Blank Wellstar Financial Assistance Application PDF Template

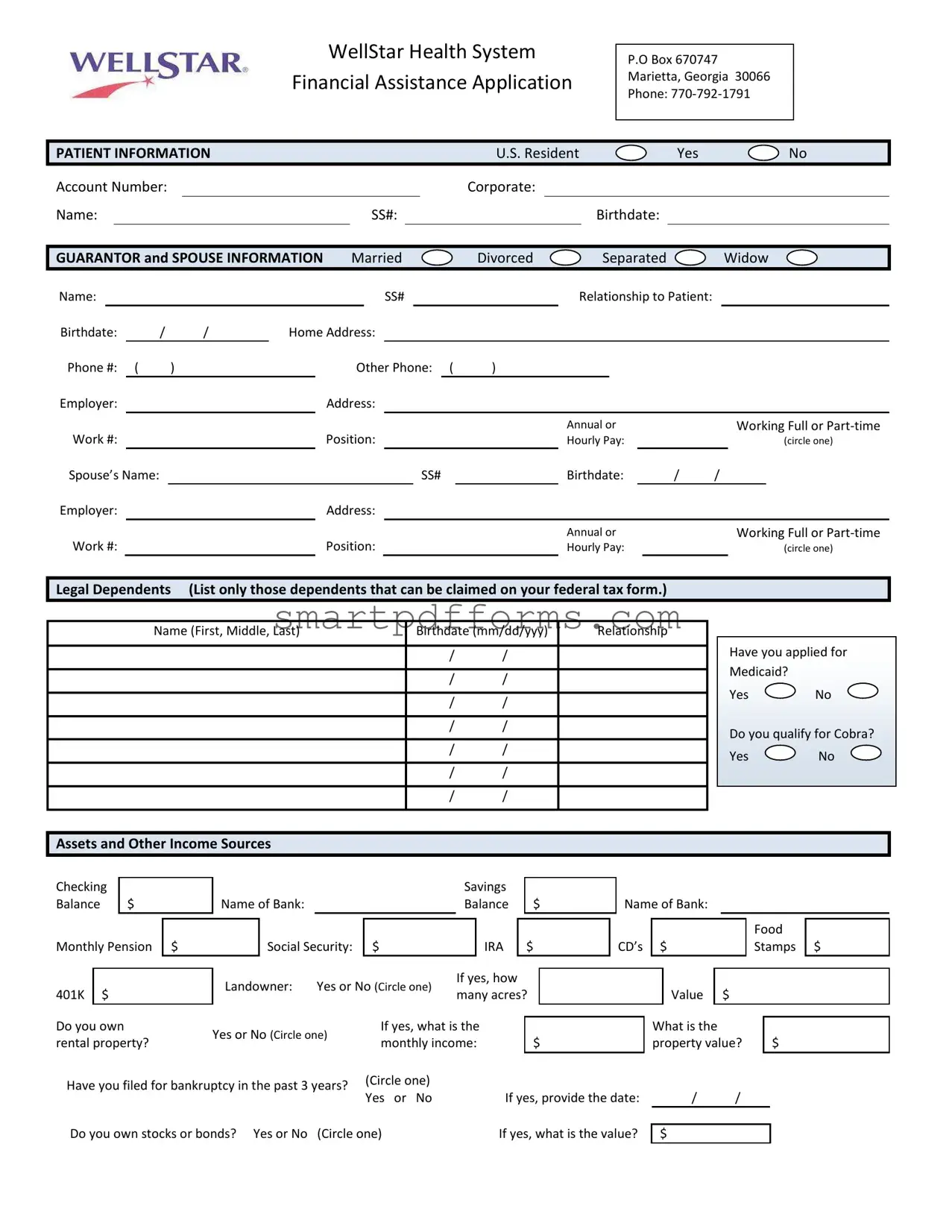

In an era where healthcare affordability remains a critical issue for many individuals, the Wellstar Health System has introduced a Financial Assistance Application with the intention of alleviating the financial burden on patients requiring medically necessary care but lacking the means to afford it. This comprehensive application process, as headquartered in Marietta, Georgia, demands thorough documentation from the applicant to ensure an accurate and fair evaluation of one’s financial standing. Patients are required to submit not only a completed, signed application but also a copy of their prior year's Federal Income Tax Return along with W2/1099 forms. For those unable to provide these specific documents, alternative proofs such as recent pay stubs, bank statements, or social security award letters are accepted. This process underlines the importance of transparency and cooperation between the patient and Wellstar Health System to identify possible coverage through public and private payment programs. Moreover, the form captures detailed information about the patient and, if applicable, their guarantor or spouse, assessing marital status, employment, income, legal dependents, and various assets. It’s designed to provide a holistic view of an individual's or family’s financial circumstances to determine eligibility for aid. Crucially, the application also mandates applicants to seek any other available assistance (e.g., Medicaid, Medicare) promising full cooperation in pursuing these avenues. By signing the application, the individuals attest to the accuracy of the provided information and agree to the terms of the financial assistance, including the obligation to pay any remaining balances after adjustments are made, highlighting Wellstar Health System's commitment to offering emergency medical care to everyone, irrespective of their financial status.

Preview - Wellstar Financial Assistance Application Form

WellStar Health System

Financial Assistance Application

P.O Box 670747

Marietta, Georgia 30066

Phone:

PATIENT INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Resident |

|

|

|

|

Yes |

|

|

|

No |

|||||||||

Account Number: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name: |

|

|

|

|

|

|

|

SS#: |

|

|

|

|

|

Birthdate: |

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

GUARANTOR and SPOUSE INFORMATION |

|

Married |

|

Divorced |

|

|

|

Separated |

|

|

Widow |

|||||||||||||||||||||

