Blank Wells Fargo Checking Beneficiary PDF Template

Managing your finances wisely includes preparing for the future, which is where the Wells Fargo Checking Beneficiary Form comes into play. This essential document allows account holders to designate beneficiaries for their accounts, ensuring that their assets are distributed according to their wishes in the event of their death. Completion of this form involves listing primary and contingent beneficiaries along with their social security numbers, dates of birth, relationship to the account holder, and the percentage of the account they are to receive. It underscores the importance of accurately filling out each field to avoid any delays or issues. Moreover, the form outlines that upon the participant's death, separate accounts will be set up for each beneficiary, and the distribution of assets is conducted according to a set order of precedence, considering primary and contingent beneficiaries. It also highlights that no beneficiary designation can take effect until the form is filed with Wells Fargo and clarifies that the account holder can change their beneficiary at any time. This flexibility is a critical aspect of managing one's estate, as personal circumstances and relationships may change over time. The form's stipulations, such as the inability of beneficiaries to designate successors and the process for amending beneficiary designations, are governed by the broader terms of the plan, which also reserves the employer's right to amend the plan in ways that could affect the designation. Overall, the Wells Fargo Checking Beneficiary Form is an integral part of financial planning, empowering individuals to have a say in the handling of their assets beyond their lifetime.

Preview - Wells Fargo Checking Beneficiary Form

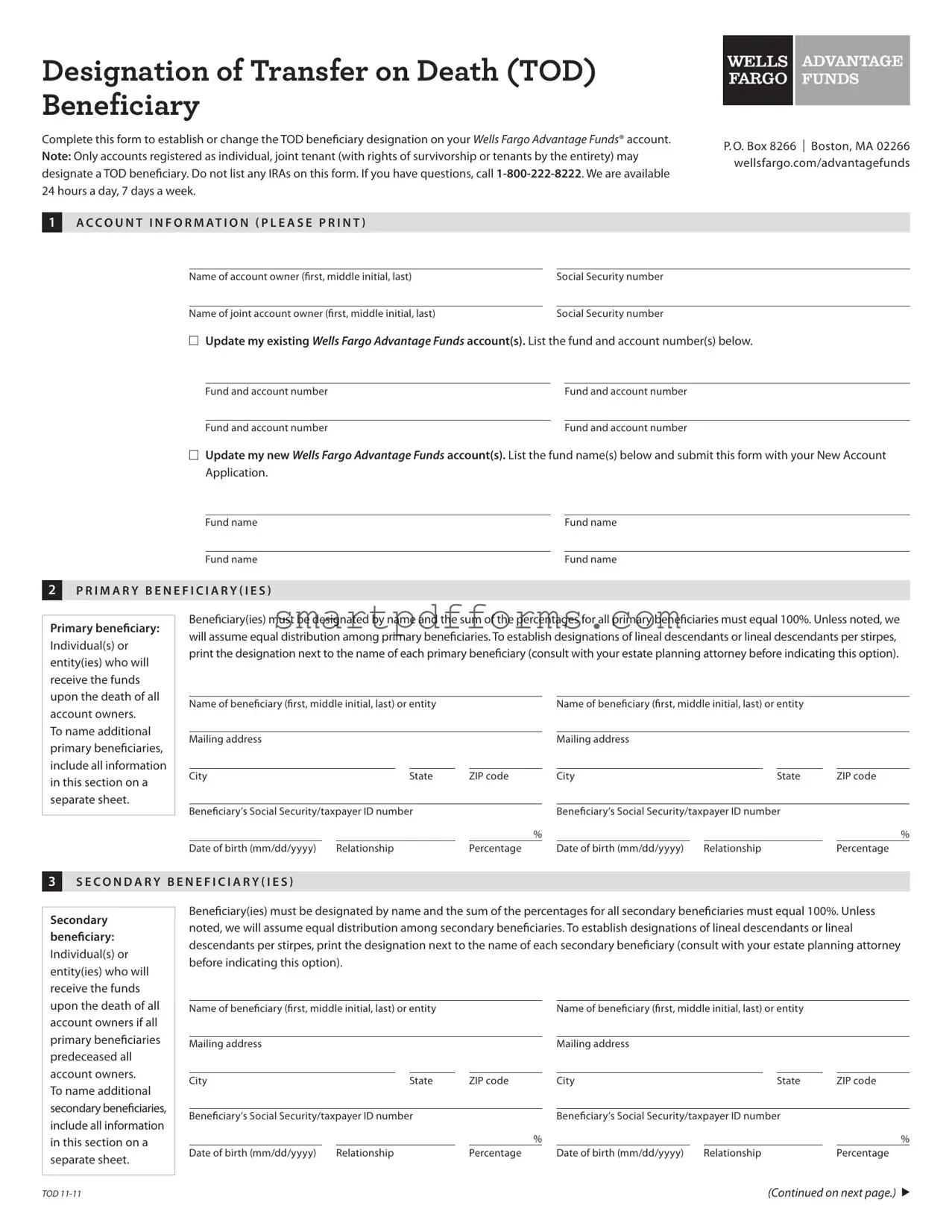

Designation of Transfer on Death (TOD) Beneficiary

Complete this form to establish or change the TOD beneficiary designation on your Wells Fargo Advantage Funds® account. Note: Only accounts registered as individual, joint tenant (with rights of survivorship or tenants by the entirety) may designate a TOD beneficiary. Do not list any IRAs on this form. If you have questions, call

1 A C C O U N T I N F O R M AT I O N ( P L E A S E P R I N T )

P. O. Box 8266 | Boston, MA 02266 wellsfargo.com/advantagefunds

Name of account owner (first, middle initial, last) |

|

Social Security number |

|

|

|

Name of joint account owner (first, middle initial, last) |

|

Social Security number |

Update my existing Wells Fargo Advantage Funds account(s). List the fund and account number(s) below.

Fund and account number

Fund and account number

Fund and account number

Fund and account number

