $ in monthly rent.

in monthly rent.

5. The secondary tenant pays the rent to: (check one) |

the landlord |

to me |

(Turn Page)

Human Resources Administration |

|

LLF |

Family Independence Administration |

|

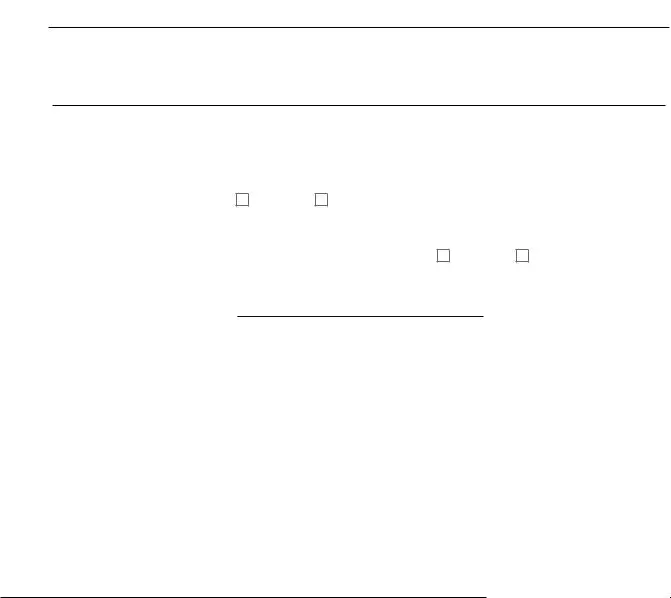

6. The secondary tenant's rent is paid to (must include address):

Name

StreetApartment Number Town/State Zip Code

7. Does the secondary tenant pay an amount separate from the rent for heating or air

conditioning? |

Yes |

No |

If no, does the secondary tenant pay an amount separate from the rent for other

utilities that are not heating or air conditioning? |

Yes |

No |

8.My telephone number is :

9.Attached is a copy of my lease or other documents proving that I am the primary tenant.

I affirm under penalty of perjury that the information I have given on this form is correct and complete to the best of my knowledge.

Signature of Primary Tenant |

Date |

Form Data

| Fact Number | Description |

|---|---|

| 1 | This form is identified as W-147Q (E) with an edition date of 11/02/2018. |

| 2 | It is used for the verification of a secondary tenant's residence and housing costs. |

| 3 | A primary tenant is defined as the individual listed on the lease or rental agreement who shares or rents the property to a secondary tenant. |

| 4 | The form requires the primary tenant to confirm they are the main leaseholder and to provide the residence's location. |

| 5 | The secondary tenant’s monthly rent amount and the payment recipient are specified in the document. |

| 6 | Details on whether the secondary tenant pays separately for heating, air conditioning, or other utilities are collected. |

| 7 | The primary tenant must provide their telephone number and attach proof of their status as the primary leaseholder. |

| 8 | Completion and signing of the form require affirmation under penalty of perjury that all provided information is correct and complete. |

Instructions on Utilizing W 147Q

Filling out the W-147Q form is an important step for primary tenants sharing their apartment or home with a secondary tenant. This form helps document the living arrangement and financial details of secondary tenants' residence and housing costs. It's crucial for maintaining transparent and legal housing agreements. Completing the form can seem daunting, but breaking it down into manageable steps makes it a more straightforward process.

- Start by writing the current date in the "Date:" field at the top of the first page.

- Next, fill in the "Case Number:" if known; otherwise, leave this blank.

- In the "Case Name:" field, enter the relevant case name if applicable.

- Input the "Center Number:" which pertains to your location or case, if known.

- Under "Primary Tenant’s Name:", write your full name as the primary tenant.

- In the "Secondary Tenant’s Name:" section, enter the full name of the individual renting from you.

- Check the box or clearly denote that you either share with or rent an apartment/house (or room) to the secondary tenant.

- Provide the full address of the property in question, including street, apartment number, town/state, and zip code under section 2.

- List all family members of the secondary tenant living in the residence under question 3.

- For question 4, specify the monthly rent amount the secondary tenant pays.

- Decide whether the secondary tenant pays rent directly to the landlord or to you and check the appropriate box for question 5.

- Fill out question 6 with the name and address of whom the rent is paid to. Ensure this includes the name, street, apartment number, town/state, and zip code.

- Answer questions 7 regarding whether the secondary tenant pays separate amounts for heating/air conditioning or other utilities. Check the appropriate "Yes" or "No" box for each part.

- Provide your telephone number in section 8.

- Attach a copy of your lease or other documents proving you are the primary tenant to the form.

- Sign and date the form at the bottom confirming the provided information is accurate to the best of your knowledge.