Name: |

|

|

|

|

|

|

|

|

|

SS# |

|

|

|

|

|

Relationship to Patient: |

|

|

|

|

||||||||||||

Birthdate: |

|

/ |

|

/ |

Home Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Phone #: ( |

) |

|

|

|

|

Other Phone: ( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Employer: |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual or |

|

|

|

Working Full or |

|||||

Work #: |

|

|

|

|

|

|

Position: |

|

|

|

|

|

Hourly Pay: |

|

|

|

|

|

(circle one) |

|||||||||||||

Spouse’s Name: |

|

|

|

|

|

|

|

|

|

|

|

|

SS# |

|

|

|

|

|

Birthdate: |

|

/ |

/ |

|

|

|

|||||||

Employer: |

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual or |

|

|

|

Working Full or |

|||||

Work #: |

|

|

|

|

|

|

Position: |

|

|

|

|

|

Hourly Pay: |

|

|

|

|

|

(circle one) |

|||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Legal Dependents |

(List only those dependents that can be claimed on your federal tax form.) |

|

|

|

|

|

||||||||||||||||||||||||||

Name (First, Middle, Last) |

Birthdate (mm/dd/yyy) |

Relationship |

/ /

/ /

/ /

/ /

/ /

/ /

/ /

Have you applied for Medicaid?

Yes No

Do you qualify for Cobra?

Yes No

Assets and Other Income Sources

Assets and Other Income Sources

Checking |

|

Balance |

$ |

Monthly Pension $

|

|

|

|

Savings |

|

|

||

Name of Bank: |

|

Balance |

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

Social Security: |

$ |

|

IRA |

|

$ |

|

|

Name of Bank:

CD’s $

Food Stamps $

|

|

Landowner: |

Yes or No (Circle one) |

If yes, how |

|

|||

401K |

$ |

many acres? |

|

|||||

|

|

|

|

|||||

Do you own |

Yes or No (Circle one) |

If yes, what is the |

|

|

|

|||

|

|

|

||||||

rental property? |

monthly income: |

|

$ |

|||||

|

|

|

||||||

Have you filed for bankruptcy in the past 3 years? |

(Circle one) |

|

|

|

|

|||

Yes or No |

|

If yes, provide the date: |

||||||

|

|

|

|

|

||||

|

Value |

|

$ |

|

|

What is the |

|

|

|

||

|

|

|

|||

property value? |

$ |

||||

/ |

|

/ |

|

|

|

Do you own stocks or bonds? Yes or No (Circle one) |

If yes, what is the value? |

$ |

WellStar Health System is committed to providing financial assistance to patients who have sought medically necessary care at WellStar Health System but have limited or no means to pay for that care. WellStar Health will provide emergency medical care to all individuals, regardless of their ability to pay or eligibility under the Community Financial Assistance Policy.