Update my new Wells Fargo Advantage Funds account(s). List the fund name(s) below and submit this form with your New Account Application.

Fund name

Fund name

Fund name

Fund name

2P R I M A R Y B E N E F I C I A R Y ( I E S )

Primary beneiciary:

Individual(s) or entity(ies) who will receive the funds upon the death of all account owners.

To name additional primary beneficiaries, include all information in this section on a separate sheet.

Beneficiary(ies) must be designated by name and the sum of the percentages for all primary beneficiaries must equal 100%. Unless noted, we will assume equal distribution among primary beneficiaries. To establish designations of lineal descendants or lineal descendants per stirpes, print the designation next to the name of each primary beneficiary (consult with your estate planning attorney before indicating this option).

Name of beneficiary (first, middle initial, last) or entity |

|

|

|

Name of beneficiary (first, middle initial, last) or entity |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

|

ZIP code |

City |

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Beneficiary’s Social Security/taxpayer ID number |

|

|

|

Beneficiary’s Social Security/taxpayer ID number |

|

|

||||||||

|

|

|

|

|

|

% |

|

|

|

|

|

% |

||

Date of birth (mm/dd/yyyy) |

|

Relationship |

|

Percentage |

|

Date of birth (mm/dd/yyyy) |

|

Relationship |

|

Percentage |

||||

3S E C O N D A R Y B E N E F I C I A R Y ( I E S )

Secondary beneiciary:

Individual(s) or entity(ies) who will receive the funds upon the death of all account owners if all primary beneficiaries predeceased all account owners.

To name additional secondary beneficiaries, include all information in this section on a separate sheet.

Beneficiary(ies) must be designated by name and the sum of the percentages for all secondary beneficiaries must equal 100%. Unless noted, we will assume equal distribution among secondary beneficiaries. To establish designations of lineal descendants or lineal descendants per stirpes, print the designation next to the name of each secondary beneficiary (consult with your estate planning attorney before indicating this option).

Name of beneficiary (first, middle initial, last) or entity |

|

|

|

Name of beneficiary (first, middle initial, last) or entity |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

State |

|

ZIP code |

City |

|

|

|

State |

|

ZIP code |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Beneficiary’s Social Security/taxpayer ID number |

|

|

|

Beneficiary’s Social Security/taxpayer ID number |

|

|

||||||||

|

|

|

|

|

|

% |

|

|

|

|

|

% |

||

Date of birth (mm/dd/yyyy) |

|

Relationship |

|

Percentage |

|

Date of birth (mm/dd/yyyy) |

|

Relationship |

|

Percentage |

||||

TOD

(Continued on next page.)

