Blank Wells Fargo Authorization PDF Template

At the heart of managing or altering aspects of your mortgage with Wells Fargo is the Wells Fargo Authorization Form. This vital document serves as your written consent allowing Wells Fargo to share information regarding your loan with a designated third party. The breadth of the form covers essential areas including the borrower's name and property address, loan number, and detailed information about the third party, be it an attorney, real estate agent, or other pertinent relations. The form distinctly outlines the extent of the authorization, whether it be to receive information about the loan, update tax or insurance information, or provide new insurance coverage details. It interestingly highlights the consequences of such updates, which may affect your monthly mortgage payments immediately. Furthermore, the document alludes to a significant provision regarding the duration of the authorization, which, unless stated otherwise, remains effective for the lifetime of the loan or, in cases involving real estate agents, expires after one year. Among its clauses, it contains a requirement for a notarized Power of Attorney or a Court Order to enact more substantial changes to the loan details. Through the borrower's signature, responsibility is accepted for actions taken under this authorization, underpinning the importance of formally notifying Wells Fargo should one decide to retract the permissions granted. Wells Fargo ensures that your consent is pivotal for such exchanges, underscoring the form's role in maintaining the integrity and privacy of your financial information.

Preview - Wells Fargo Authorization Form

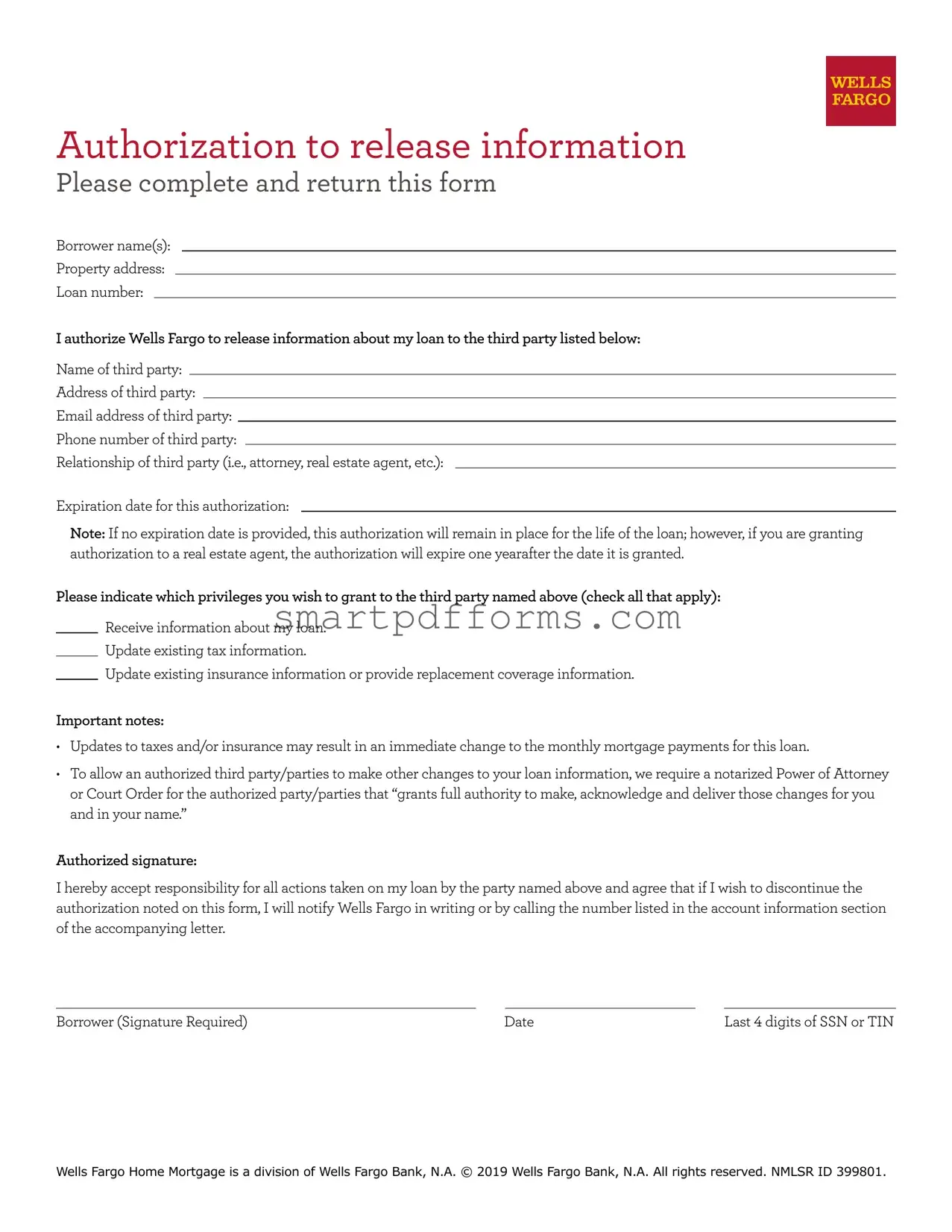

Authorization to release information

Please complete and return this form

Borrower name(s):

Property address:

Loan number:

I authorize Wells Fargo to release information about my loan to the third party listed below:

Name of third party:

Address of third party:

Email address of third party:

Phone number of third party:

Relationship of third party (i.e., attorney, real estate agent, etc.):

Expiration date for this authorization:

Note: If no expiration date is provided, this authorization will remain in place for the life of the loan; however, if you are granting authorization to a real estate agent, the authorization will expire one yearafter the date it is granted.

Please indicate which privileges you wish to grant to the third party named above (check all that apply):

Receive information about my loan.

Update existing tax information.

Update existing insurance information or provide replacement coverage information.

Important notes:

•Updates to taxes and/or insurance may result in an immediate change to the monthly mortgage payments for this loan.

•To allow an authorized third party/parties to make other changes to your loan information, we require a notarized Power of Attorney or Court Order for the authorized party/parties that “grants full authority to make, acknowledge and deliver those changes for you and in your name.”

Authorized signature:

I hereby accept responsibility for all actions taken on my loan by the party named above and agree that if I wish to discontinue the authorization noted on this form, I will notify Wells Fargo in writing or by calling the number listed in the account information section of the accompanying letter.