Once all steps are completed, make sure to review the form for accuracy and completeness. Submit it to the appropriate authority or administration as instructed. By completing the W-147Q form, you're ensuring a clear understanding and agreement between you, the secondary tenant, and the administering body overseeing your housing arrangements. This process highlights the importance of transparency and legality in shared housing situations.

Obtain Answers on W 147Q

- What is a W-147Q form?

- Who needs to fill out the W-147Q form?

- What information is required on the W-147Q form?

- The primary tenant's name, address of the housing unit, and telephone number.

- The secondary tenant's name and the names of the family members living with them in the unit.

- The amount of monthly rent paid by the secondary tenant, whom they pay it to, and whether it includes costs for heating, air conditioning, or other utilities.

- Verification, typically in the form of the lease or other documents, that the form filler is indeed the primary tenant.

- How is the rent specified on the form?

- Do secondary tenants have to pay for utilities?

- Is it mandatory to attach proof of tenancy?

- What legal affirmation does the primary tenant make by signing the W-147Q form?

- Where should the completed W-147Q form be submitted?

- Can the W-147Q form affect housing benefits?

- What happens if information on the W-147Q form is found to be false?

The W-147Q form, titled "Verification of Secondary Tenant's Residence and Housing Costs," is a document utilized to confirm the living situation and share of housing expenses of a secondary tenant. It is primarily used to establish a secondary tenant's occupancy and financial responsibilities within a rental arrangement, distinguishing them from the primary tenant who holds the official lease or rental agreement.

This form is to be completed by the primary tenant. This individual is the one listed on the lease or rental agreement and is responsible for sharing with or renting part of the apartment, house, or a specific room to another person, known as the secondary tenant.

Completing the W-147Q form involves providing specific details such as:

On the W-147Q form, the primary tenant must detail the exact amount of rent the secondary tenant is responsible for per month. Additionally, the form requires information on to whom the secondary tenant pays their rent, whether directly to the landlord or to the primary tenant themselves.

The form inquires whether the secondary tenant pays an amount separate from the rent for heating or air conditioning. If not, it further asks whether they pay separately for other utilities. The arrangement for utility payments, separate from the rent, needs to be clearly stated on the form.

Yes, it is obligatory for the primary tenant to attach a copy of their lease or other documentary evidence proving they are the rightful lessee of the property. This acts as verification of the claims made within the form.

By signing the W-147Q form, the primary tenant affirms under penalty of perjury that all information provided is accurate and complete to the best of their knowledge. This signature legally binds them to the statements made on the form.

The completed form should be submitted to the appropriate administrative body as directed, typically the Human Resources Administration or the Family Independence Administration, depending on the local jurisdiction's procedures.

Potentially, yes. Since the form verifies residence and housing costs for a secondary tenant, it could influence eligibility or calculations for housing benefits or assistance programs. It's vital to provide truthful information to ensure accurate assessment of benefits.

Providing false information on the W-147Q form can lead to serious consequences, including legal penalties for perjury. It's crucial for the primary tenant to ensure all information is truthful and accurate.

Common mistakes

Filling out the W-147Q form, known as the Verification of Secondary Tenant's Residence and Housing Costs, is crucial for documenting the residence and housing costs of a secondary tenant. However, common mistakes can lead to complications or rejections. By understanding and avoiding these errors, individuals can ensure a smoother process.

Not providing complete information for both the primary and secondary tenant. It's essential to fill out all fields, including full names, addresses, and contact numbers accurately to avoid delays or verification issues.

Forgetting to detail the household composition under question 3. All family members of the secondary tenant's household living in the residence must be listed to paint a clear picture of the living situation.

Misunderstanding the rent payment arrangements. The form specifies whether the rent is paid to the landlord directly or to the primary tenant. Clarifying this payment flow is crucial for avoiding confusion.

Leaving the rent amount blank or unclear. The exact monthly rent amount the secondary tenant pays must be specified to ensure proper documentation of housing costs.

Ignoring utility payments. Questions 7 regarding separate payments for utilities, such as heating, air-conditioning, and other utilities, must be answered clearly to provide a comprehensive overview of the secondary tenant's financial responsibilities.

Failing to attach proof of the primary tenant's legal tenancy. A copy of the lease or other documents proving the primary tenant's residency must be attached, as stated in question 9, to validate the information provided.

By addressing these areas with care and attention to detail, individuals can effectively complete the W-147Q form, supporting the needs of secondary tenants and facilitating their housing arrangements.