▲

4S I G N AT U R E ( S )

All account owners must sign and date this form

to complete this request.

I understand that this TOD beneficiary designation shall replace any previous TOD beneficiary designation(s) I have made for the Wells Fargo Advantage Funds accounts listed in section 1 of this form. I acknowledge that this designation is effective upon receipt in good order by the fund’s transfer agent and will remain in effect until I deliver written notice of a change or revocation of beneficiary(ies) to the fund’s transfer agent. I agree to be bound by the Boston Financial Data Services (BFDS) TOD Rules, which BFDS may amend from time to time or may be altered, modified, or supplemented by Wells Fargo Advantage Funds. I further understand that Wells Fargo Advantage Funds reserves the right, at any time without prior notice, to suspend, limit, modify, or terminate the TOD registration.

I, my successors and assigns, do hereby agree to indemnify and hold harmless Wells Fargo Advantage Funds, Wells Fargo Funds Management, LLC, their affiliates, and

7

Signature of account ownerPrint nameDate

7

Signature of joint account owner |

Print name |

Date |

5T R A N S F E R O N D E AT H ( T O D ) L I M I TAT I O N S A N D M O D I F I C AT I O N S

TOD registrations are governed by the fund’s transfer agent, BFDS TOD Rules, except as altered, modified, or supplemented by Wells Fargo Advantage Funds. The phrase “Subject to BFDS TOD Rules” in an account registration shall incorporate the modifications adopted by Wells Fargo Advantage Funds. The following guidelines are currently in effect:

1.The TOD registration requested on this application complies with the applicable laws of the state of Massachusetts. If there is a dispute regarding the right of a TOD beneficiary to receive assets pursuant to this TOD registration, Wells Fargo Advantage Funds cannot assure you that the party or court hearing the dispute will apply Massachusetts law when making its determination.

2.The designation Payable on Death (POD) may be substituted for TOD at the account owner’s request.

3.Beneficiary designations will only apply to the account(s) as designated in section 1 of this form and any new accounts established by subsequent exchange from one of the designated TOD beneficiary accounts. In the event that a named primary beneficiary predeceases all account owners, the deceased beneficiary’s designated portion of the account will be allocated among the surviving primary beneficiaries on a pro rata basis, except for designations of lineal descendants or lineal descendants per stirpes. If all primary beneficiaries predecease all account owners, and lineal descendants or lineal descendants per stirpes were not designated, then the assets will be allocated among the designated secondary beneficiaries.

4.You can change your designation of beneficiary at any time by:

a.submitting a new Designation of Transfer on Death (TOD) Beneficiary form;

b.submitting a letter of instruction detailing the same information requested on this form; or

c.submitting a letter of instruction to revoke the beneficiary designation.

5.A TOD registration may not be changed or revoked by will, codicil, or telephone conversation.

6.A custodian under the Uniform Gift to Minors Act (UGMA) may not be designated as a beneficiary because the UGMA applies only to gifts made during the lifetime of the donor. A custodian under the Uniform Transfer to Minors Act (UTMA) may be designated

as a beneficiary.

7.In the event of divorce and a former spouse is a designated beneficiary at the time of death of the account owner, applicable state law may dictate that this designation is automatically revoked unless the designation was made after the divorce.

8.The legend “Subject to BFDS TOD Rules” must appear in the account registration at all times. For example:

John H. Smith & Mary M. Smith JT Ten Subject to BFDS TOD Rules Address

City, State ZIP

Wells Fargo Funds Management, LLC, a wholly owned subsidiary of Wells Fargo & Company, provides investment advisory and administrative services for Wells Fargo Advantage Funds. Other affiliates of Wells Fargo & Company provide subadvisory and other services for the funds. The funds are distributed by Wells Fargo Funds Distributor, LLC, Member FINRA/SIPC, an affiliate of Wells Fargo & Company.

Form Data

| Fact | Detail |

|---|---|

| Form Purpose | Allows participants to designate beneficiaries for their account in case of death. |

| Writing Requirement | Must be completed using black ink pen. |

| Submission Information | Form can be returned to Wells Fargo via mail or fax as provided on the form. |

| Beneficiary Setup | Separate accounts are set up for each beneficiary upon participant's death with acceptable proof. |

| Beneficiary Designation | Designation includes primary and contingent beneficiaries and allows for share percentages to be specified. |

| Governing Terms | Subject to the terms of the plan and may be governed by specific state laws where applicable. |

Instructions on Utilizing Wells Fargo Checking Beneficiary

When it comes time to fill out the Wells Fargo Checking Beneficiary form, it's about ensuring that your wishes are known regarding who should inherit the funds in your checking account after your passing. This task, while sensitive, is crucial for the seamless transfer of your assets and provides peace of mind for both you and your loved ones. Here's a step-by-step guide to complete this important form correctly.