Borrower (Signature Required) |

Date |

Last 4 digits of SSN or TIN |

Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N.A. © 2019 Wells Fargo Bank, N.A. All rights reserved. NMLSR ID 399801.

Form Data

| Fact Name | Detail |

|---|---|

| Purpose of Form | This form authorizes Wells Fargo to release loan information to a specified third party. |

| Required Information | Borrower's name(s), property address, loan number, and third party's details (name, address, email, phone number, and relationship). |

| Authorization Expiration | If no expiration date is provided, the authorization remains valid for the life of the loan. For real estate agents, it expires one year after the date it is granted. |

| Privileges Granted | Third parties can receive loan information, update tax information, and update/replace insurance coverage information. |

| Immediate Impact | Updates to taxes and/or insurance may immediately change the monthly mortgage payments. |

| Additional Requirements for Changes | To permit other changes to loan information, a notarized Power of Attorney or Court Order is required, granting full authority to the third party. |

| Revocation of Authorization | The borrower agrees to accept responsibility for all actions taken by the third party and can revoke authorization by notifying Wells Fargo in writing or by phone. |

Instructions on Utilizing Wells Fargo Authorization

Filling out the Wells Fargo Authorization form is an important process that facilitates the release of information related to your loan to a specified third party. Whether the third party is an attorney, a real estate agent, or someone else with a legitimate need for this information, this form serves as your consent for Wells Fargo to share your loan details with them. It is crucial to fill out this form carefully and accurately to ensure that the correct permissions are granted to the right individual or entity. Following these steps will guide you through the process.

- Borrower name(s): Start by entering the full legal name(s) of the borrower or borrowers associated with the loan in question.

- Property address: Provide the complete address of the property that the loan is for, including any applicable suite or apartment numbers.

- Loan number: Enter the specific loan number assigned to your mortgage. This can typically be found on your loan documents or monthly mortgage statement.

- Name of third party: Write the full name of the individual or entity to whom you are granting authorization to receive information about your loan.

- Address of third party: Provide the current address of the third party. Be sure to include any necessary details such as suite numbers.

- Email address of third party: List the email address of the third party, ensuring it's the one they regularly use for correspondence.

- Phone number of third party: Write down the third party's phone number, including the area code, to facilitate easy communication.

- Relationship of third party: Clearly state the relationship between you and the third party, such as attorney, real estate agent, etc.

- Expiration date for this authorization: Indicate when this authorization will expire. If you leave this blank, the authorization will remain effective for the life of the loan or, in the case of a real estate agent, one year after the date it is granted.