Documents used along the form

When one is dealing with rental agreements and tenant relationships, the W-147Q form plays a crucial role in verifying the secondary tenant's residence and housing costs. This is not the only document typically required in these situations; several others often accompany it to ensure all aspects of tenancy and financial responsibilities are clearly outlined and understood. The forms and documents often used alongside the W-147Q form contribute to a comprehensive understanding of tenant agreements, responsibilities, and financial commitments.

- Lease Agreement: This document outlines the terms and conditions agreed upon by the landlord and the primary tenant. It includes details such as the rental period, monthly rent amount, and the rights and responsibilities of each party.

- Rental Application: Completed by the secondary tenant, this form collects personal information, rental history, and financial details to assess their eligibility as a tenant.

- Security Deposit Receipt: Proof that the secondary tenant has paid a deposit, potentially refundable, to cover any damages they might cause to the property.

- Move-In Checklist: A document used at the beginning of a tenancy to record the condition of the property, ensuring any pre-existing damages are not attributed to the secondary tenant.

- Utility Bills: These documents show the cost of utilities that the secondary tenant is responsible for, separate from the rent, especially if utilities are not included in the rental agreement.

- Rent Receipts: Offer proof of rent paid by the secondary tenant to the primary tenant or landlord, detailing the date, amount, and method of payment.

- Income Verification: Documents or forms that provide proof of the secondary tenant's income to ensure they can afford the rent and other associated costs.

- Identification Documents: Typically includes a government-issued ID or passport to verify the identity of the secondary tenant.

- Sublease Agreement: If the primary tenant is subletting to the secondary tenant, this agreement outlines the terms under which the secondary tenant is renting the property or room.

The harmonious blend of these documents with the W-147Q form creates a thorough and clear framework for both primary and secondary tenancy arrangements. They not only serve to protect the interests of all parties involved—landlord, primary tenant, and secondary tenant—but also ensure compliance with legal standards and responsibilities. Accurate completion and appropriate use of these documents can significantly contribute to maintaining well-organized and legally sound rental agreements, reducing potential disputes and misunderstandings over the course of the tenancy.

Similar forms

The W-147Q form, essential for verifying a secondary tenant's residence and housing costs, bears similarities with several other documents in the realm of real estate and legal verification processes. Below are four documents that share common purposes or features with the W-147Q form:

- Rental Application Forms: Like the W-147Q, rental application forms collect detailed information about tenants, including their living situation and financial responsibilities. Both documents are used by landlords or property managers to gather necessary information for housing arrangements, though rental applications often focus on potential tenants seeking approval for occupancy.

- Lease Agreements: A lease agreement outlines the terms under which the primary tenant occupies the rental property. Although it serves a different function, focusing on the rights and obligations of landlords and tenants, it is similar to the W-147Q form in that it also verifies residential details and financial commitments within housing arrangements. Specifically, both documents might include information about rent amounts, utilities, and address verification.

- Sublease Agreements: This document is particularly relevant when a primary tenant wishes to rent out a portion of their rental unit to a secondary tenant, which directly relates to the situation the W-147Q addresses. Both forms establish a formal understanding of the living arrangement between the primary and secondary tenants, including financial contributions and living spaces shared or rented separately.

- Income Verification Forms: These forms are used by employers, lenders, or government agencies to verify an individual's income level. While their primary purpose is to confirm income, not residency or housing costs, they overlap with the W-147Q form in terms of verifying financial capabilities and obligations. Both documents can play a role in assessing affordability and financial responsibility in housing situations, especially if the secondary tenant's ability to pay rent is in question.

These documents, each serving its unique purpose, collectively contribute to a comprehensive understanding of housing arrangements, financial responsibilities, and legal relationships between involved parties in rental scenarios.

Dos and Don'ts

When it comes to completing the W-147Q form, a document designed to verify the residence and housing costs of secondary tenants, there are key dos and don'ts that should be followed to ensure the process is smooth and error-free. Here’s a guide to help:

Do:- Review the form thoroughly before you start filling it out. This ensures you understand what information is required.

- Ensure that all sections are filled out completely. Incomplete forms may result in processing delays.

- Print clearly in all areas of the form. This helps avoid any confusion or misinterpretation of your responses.

- Provide accurate and current information. Misinformation can lead to issues down the line, even legal problems.

- Double-check the address and contact details you provide. Mistakes here could impact communication regarding the form.

- Include all household members living with the secondary tenant, as this may have implications on their verification.

- Attach a copy of your lease or rental agreement. This serves as proof of your status as the primary tenant.

- Sign and date the form. Without your signature, the document is not legally binding or valid.

- Leave sections blank. If a section does not apply, indicate this by writing “N/A” (not applicable) instead of leaving it empty.

- Forget to check the appropriate boxes, especially regarding whether the secondary tenant pays for heating or air conditioning separately from rent.

