Blank Wells Fargo Direct Deposit PDF Template

At the heart of modern banking, convenience, and financial management lies the Wells Fargo Direct Deposit form, a pivotal tool designed to streamline the process of receiving and making regular payments. This form, serving as a guide, facilitates individuals in setting up automatic deposits or payments to and from third parties, embodying the essence of a hassle-free monetary transaction approach. The form extends its benefits by providing a free service that allows qualifying recurring income to be automatically deposited into Wells Fargo checking, savings, or prepaid card accounts, enabling individuals to enjoy the comforts of convenience, speed, safety, and the lucrative prospect of automatic saving. It meticulously defines qualifying income to include payments from an extensive range of sources such as employers, Social Security, pensions, and more, ensuring a wide applicability. Furthermore, it emphasizes the critical aspect of automatic payments, safeguarding individuals from the risks of missed payments and their ensuing consequences by necessitating sufficient funds in the account for scheduled transactions. The form is meticulously structured to guide users through the initial steps of gathering and reviewing account information, contacting employers or payors/payees, and monitoring the account, thus ensuring a seamless integration of the service into their financial management practices. The document not only simplifies banking transactions but also reinforces Wells Fargo’s commitment to providing secure and efficient banking solutions, marking a significant stride toward enhancing customer experience in the digital age.

Preview - Wells Fargo Direct Deposit Form

Clear/Reset

Direct Deposit/Automatic Payments

Information to help you arrange automatic deposits or payments to/from third parties

How to take advantage of the fastest, and most convenient and secure way to manage receiving regular deposits to, or making regular payments from your account.

Key Benefits of Direct Deposit:

Direct Deposit is a free service that automatically deposits qualifying recurring income* into any Wells Fargo checking, savings, or prepaid card account you choose.

•Convenient – Your money is deposited into your account, even when you are ill, on vacation or too busy to get to the bank.

•Fast – You have immediate access to your money on the day of deposit

•Safe – You never have to worry about checks getting lost, delayed or stolen.

•Opportunity for automatic saving – You can watch your savings grow by directing at least part of your pay to a savings account

*Income you receive from your employer, Social Security, pension and retirement plans, the Armed Forces, VA Benefits, and annuity or dividend payments may all qualify for Direct Deposit.

Key Benefits of automatic payments:

Never worry about missing a payment or possible late fees or other consequences. You will need to have the required available funds in your account at the time of the payment. Note that you can also make recurring payments through Wells Fargo Online with Bill Pay.