- Check the boxes next to the specific privileges you are granting to the third party. These could include receiving information about your loan, updating tax information, or updating insurance details.

- Authorized signature: Sign your name to confirm that you accept responsibility for all actions taken by the named party with respect to your loan.

- Date: Fill in the date on which you are completing the form.

- Last 4 digits of SSN or TIN: Enter the last four digits of your Social Security Number or Tax Identification Number.

After completing the form, ensure that all details are correct and reflect your intentions accurately. Submitting this authorization form will allow Wells Fargo to share specified loan information with the third party you've named. This step is essential in situations where a third party needs to intervene or act on your behalf regarding your loan. Once submitted, remember to keep a copy of the form for your records and monitor any actions taken by the third party to ensure they align with your permissions.

Obtain Answers on Wells Fargo Authorization

- What is the purpose of the Wells Fargo Authorization Form?

The Wells Fargo Authorization Form is a document that borrowers use to grant permission for Wells Fargo to release information about their loan to a specified third party. This could be an attorney, real estate agent, or any other entity the borrower wishes to allow access to their loan details. The form outlines which specific privileges are being granted, such as receiving information about the loan, updating tax information, or updating insurance information. This authorization is especially useful during transactions like selling a property or managing estate affairs.

- Who needs to complete the Wells Fargo Authorization Form?

Any Wells Fargo borrower who wishes to give a third party access to their loan information needs to complete this form. It's necessary when a borrower wants someone else to be able to receive loan information or make updates on their behalf, for reasons including but not limited to legal representation, real estate transactions, or financial management.

- What happens if no expiration date is provided on the form?

If no expiration date is specified on the form, the authorization will remain effective for the lifetime of the loan. However, there's an exception for real estate agents; in their case, the authorization expires one year after it's granted. This setup ensures that borrowers don’t need to renew the authorization repeatedly while also protecting their privacy by limiting the duration of access for agents.

- Can I specify what information the third party has access to?

Yes, the form allows borrowers to specify exactly which privileges they are granting to the third party. These can range from simply receiving information about the loan to making updates on tax and insurance information. It's a way to ensure borrowers have control over what information is shared and what actions the third party can take.

- How can I revoke the authorization?

To revoke the authorization, the borrower needs to notify Wells Fargo either in writing or by calling the phone number provided in the account information section of their loan documents. This measure is in place to ensure that borrowers can easily withdraw permission if their circumstances change or if they no longer wish for the third party to have access to their loan information.

- What is required for a third party to make changes beyond receiving information or updating tax and insurance details?

For a third party to make other changes to the loan information, Wells Fargo requires a notarized Power of Attorney or a Court Order. This document must grant full authority to the third party to make, acknowledge, and deliver those changes in the name of the borrower. This ensures that any significant modifications to the loan are legally authorized and documented.

- What are the responsibilities of the borrower after authorizing a third party?

After authorizing a third party, the borrower accepts responsibility for all actions taken on their loan by the third party. This means that the borrower is accountable for any updates or changes made by the third party as if they had made those changes themselves. It's crucial for borrowers to trust the third party they authorize to ensure their loan remains in good standing.

Common mistakes

When filling out the Wells Fargo Authorization form, it's crucial to pay close attention to detail to ensure that all the information provided is accurate and complete. Common mistakes can lead to unnecessary delays or complications. Here are six common errors people often make:

- Not specifying an expiration date for the authorization, which can result in the authorization remaining in effect for the unintended duration. For real estate agents, it's especially important because the authorization automatically expires one year after the date it is granted if no specific date is provided.

- Omitting the relationship of the third party, such as whether they are an attorney, real estate agent, etc. This detail is vital for Wells Fargo to understand the capacity in which the third party is involved.

- Failing to check off the specific privileges granted to the third party. It's essential to clearly indicate whether the third party is authorized to receive information about the loan, update tax information, or update insurance information.

- Forgetting to sign the form or provide the last 4 digits of the SSN or TIN. The borrower's signature and identification number are critical for validating the authorization.

- Not providing a clear and complete address, email, and phone number for the third party. Wells Fargo requires this information to contact the third party if necessary.

- Ignoring the important notes section that outlines the consequences of updating taxes and/or insurance, which may affect monthly mortgage payments, and the requirement of a notarized Power of Attorney or Court Order for certain changes to the loan information.