- Read the General Provisions on the reverse side of the Designation of Beneficiary form carefully before you begin to understand the terms and implications of your designation.

- Use a black ink pen to fill out the form to ensure that the information is legible and can be processed without errors.

- Enter the Plan Name (Lender Process Services Employee Stock Purchase Plan - LPS1) at the top of the form.

- Fill in the Date field with the current date to document when the beneficiary designation is made.

- Write your Name of Participant as it appears on your Wells Fargo checking account to avoid any discrepancies.

- Insert your Social Security Number for identification purposes, ensuring accuracy to prevent any delays or issues with processing the form.

- Under the section titled "List Primary Beneficiary Name(s)", include the name(s), Social Security Number, Date of Birth, Relationship, Share Percentage, and Current Address for each person you wish to designate as a primary beneficiary. If designating multiple beneficiaries, ensure that the share percentages add up to 100%.

- In the section labeled "List Contingent Beneficiary Name(s)", repeat the process for any contingent beneficiaries, who will inherit the funds should none of the primary beneficiaries be able to do so.

- Sign the form at the bottom to validate the designations you've made. A signature is required for the form to be processed.

- Finally, return the form to Wells Fargo using either the mailing address or fax number provided on the form. Ensure you keep a copy for your records.

After submitting the form, Wells Fargo will process your beneficiary designations in accordance with the provided instructions and the general provisions outlined. This step ensures that your designated beneficiaries will be recognized by Wells Fargo upon your passing, facilitating the transition of assets according to your wishes. For any additional information or if you encounter any difficulties, Wells Fargo Shareowner Services is available to assist you via the phone number provided on the form.

Obtain Answers on Wells Fargo Checking Beneficiary

How do I complete the Wells Fargo Checking Beneficiary Form?

To complete the Wells Fargo Checking Beneficiary Form, use a black ink pen. Fill out the form by providing the plan name, your name (as the participant), and your Social Security Number. You must revoke any previous beneficiary designations by completing this form. Then, list your primary beneficiary(ies) with their full name(s), Social Security Number(s), date of birth, the share percentage you are assigning to each, their relationship to you, and their current address. If you wish to designate contingent beneficiaries (who will receive benefits in the absence of any surviving primary beneficiaries), list their information similarly. Make sure all fields for each beneficiary are complete; otherwise, the form will be returned to you for correction. Finally, sign the form. Keep in mind that the form also includes a section for General Provisions which you should read carefully before submission.

What happens if I do not complete all fields for each beneficiary on the form?

If all fields for each designated beneficiary are not fully completed, the Wells Fargo Checking Beneficiary Form will be returned to you. It is essential to provide the complete name, Social Security Number, date of birth, relationship status, current address, and the share percentage for each beneficiary. This step ensures the form is processed without delay and your beneficiary designations are recorded as intended.

Can a beneficiary designate a successor to receive their benefit?

No, a beneficiary cannot designate a successor beneficiary. According to the General Provisions outlined in the Wells Fargo Checking Beneficiary Form, if a beneficiary is eligible and alive at the date of the participant's death but passes away before receiving the entire benefit, the remaining benefit will be paid to the deceased beneficiary's estate. This means the chain of benefit transfer stops with the estate of the beneficiary and does not allow for further succession by the beneficiary's nomination.

How can I change my Beneficiary Designation?

You can change your Beneficiary Designation at any time without needing consent from anyone, except in cases where spouse's consent is required. To make a change, you should complete a new Beneficiary Designation Form with the updated information. This form must be submitted to Wells Fargo in the same manner as the original form - by mail or fax, as provided in the instructions. Remember, for the change to be valid, it must be filed with Wells Fargo before your (the Participant’s) death. It’s also important to note that all beneficiary rights are subject to the terms of the Plan, which may be amended over time by your employer without notice.