Step 1. Gather and Review Account Information

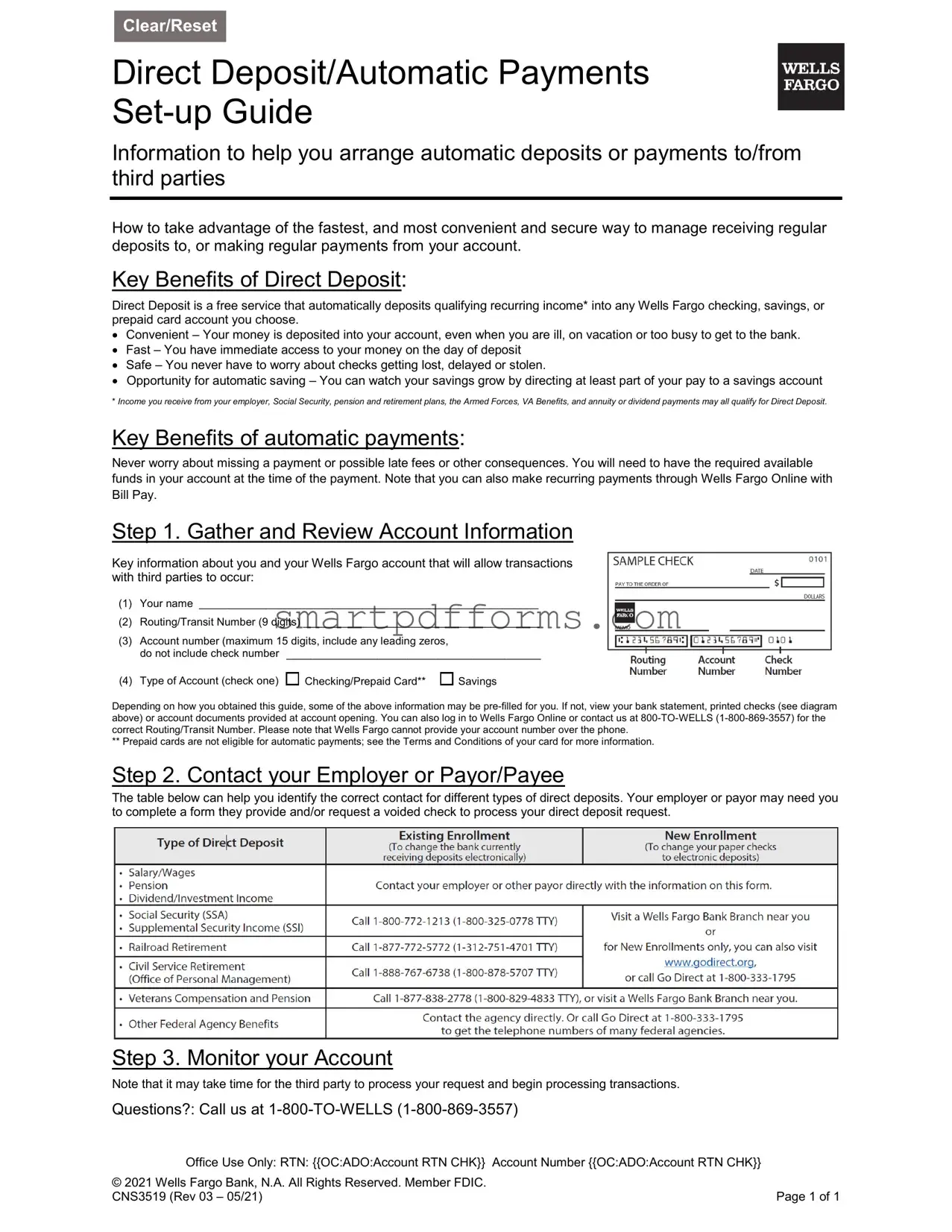

Key information about you and your Wells Fargo account that will allow transactions with third parties to occur:

(1)Your name ________________________________________________________

(2)Routing/Transit Number (9 digits) _______________________________________

(3)Account number (maximum 15 digits, include any leading zeros,

do not include check number __________________________________________

(4) Type of Account (check one) |

Checking/Prepaid Card** |

Savings |

Depending on how you obtained this guide, some of the above information may be

** Prepaid cards are not eligible for automatic payments; see the Terms and Conditions of your card for more information.

Step 2. Contact your Employer or Payor/Payee

The table below can help you identify the correct contact for different types of direct deposits. Your employer or payor may need you to complete a form they provide and/or request a voided check to process your direct deposit request.

Step 3. Monitor your Account

Note that it may take time for the third party to process your request and begin processing transactions. Questions?: Call us at

Office Use Only: RTN: {{OC:ADO:Account RTN CHK}} Account Number {{OC:ADO:Account RTN CHK}} |

|

© 2021 Wells Fargo Bank, N.A. All Rights Reserved. Member FDIC. |

|

CNS3519 (Rev 03 – 05/21) |

Page 1 of 1 |

Form Data

| Fact Name | Description |

|---|---|

| Availability of Service | Direct Deposit is a free service provided by Wells Fargo that allows for the automatic deposit of qualifying recurring income into a Wells Fargo checking, savings, or prepaid card account. |