By avoiding these mistakes, individuals can facilitate a smoother process with Wells Fargo and ensure that their intentions regarding the authorization are clearly understood and properly executed.

Documents used along the form

When dealing with the Wells Fargo Authorization form, it’s often just one part of a larger documentation process, especially pertaining to real estate transactions or loan management. Several other forms and documents may be required in tandem to ensure smooth, legally compliant transactions. Understanding these documents can help individuals navigate financial and legal landscapes more effectively.

- Loan Application Form: This is the initial step for borrowers. It collects comprehensive information about the borrower, including employment history, income, debts, and assets. It's crucial for the lending process, laying the foundation for assessing the borrower's creditworthiness and loan terms.

- Mortgage or Deed of Trust: This document secures the loan by linking it to the physical property. It outlines the legal terms and conditions of the mortgage and grants the lender a lien on the property as security for the loan. Its execution is pivotal in the real estate buying process.

- Good Faith Estimate or Loan Estimate: This provides borrowers with an itemized list of expected closing costs and loan terms. It's designed to give borrowers a clear understanding of the financial commitments involved in their loan, encouraging informed decision-making.

- Closing Disclosure: This is a detailed outline of final loan terms and closing costs, provided to the borrower at least three business days before closing the loan. It allows borrowers to confirm that the terms match their expectations and that they are prepared for the financial obligations ahead.

In summation, navigating real estate or loan transactions demands attention to a variety of legal documents, of which the Wells Fargo Authorization form is just the beginning. Each document plays a unique role in ensuring the transaction is conducted fairly and legally, safeguarding the interests of all parties involved. Familiarity with these documents can streamline the process, making it less daunting and more efficient.

Similar forms

Power of Attorney: Just like the Wells Fargo Authorization form, a Power of Attorney (POA) allows someone else to act on your behalf. In the case of a POA, this can range from managing financial transactions to making healthcare decisions, depending on the type specified. Both documents officially delegate authority from the principal to a third party, although a POA typically grants wider powers.

Medical Records Release Form: This form functions similarly to the Wells Fargo form by permitting healthcare providers to share personal medical records with authorized third parties. It specifies who can receive the information, mirroring the way the Wells Fargo form identifies who can learn about or make changes to a loan account.

IRS Form 4506-T: The IRS Form 4506-T allows third parties to request and receive someone's tax return information, with the individual's authorization. Comparable to the Wells Fargo Authorization form, it identifies specific information that can be shared and requires the taxpayer's consent for such a release, highlighting the importance of consent in sharing personal information.

Credit Authorization Form: This form permits lenders, landlords, or employers to perform credit checks on an individual, similar to how the Wells Fargo form allows a designated third party to receive loan information. Both forms require explicit permission from the individual, ensuring that personal financial data is shared responsibly and with consent.

Third-Party Mortgage Authorization Form: Specifically related to mortgages, this form, like Wells Fargo’s, enables borrowers to give third parties access to their mortgage information. It could be for purposes such as consulting, loan modification, or simply managing the account, making it highly similar in function and purpose to the Wells Fargo document.

Release of Information Form (ROI) in Education: Schools and universities often use an ROI form to allow the sharing of a student's academic records with designated third parties, like parents or potential employers. The parallels to the Wells Fargo Authorization form come from the need for the student's signature to authorize the release, as well as specificity regarding the information that can be shared, echoing the controlled, consent-based sharing of personal information.

Dos and Don'ts

When filling out the Wells Fargo Authorization form, it is important to pay careful attention to the details required to ensure proper handling of your loan information. The following advisories are meant to guide you through this process efficiently and securely.

- Do verify the accuracy of all the information you provide, such as your name, loan number, and property address to avoid any discrepancies.

- Do not leave any required fields blank. If a section does not apply, consider writing 'N/A' to indicate this clearly.

- Do specify an expiration date for the authorization if you only intend for it to last a certain period, remembering that without doing so, the authorization could remain indefinitely.

- Do not rush through reading the permissions you are granting. It's crucial to understand what each authorization allows the third party to do with your loan information.

- Do check the appropriate boxes that align with the privileges you wish to grant to the third party, ensuring you grant only the necessary access.

- Do not forget to consider the implications of allowing updates to your tax or insurance information, as these actions can affect your monthly mortgage payments.

- Do provide a notarized Power of Attorney or Court Order if you're permitting the third party to make significant changes to your loan, as merely filling out this form does not grant such broad permissions.