- Provide false information. This can have serious legal consequences, including penalties for perjury.

- Rush through the form. Taking your time ensures accuracy and completeness.

- Submit the form without making a copy for your records. Having a copy is important for future reference.

- Assume the form has been processed without confirmation. Follow up with the appropriate office if necessary.

- Use abbreviations or unclear terms. This could lead to misunderstandings or requests for clarification.

- Ignore instructions regarding attachments and supplementary documents. These are often crucial for the verification process.

By adhering to these dos and don'ts, the completion of the W-147Q form should be a straightforward task, leading to a successful verification of your secondary tenant's residence and housing costs.

Misconceptions

There are a number of misunderstandings about the W-147Q form, which is designed for the verification of a secondary tenant's residence and housing costs. Here are five common misconceptions and explanations to clarify them:

- Only the primary tenant needs to sign the form. This is a misunderstanding. While the form primarily collects information from the primary tenant, including their affirmation under penalty of perjury that the information given is correct and complete, it's essential for the process that could involve both parties for accuracy and validation of the living arrangement.

- The form is only applicable if both tenants have a formal lease agreement. This is not accurate. The W-147Q form is used to verify the living situation and expenses of a secondary tenant irrespective of whether there are formal lease agreements for both parties. It effectively serves to acknowledge a living arrangement that may not necessarily be reflected in official property lease agreements.

- Secondary tenants are not responsible for providing any documentation. While the primary tenant is the one who completes the form, secondary tenants may need to provide supporting documentation or information, especially when verifying their living arrangement or contributing to the household expenses. This cooperative approach ensures accurate representation of the living conditions and responsibilities.

- Utility payments do not need to be disclosed unless they are for heating or air conditioning. This misconception overlooks part of the form that inquires about payments separate from the rent for other utilities not limited to heating or air conditioning. It's important to disclose these expenses to give a full picture of the secondary tenant's financial responsibilities within the household.

- The form doesn't need to be updated if the living situation changes. Changes in the living arrangement, such as the secondary tenant moving out or changes in the amount of rent paid, necessitate an update to the information originally provided. Staying current is crucial for maintaining the accuracy of records and ensuring that all parties are aware of and agree to the living and financial arrangement.

Understanding the purpose and requirements of the W-147Q form is essential for both primary and secondary tenants. Misconceptions can lead to inaccuracies or oversights that might affect the verification process of a secondary tenant's residence and housing costs. It's important for all parties involved to be properly informed and to communicate openly to ensure the accuracy and completeness of the information provided on the form.

Key takeaways

When dealing with the W-147Q form, it's crucial to grasp its essence and implications both for tenants and housing authorities alike. Here's a distilled guide to navigating this form's requirements:

- Understand the Role Definitions: The form distinguishes between "primary tenants," who are listed on the lease or rental agreement, and "secondary tenants," who live in the same space but are not on the lease. Recognizing these roles is crucial for accurate form completion.

- Complete Address Details: A comprehensive address of the residence shared by the primary and secondary tenants must be provided. This includes the street address, apartment number, city, state, and zip code, ensuring the housing situation is clearly identified.

- Family Member Information: It's necessary to list all family members of the secondary tenant living in the residence. This offers a complete picture of the dwelling situation.

- Rent Payment Information: The form requires disclosing the monthly rent amount that the secondary tenant pays. Clarifying this figure is fundamental for verifying financial arrangements.

- Payment Recipient Details: Specify whether the rent is paid directly to the landlord or to the primary tenant. This helps in understanding the flow of payments and any financial responsibilities entailed.

- Utility Payments: It addresses separate utility payments, specifically asking if the secondary tenant pays separately for heating or air conditioning, or any other utilities. This distinguishes the full scope of the secondary tenant's financial obligations.

- Verification Documents: Attaching a copy of the lease or other documents proving the primary tenant's status is a mandatory step. This serves as proof of the tenancy arrangement and substantiates the claims made in the form.

- Accuracy and Legality: The primary tenant must affirm the accuracy and completeness of the information under penalty of perjury. This emphasizes the legal seriousness of the document and ensures that all provided information is truthful and reliable.

Effectively navigating the W-147Q form involves a careful consideration of these elements, ensuring all parties involved maintain transparency and fulfill their housing and financial responsibilities accurately. This form not only facilitates a smooth verification process but also protects the rights and understandings of both primary and secondary tenants in shared housing situations.

Popular PDF Forms

Can You Collect Unemployment If You Are Fired After Fmla - Claimants can refer to the Pennsylvania UC Handbook for detailed instructions on how to properly complete and submit their work search record.

Marriott Friends and Family Form - Plan your next getaway with Marriott's Friends and Family discounts.