| Benefits of Direct Deposit | Using Direct Deposit is convenient, fast, and safe, allowing immediate access to money on the day of deposit without the worry of lost, delayed, or stolen checks. It also offers an opportunity for automatic saving by directing a portion of income into a savings account. |

| Qualifying Income | Income eligible for Direct Deposit includes payments from employers, Social Security, pension and retirement plans, the Armed Forces, VA Benefits, and annuity or dividend payments. |

| Preparation and Process | To set up Direct Deposit, one needs to gather and review their account information, including their name, routing/transit number, account number, and account type. Then, contact the employer or payor/payee with this information, possibly completing a provided form and submitting a voided check. |

Instructions on Utilizing Wells Fargo Direct Deposit

Setting up Direct Deposit with Wells Fargo is an excellent way to ensure your income is automatically deposited into your account, offering convenience, speed, safety, and an opportunity for automatic savings. The process is straightforward, and by following a few steps, you can enjoy the benefits of not worrying about checks getting lost or delayed. Here's how to fill out the Wells Fargo Direct Deposit form step by step.

- Gather and Review Account Information:

- Write your name as it appears on your Wells Fargo account.

- Enter your Routing/Transit Number, which consists of 9 digits. If you're unsure, check your bank statement, printed checks, or contact Wells Fargo.

- Provide your Wells Fargo account number, ensuring it's no longer than 15 digits and doesn't include the check number or any spaces.

- Select the type of account you have: either Checking/Prepaid Card or Savings. Remember, Prepaid cards are not eligible for automatic payments.

- Contact your Employer or Payor/Payee:

- Determine who to talk to for setting up Direct Deposit or automatic payments. This could be your employer’s payroll department, Social Security, pension and retirement plans administrators, or others.

- You may need to fill out a form provided by them or supply a voided check to help process your direct deposit request.

- Monitor your Account:

- Keep an eye on your account to see when the Direct Deposit begins. Remember, it might take a little time for your employer or payor to process your request and start the deposits.

- If you have any questions during the process or about the status of your Direct Deposit, don't hesitate to call Wells Fargo at 1-800-869-3557 for assistance.

By following these steps, you'll be well on your way to enjoying the benefits of Direct Deposit with Wells Fargo. It’s a safe, fast, and convenient method to manage your money, allowing you more freedom to focus on what matters most to you.

Obtain Answers on Wells Fargo Direct Deposit

When considering setting up direct deposits or making automatic payments with Wells Fargo, individuals often have questions about the process. Below are detailed answers to some of the most commonly asked questions regarding the Wells Fargo Direct Deposit form.

- What are the key benefits of using Direct Deposit with Wells Fargo?

- What types of accounts can receive Direct Deposit?

- What information do I need to set up Direct Deposit?

- Your name

- Routing/Transit Number (9 digits)

- Account number (maximum 15 digits, omit check number)

- Type of Account (Checking/Prepaid Card or Savings)

- How can I find the correct Routing/Transit Number for my account?

- What should I do if my personal information changes?

- How do I set up automatic payments from my account?

- What steps should I take to begin Direct Deposit?

- Collect the necessary personal and account information.

- Contact your employer or income source (payor) to provide them with your Direct Deposit information, which might include completing a form they provide and/or submit a voided check.

- Regularly monitor your account, especially around the expected start time of your Direct Deposit, as third parties may require some time to process your request.

- Where can I get help if I encounter problems with my Direct Deposit?

Direct Deposit with Wells Fargo offers several advantages, making it a preferred method for managing finances. It's a free service that automatically deposits income such as from an employer, Social Security, pensions, and more into a chosen Wells Fargo account. This service is not only convenient—ensuring money is deposited even when you are unable to personally attend to it—but it also provides immediate access to funds on the day of deposit, enhances security by reducing the risks associated with lost or stolen checks, and facilitates automatic savings by allowing portions of deposits to be directed straight into a savings account.