- Do sign and date the form; your signature is a mandatory step to validate the authorization. Ensure the date reflects the true day you filled out the form.

- Do not hesitate to notify Wells Fargo in writing or by calling the specified number if you ever wish to revoke this authorization, taking responsibility for any actions the third party takes until then.

By following these guidelines, you can help ensure that the authorization process for your loan information with Wells Fargo is both secure and aligned with your intentions.

Misconceptions

Understanding the intricacies of banking and legal agreements can often lead to confusion. The Wells Fargo Authorization Form is no exception, surrounded by various misconceptions. Unpacking these can enlighten borrowers and third parties involved, ensuring they navigate these waters with more clarity and confidence.

Misconception 1: The form grants unlimited access to the third party.

One common misconception is that by completing the Wells Fargo Authorization Form, the borrower is giving the third party unrestricted access to their loan information and the ability to make any changes. In reality, the form specifies the types of information and updates that the third party is authorized to receive and make. These include receiving information about the loan, updating existing tax information, and updating existing insurance information or providing replacement coverage information. Any further changes require a notarized Power of Attorney or Court Order, emphasizing the form's limitations.

Misconception 2: The authorization is permanent if no expiration date is set.

Another misunderstanding involves the duration of the authorization. Although it's true that if no expiration date is provided, the authorization will remain in effect for the life of the loan, this applies with a notable exception. If the authorization is granted to a real estate agent, it will automatically expire one year after the date it is granted, regardless of whether an explicit expiration date is provided. This built-in safeguard serves to protect the borrower's interests over time.

Misconception 3: The form allows third parties to make payment changes.

A third misconception is that the authorization enables the third party to make changes to the monthly mortgage payments. The form does allow for updates to tax and insurance information, which might result in an immediate change to the monthly mortgage payments. However, any other changes to payment details, such as re-amortization or modification of the loan terms, fall outside the scope of this authorization and would require additional, specific legal documentation.

Misconception 4: The borrower cannot revoke the authorization once granted.

Finally, there is a false belief that once the borrower has granted authorization, they cannot revoke it. The form explicitly states that the borrower can discontinue the authorization at any time, provided they notify Wells Fargo in writing or by calling a specified number. This ensures that the borrower retains control over who has access to their loan information and under what circumstances. It's a crucial aspect that protects the borrower's rights and autonomy throughout the loan's life.

In dispelling these misconceptions, it becomes evident that the Wells Fargo Authorization Form is designed with specific checks and balances. These not only enable third-party interactions that can aid in the management of the loan but also safeguard the borrower's control and privacy.

Key takeaways

Understanding the Wells Fargo Authorization form is crucial for effectively managing your loan and granting proper access to required third parties. This form is designed to authorize Wells Fargo to release your loan information to a specified third party, under conditions that you set. Here are key takeaways on completing and using this form:

- Specifying the Third Party: Clearly identifying the third party by providing their full name, address, email, and phone number is essential. You also need to describe the relationship between you and the third party, such as attorney, real estate agent, etc. This information helps Wells Fargo ensure that only authorized individuals receive access to your sensitive loan information.

- Authorization Duration: It's important to note that if no expiration date is provided, the authorization will remain effective for the lifetime of the loan. However, for real estate agents, the authorization automatically expires one year after the date it is granted. This provision is crucial for maintaining control over who has access to your loan information and for how long.

- Privileges Granted: The form allows you to specify the types of information and updates the third party can access or modify. Options include receiving loan information, updating tax information, and updating or providing new insurance coverage details. Selecting the precise privileges helps in limiting the third party’s access to only necessary information.

- Responsibility and Revocation: By signing the form, you accept responsibility for all actions taken by the authorized third party as it pertains to your loan. If you decide to revoke the authorization, it’s imperative to notify Wells Fargo in writing or by phone, using the contact information provided in the account information section. Understanding this process is vital for maintaining the security and integrity of your loan management.

The Wells Fargo Authorization form is a powerful tool for loan management, allowing borrowers to securely grant access to their loan information to third parties. By understanding these key aspects, borrowers can ensure they are making informed decisions about who can access and manage their loan information and under what conditions.

Popular PDF Forms

Dd Form 1351-2 - The form acts as a safeguard for service members, providing financial protection against unforeseen travel expenses.

Pa Sellers Disclosure - Grasp the significance of understanding the structural integrity of the property, including foundations, walls, and any known defects.