Common mistakes

When filling out the Wells Fargo Checking Beneficiary form, attention to detail is imperative to ensure that your wishes are accurately recorded. However, a number of common errors can complicate this process. Avoiding these mistakes ensures clarity and efficacy in the designation of your beneficiaries.

- Not using black ink: The instructions specify that the form should be filled out using a black ink pen. Other colors of ink or pencil may cause legibility issues or may not be accepted.

- Skipping the review of General Provisions: It is crucial to understand the General Provisions on the reverse side of the form before completion. This section outlines essential rules and conditions that impact how the beneficiary designations are executed upon the participant's death.

- Incomplete beneficiary information: Every field requested for each beneficiary must be filled out. Incomplete information leads to the form being returned, delaying the process.

- Incorrectly calculating shares: The shares allocated to primary and contingent beneficiaries must total 100%. An incorrect calculation can result in processing delays or unintended distributions.

- Omitting Social Security numbers: Failing to provide the Social Security number for each beneficiary can lead to identification issues and challenges in executing the intended beneficiary designations.

- Not listing contingent beneficiaries: Neglecting to designate contingent beneficiaries can create complications, possibly leading to the entire death benefit being paid in a manner not in line with the participant's wishes should no primary beneficiary survive the participant.

- Forgetting to sign the form: An unsigned form is invalid. The participant’s signature is necessary to verify the intentions stated on the form.

- Designating a minor without a legal guardian or conservator in place can complicate the disbursement of the benefits, as minors cannot directly receive the death benefit without a legal guardian or conservator.

- Failing to update the form to reflect life changes, such as marriage, divorce, or the death of a beneficiary, can result in benefits going to individuals no longer intended to receive them.

- Assuming the form has been filed without confirmation from Wells Fargo can lead to an unforeseen situation where the designation is not considered valid because it was never properly filed.

By paying careful attention to these details, participants can ensure that their Wells Fargo Checking Beneficiary form is filled out correctly, reflecting their current wishes accurately and making the process smoother for their loved ones.

Documents used along the form

When managing financial matters, especially concerning future planning and the distribution of assets, it's important to understand the suite of documents that often accompany the Wells Fargo Checking Beneficiary form. This form is crucial for designating who will receive the contents of a checking account in the event of the account holder's death. To ensure a comprehensive approach to estate planning and asset management, several other documents often come into play alongside this designation form. These documents help in outlining an individual's complete wishes regarding their assets and healthcare preferences.

- Will: A legal document that articulates an individual's wishes regarding the distribution of their property and the care of any minor children if they die.

- Durable Power of Attorney (POA): Grants a designated person the authority to make financial decisions on behalf of the individual, should they become unable to do so.

- Healthcare Power of Attorney: Appoints a trusted person to make medical decisions for the individual, should they become incapacitated and unable to express their wishes.

- Living Will: Specifies the individual's preferences for medical treatment in case they are unable to communicate their decisions due to illness or incapacity.

- Revocable Living Trust: Allows the individual to retain control over their assets during their lifetime and specifies how these assets are distributed after their death.

- Last Letter of Instruction: Provides clear instructions on personal matters and the distribution of small assets. It can include passwords, location of documents, and other personal messages.

- Certificate of Trust: Certifies the existence of a trust and outlines its key elements without revealing private information. It is often used in transactions to prove the trust's authority.

- Financial Account Forms: Required by banks and other financial institutions for each account held. These forms designate beneficiaries for specific accounts, overriding wills.

- Life Insurance Policies: Outlines the beneficiaries for life insurance payouts, ensuring that proceeds go directly to the intended individuals without passing through probate.

Collectively, these documents contribute to a well-rounded estate plan that not only directs the distribution of an individual's financial assets but also addresses healthcare decisions and personal wishes. It's important for individuals to review and update these documents regularly to ensure that their estate plan accurately reflects their current wishes and circumstances. Together with the Wells Fargo Checking Beneficiary form, these documents provide a comprehensive strategy for asset management and future planning, offering peace of mind to the individual and their loved ones.

Similar forms

Retirement Account Beneficiary Designations: These forms, used for retirement accounts such as IRAs or 401(k)s, are quite similar to the Wells Fargo Checking Beneficiary form. Both allow the account holder to designate who will inherit the assets in the account upon their death. They require the account holder to specify primary and contingent beneficiaries, highlighting the importance of having backups in case the primary beneficiaries predecease the account holder. Both forms also require similar information, like the full name, Social Security Number, and the share each beneficiary is to receive.