Wells Fargo allows Direct Deposits to be made into checking, savings, or prepaid card accounts. However, it's important to note that prepaid cards are not eligible for automatic payments setup. Each type of account offers distinct benefits, so individuals can choose the one that best suits their financial goals and needs.

Setting up Direct Deposit requires some essential information to ensure accurate and secure transactions

The Routing/Transit Number is crucial for setting up Direct Deposit, as it identifies Wells Fargo as your banking institution. This 9-digit number is located on your checks or account documents. If you're unable to find it, you can securely obtain this number by logging into Wells Fargo Online or by contacting customer service at 1-800-TO-WELLS (1-800-869-3557).

If there are changes to your personal information, such as your name or account details, it's imperative to update this information with Wells Fargo and any payors making direct deposits or automatic payments into your account. This ensures uninterrupted and secure transactions.

Besides receiving deposits, you can arrange automatic payments for recurring expenses. While prepaid cards are ineligible for this feature, holders of checking or savings accounts can enlist automatic payments through Wells Fargo Online using Bill Pay. This convenient feature ensures timely payments and avoids potential late fees. The prerequisite is having sufficient funds in your account to cover the payments.

To initiate Direct Deposit,

If you face any issues with your Direct Deposit, Wells Fargo provides support to help resolve any complications. Contacting Wells Fargo's customer service at 1-800-TO-WELLS (1-800-869-3557) can provide the assistance needed to address any concerns related to Direct Deposit or automatic payments.

Common mistakes

When filling out the Wells Fargo Direct Deposit form, it's essential to pay attention to detail to ensure the process is smooth and successful. Unfortunately, errors can occur which delay the benefits of direct deposit. Here are nine common mistakes:

Not double-checking the routing/transit number: This 9-digit number is crucial for directing your income to the right place. An incorrect routing number can send your funds to the wrong bank.

Entering the wrong account number: Your account number must be exact. Including any leading zeros and excluding the check number ensures your money lands in your account, not someone else's.

Choosing the incorrect account type: Wells Fargo allows deposits into checking, savings, or prepaid card accounts. Selecting the wrong type may cause the deposit to fail.

Skipping over pre-filled information verification: If some fields come pre-filled, always verify their accuracy. Outdated or incorrect pre-filled information can lead to transaction errors.

Ignoring the eligibility of accounts for automatic payments: Prepaid cards are not eligible for automatic payments. Ensuring your account type supports your intended transactions is essential.

Not contacting the employer or payor with the correct information: Providing incomplete or incorrect information to the party making the deposit or payment can prevent the transaction from being processed.

Forgetting to provide a voided check when required: Some employers or payors request a voided check for verification purposes. Neglecting this step can delay the setup.

Failing to monitor the account after set-up: After setting up direct deposit or automatic payments, it's important to check your account to ensure transactions are occurring as expected.

Not seeking help when needed: If there's any confusion or issue, contacting Wells Fargo for assistance can prevent mistakes and ensure everything is set up correctly.

Avoiding these mistakes can streamline your direct deposit or automatic payment process, making your financial transactions more efficient and stress-free.

Documents used along the form

When setting up or managing your financial transactions, especially involving direct deposits, it's crucial to have a thorough understanding of all relevant paperwork. The Wells Fargo Direct Deposit form is an essential document designed to facilitate automatic deposits into your account, offering convenience, security, and speed. Beyond this form, there are several other documents and forms that individuals often find necessary to ensure their financial arrangements are comprehensive and up-to-date. Understanding these documents can significantly enhance your financial management efficiency.

- Authorization for Automatic Withdrawals: This form is necessary for setting up automatic payments from your account for recurring expenses such as mortgages, loans, utility bills, and subscription services. It grants permission to the service provider to withdraw agreed-upon amounts at specified intervals.

- Employer’s Direct Deposit Setup Form: While similar to the Wells Fargo form, many employers have their own specific form that employees must complete to initiate direct deposit of paychecks. This form typically requires similar information, such as account number and bank routing number.