Life Insurance Policy Beneficiary Designations: Much like the Wells Fargo Checking Beneficiary form, life insurance beneficiary designations require the policy owner to name individuals or entities that will receive the policy proceeds upon the policyholder's death. These designations also emphasize listing both primary and contingent beneficiaries and include details such as their social security numbers, addresses, and the percentage of the proceeds each beneficiary is to receive, ensuring clear directives for the distribution of the policy's benefits.

Transfer on Death (TOD) Account Registrations: TOD accounts allow account holders to name beneficiaries who will receive the assets in the account upon the holder's death, bypassing probate. This is similar to the Wells Fargo Checking Beneficiary form in that both specify the transfer of assets upon death directly to named beneficiaries, avoiding the often lengthy probate process. The requirements for designating beneficiaries, including their names, share of assets, and identifying information, mirror each other closely.

Payable on Death (POD) Account Instructions: Similar to the Wells Fargo form, POD account instructions allow an account holder to specify beneficiaries for bank accounts, including checking and savings accounts. Upon the death of the account holder, the assets are payable directly to the named beneficiaries. Both forms are designed to direct the transfer of assets outside of probate, ensuring beneficiaries gain access to the funds quickly and efficiently. The process typically requires similar beneficiary information, streamlining asset distribution.

Trust Documents: Trusts are arrangements where assets are held by one party for the benefit of another. While more complex, the basic principle of designating beneficiaries in trust documents parallels the Wells Fargo Checking Beneficiary form. Both specify individuals or entities that will benefit from the assets controlled by the account or trust, including the distribution percentages and necessary personal information of those beneficiaries. This parallel ensures that assets are directed according to the account holder's wishes.

Will Testamentary Provisions: While wills encompass more than beneficiary designations, the sections dedicating assets or accounts to specific individuals function similarly to the Wells Fargo Checking Beneficiary form. These testamentary provisions direct the distribution of the decedent's assets, including possibly specifying accounts and their beneficiaries. Although wills require a probate process, the directive nature of both documents aligns in guiding the distribution of assets per the decedent's wishes.

Totten Trust Declaration: Also known as a tentative trust or informal trust, a Totten trust allows an account holder at a bank to designate beneficiaries for that account, who will receive the account's assets upon the holder's death. The process and intent behind a Totten trust mirror the objectives of the Wells Fargo Checking Beneficiary form, aiming to ensure a smooth transition of assets to beneficiaries without the need for probate court proceedings, relying on clear beneficiary designations.

Dos and Don'ts

When filling out the Wells Fargo Checking Beneficiary form, it's important to pay close attention to detail and follow specific instructions to ensure that your wishes are clearly understood and properly executed. Here are several do's and don'ts to consider:

Do:- Use black ink: Complete the form using a black ink pen to ensure that the information is legible and that the form is processed without delays.

- Read the General Provisions carefully: Before filling out the form, make sure to read the General Provisions on the reverse side to understand the rules and regulations that govern the beneficiary designation.

- Revoke previous designations: Clearly indicate that you are revoking any previous beneficiary designations by completing this form, as this helps in avoiding any confusion regarding your true intentions.

- List all required information for each beneficiary: Ensure you complete all fields for each beneficiary, including name, social security number, date of birth, share percentage, relationship, and current address, to prevent the form from being returned to you.

- Sign the form: Don't forget to sign the form yourself. Your signature is necessary to validate your beneficiary designation.

- Leave fields incomplete: Failing to complete all required information for each beneficiary may result in the form being returned to you, thus delaying the designation process.

- Use any ink color other than black: Using ink colors other than black might cause issues with form processing and legibility, potentially invalidating your submission.

By following these guidelines, you can help ensure that your Wells Fargo Checking Beneficiary form is filled out correctly and processed in a timely manner, accurately reflecting your wishes regarding your beneficiaries.

Misconceptions

When discussing the Wells Fargo Checking Beneficiary form, several misconceptions often arise. It's crucial to set the record straight on how these forms work and what they mean for account holders and their beneficiaries. Understanding these misconceptions can help ensure that individuals make informed decisions about their financial planning.

- Misconception 1: Filling out a beneficiary form is optional and not really necessary.