- Voided Check: Though not a form, a voided check is often requested by employers or third parties setting up direct deposit or automatic payments as it provides all necessary banking information, including the account and routing numbers, in a reliable format.

- Bank Account Verification Letter: For certain financial transactions, a verification letter from the bank confirming the account's existence, ownership, and current standing may be required. This document serves as a proof of account for landlords, mortgage companies, or other entities needing to verify financial stability.

Ensuring all pertinent forms and documents are correctly filled out and submitted as required is fundamental to the smooth operation of your financial activities. Each of these forms plays a unique role in the management of your finances, from facilitating the initial setup of direct deposits to ensuring all automated payments are processed without a hitch. Keeping these documents in order, along with a clear understanding of their purpose and how they interconnect, can significantly reduce the complexity and increase the efficiency of your financial management tasks.

Similar forms

Payroll Authorization Form: Similar to the Wells Fargo Direct Deposit form, a Payroll Authorization form is used by employees to instruct their employer to deposit their paycheck directly into a bank account. Both forms require the employee's bank account information and employer's action to start the process.

Bank Account Opening Form: This form, required when opening a new bank account, collects similar information as the Direct Deposit form, such as the account holder's name, account type, and bank routing and account numbers, to set up the account properly.

Automatic Bill Payment Authorization Form: Often used to set up recurring bill payments from a bank account, this form parallels the Direct Deposit form in its use for arranging automatic transactions. Both necessitate the account holder's authorization and banking details for setup.

Social Security Direct Deposit Enrollment Form: Specifically used to arrange for Social Security benefits to be deposited directly into an individual's bank account. Like the Wells Fargo form, it collects recipient’s banking information and confirms their wish for direct deposit.

Pension Plan Direct Deposit Enrollment Form: Retirees use this form to have their pension payments deposited directly into their bank account. It gathers information similar to the Direct Deposit form for Wells Fargo, facilitating the automatic deposit of recurring income.

Government Benefits Enrollment Form: Utilized for automatic deposit of government benefits like veterans' benefits, this form shares the objective of securing quick and secure access to funds via direct deposit, necessitating similar account information.

Investment Dividends Direct Deposit Form: This form allows investors to have dividends from stocks, bonds, or mutual funds directly deposited into a bank account, requiring similar details as the Direct Deposit form to ensure accurate and prompt payment.

Rental Property Management Auto-Payment Form: Landlords or property management companies use this form to set up automatic deposit of rental payments into their bank account, similar to how an employee would set up direct deposit of their paycheck.

Child Support Direct Deposit Authorization Form: Used to arrange for child support payments to be directly deposited into a bank account, which mirrors the process of setting up direct deposit for payroll by requiring bank account details.

Expense Reimbursement Direct Deposit Form: Employees fill out this form to receive expense reimbursements directly into their bank account, sharing the necessity for account information and authorization with the Direct Deposit form, streamlining the reimbursement process.

Dos and Don'ts

When setting up your Wells Fargo Direct Deposit, it's important to follow the right steps to ensure a smooth and error-free process. Here are eight dos and don'ts to keep in mind:

- Do gather all necessary information before filling out the form, including your account number and routing number.

- Do check your account type (checking, savings, or prepaid card) and ensure it's clearly indicated on the form.

- Do contact your employer, or the party making the deposit, to understand any additional requirements they might have.

- Do monitor your account after submitting the form to ensure the direct deposits are being made correctly.

- Don't forget to review your bank statement or use your printed checks as a reference to obtain your routing/transit number.

- Don't include your check number when providing your account number on the form.

- Don't attempt to set up automatic payments if you are using a prepaid card, as they are ineligible for this feature.

- Don't hesitate to call Wells Fargo customer service at 1-800-TO-WELLS (1-800-869-3557) if you have any questions or concerns.