This is not true. Without a designated beneficiary, the account holder's assets may not be distributed as intended upon their death. Designating beneficiaries ensures that assets are passed to the chosen individuals or entities more directly, often bypassing probate.

- Misconception 2: Once you submit a beneficiary designation, you cannot change it.

Account holders have the flexibility to change their beneficiary designations at any time without needing consent from the previously named beneficiaries, unless a spouse’s consent is required by state law or plan terms.

- Misconception 3: The beneficiary form only applies if all beneficiaries are living.

Wells Fargo makes provisions for various situations, including if a primary beneficiary does not survive the account holder. Contingent beneficiaries can then receive benefits, ensuring that the account holder's assets are distributed according to their wishes even if the primary beneficiaries are deceased.

- Misconception 4: Beneficiary designations are only for retirement accounts.

While often associated with retirement accounts, beneficiary designations are crucial for many financial products, including checking accounts. This ensures that all forms of assets are distributed according to the account holder's wishes.

- Misconception 5: A will can override a beneficiary designation.

A common misconception is that a will has the power to override a beneficiary designation; however, beneficiary designations typically take precedence over wills. This means that the assets in accounts with a designated beneficiary will be distributed to that beneficiary regardless of the account holder's will.

- Misconception 6: You can name an organization as a beneficiary.

It is indeed possible to name an organization as a beneficiary. This means that assets can be left to charities or other entities, ensuring support for causes important to the account holder.

- Misconception 7: Beneficiary designations are public record.

Beneficiary designations are not public records. They are confidential instructions between the account holder and Wells Fargo, ensuring privacy in financial planning.

- Misconception 8: The process to designate beneficiaries is long and complicated.

The process is relatively straightforward. By filling out and returning the designated form, account holders can easily ensure their assets are distributed according to their wishes.

- Misconception 9: Minors cannot be named as beneficiaries.

Minors can indeed be named as beneficiaries, but it's important to consult legal advice to ensure the proper handling of assets until they reach the age of majority.

Understanding these key points can help prevent common mistakes and ensure that your assets are managed and distributed exactly as you intend, providing peace of mind for yourself and your loved ones.

Key takeaways

When completing the Wells Fargo Checking Beneficiary form, it's important to follow specific guidelines to ensure your intentions regarding your beneficiaries are clearly understood and effectively implemented. Here are several key takeaways that can help guide you through the process:

- Use a black ink pen for filling out the form to ensure clarity and prevent any potential issues with readability.

- Complete all fields for each beneficiary you designate; if information is missing, the form will be returned to you, delaying the process.

- It's necessary to revoke any previous beneficiary designations you might have made under the plan, as the latest form will override prior designations.

- You must precisely list both primary and contingent beneficiaries, including their social security number, date of birth, their relationship to you, their share percentage, and their current address.

- Remember, the total share percentage allocated to beneficiaries must equal 100%. This applies to both primary and contingent beneficiaries.

- Upon your death, a separate account will be set up for each beneficiary, requiring proof of death such as a certified death certificate.

- The distribution of funds to beneficiaries will follow a specific order: first to surviving primary beneficiaries, if none, then to surviving contingent beneficiaries, and if no beneficiaries survive, the funds will be distributed according to the terms of the plan.

- A beneficiary cannot designate a successor; in cases where a beneficiary is eligible but passes away before receiving the benefit, the remaining benefit will be paid to their estate.

- You have the right to change your beneficiary designation at any time without needing consent from any current beneficiary, except where spousal consent is required by law.

- For your beneficiary designation to be valid, it must be filed with Wells Fargo prior to your death and is subject to the terms of your plan, which your employer can amend at any time without your or your beneficiaries’ consent.

- To submit your form, mail it to Wells Fargo Shareowner Services at the address provided or fax it to the number listed. For any inquiries, contact Wells Fargo Shareowner Services directly.

Ensuring your beneficiary information is accurate and up-to-date can provide peace of mind and help facilitate the transfer of benefits according to your wishes. Regular review and updating of your beneficiary designations as part of your financial planning is advisable.

Popular PDF Forms

Get California Driver's License - Payment instructions for mailing your California ID card renewal, highlighting check as the accepted payment method.

Masshealth - Directions on how to fill out each section clearly to avoid delays in your MassHealth disability application review.