Misconceptions

Many people have misconceptions about the Wells Fargo Direct Deposit form and its process. Let's clarify some common misunderstandings:

- Direct Deposit is costly. A common misconception is that setting up direct deposit incurs a fee. In reality, Direct Deposit to any Wells Fargo checking, savings, or prepaid card account is a free service. It's designed to make the process of receiving recurring income more convenient and secure for the account holder.

- It's inconvenient and time-consuming to set up. Some might think setting up Direct Deposit is a lengthy process. However, with just a few steps—gathering account information, contacting an employer or payor, and monitoring the account—it's quite straightforward and designed to offer a faster and more convenient way to manage payments or deposits.

- Benefits are limited to just receiving paychecks. While payroll deposits are a common use of Direct Deposit, many other types of recurring income qualify, such as Social Security, pension and retirement plans, VA Benefits, and annuity or dividend payments. This versatility offers a broader benefit to users beyond just payroll deposits.

- All accounts support automatic payments. It is important to note that while you can set up Direct Deposit on most Wells Fargo accounts, prepaid cards are not eligible for automatic payments. This distinction is crucial for anyone looking to manage outgoing payments automatically alongside their direct deposits.

- Direct Deposit funds are not immediately available. Another misunderstanding is regarding the availability of funds. With Direct Deposit, the funds are available on the day of deposit, offering immediate access. This prompt availability contrasts with traditional deposit methods, which may incur delays.

- Account information is difficult to find. Some might think obtaining the necessary account information for setup is hard. Wells Fargo makes this easy by providing several options: bank statements, printed checks, account documents provided at account opening, online banking, or by contacting Wells Fargo directly. Though, account numbers are not provided over the phone to ensure security.

Understanding these facts about the Wells Fargo Direct Deposit service helps in realizing its benefits, including convenience, speediness, safety, and the opportunity for automatic saving. Misconceptions can often lead to hesitation or avoidance of beneficial services, but with accurate information, one can make informed decisions that best fit their banking needs.

Key takeaways

Filling out and using the Wells Fargo Direct Deposit form is a streamlined way to manage finances, offering both convenience and security. Here are some important takeaways from the Wells Fargo Direct Deposit set-up guide to ensure that individuals can maximize the benefits of this service:

- Enhanced convenience: Direct deposit is a particularly attractive option since it ensures that income is deposited into an account automatically. This feature is invaluable for people who may not be able to physically visit the bank due to illness, vacations, or a busy schedule. The deposited funds are available for immediate use on the day of deposit, offering both convenience and efficiency in managing finances.

- Security advantages: With direct deposit, concerns about checks getting lost, delayed, or stolen are eliminated. This secure method of deposit safeguards an individual's income and ensures that it is directly transferred to the intended account without the pitfalls associated with physical checks.

- Opportunity for automatic saving: Direct deposit also offers the opportunity to automatically save a portion of one’s income. By directing part of the pay into a savings account, individuals can effortlessly build their savings over time, contributing to their financial stability and well-being.

- Setting up is straightforward: To set up direct deposit, it’s necessary to provide key information including one's name, the bank's routing/transit number, the account number, and the type of account (checking/prepaid card or savings). It may also be required to contact the employer or payor/payee to complete any forms they provide and, in some instances, supply a voided check. Monitoring the account after setting up direct deposits is crucial to ensure that the process is running smoothly and as expected.

By taking advantage of the Wells Fargo Direct Deposit service, individuals can enjoy a hassle-free way to manage their income and payments, allowing for a more efficient and secure way to handle personal finances.

Popular PDF Forms

Dd2642 - The form warns against overbilling by providers or submitting claims for unrendered services.

Child Support Modification Online - Introduces a comprehensive method for presenting a case for visitation modification, from reasons for the change to required court procedures.

Central Registry Release of Information Form - Eligibility criteria based on various roles, such as foster parent or school personnel, dictate the form's use.