In order to qualify for financial assistance, cooperation with WellStar Health is necessary in identifying and determining alternative sources of payment or coverage from public and private payment programs. In order to qualify for financial assistance, the following is necessary:

Required information:

Submit a true, accurate, signed and completed application for financial assistance; and

Provide a copy of the prior year Federal Income Tax Return and W2/1099 (including all schedules)

Provide two of the following if unable to provide a copy of the most recent Federal Income Tax Return:

Provide 3 months of the most recent pay stubs (or certification of unemployment); or

Separation Notice or unemployment claim if unemployed; or

Provide 3 current bank statements for all checking and savings accounts; or

Provide award letter from Social Security Office; or

Provide Current Profit and Loss report for all

Current CD, 401k, 403b, IRA and other investment statements; or

Provide Asset Statement, with equity adjustments (Rental property, land, second houses)

This information must be received in order to process your application. If you fail to be compliant in returning the above information within 10 business days, WellStar Health System will not process your account for Community Financial Assistance approval. You may contact

Comments:

I hereby request that WellStar determine my eligibility for Community Financial Assistance. I understand that the information which I submit regarding my annual income and family size must be verified. I also understand that if the information I submit is determined to be false, such a determination will result in a denial of eligibility for Community Financial Assistance. I further agree to make application for any assistance (i.e., Medicaid, Medicare, State Aid (for cancer), Vocational Rehab, Insurance, etc.) that may be available for payment of my WellStar account charges. I will fully cooperate in taking whatever actions may be deemed necessary to obtain such assistance, and will assign or pay WellStar the amount recovered for WellStar charges. I agree to pay any balances remaining after the Community Financial Assistance adjustment is made. Failure to do so will result in a reversal of any Community Financial Assistance

I affirm that the above information is true and correct to the best of my knowledge. |

|

|

|

|

Guarantor Signature: |

Date: |

|

|

|

Date: |

||||

|

|

|

|

|

Form Data

| Fact | Detail |

|---|---|

| Application Address | WellStar Health System Financial Assistance Application P.O Box 670747 Marietta, Georgia 30066 |

| Contact Number | 770-792-1791 |

| Eligibility Requirement | Applicants must be U.S. residents seeking medically necessary care. |

| Application Requirement | Completed application, prior year Federal Income Tax Return and W2/1099, or alternative documents if unavailable. |

| Alternative Documentation | 3 months of pay stubs, separation notice, 3 current bank statements, award letter from Social Security Office, profit and loss report, or current investment statements. |

| Compliance Deadline | Documentation must be returned within 10 business days. |

| Application Integrity | False information will result in denial of assistance. |

| Governing Law | Financial assistance is governed by WellStar Health System policies and relevant Georgian and federal laws. |

Instructions on Utilizing Wellstar Financial Assistance Application

To apply for WellStar Health System's Financial Assistance, it's necessary to fill out their application thoroughly and accurately. This document is designed to assess your financial situation to determine if you qualify for aid in covering the costs of medically necessary care received at their facilities. Once submitted alongside the required documentation, WellStar will review your application to decide on your eligibility. The steps below guide you through completing this form, ensuring a smooth submission process.

- Start by downloading or collecting a copy of the WellStar Health System Financial Assistance Application form.

- Enter the patient information section with the patient's U.S. residency status, account number, corporate (if applicable), full name, social security number, and birthdate.

- Fill in the guarantor and spouse information section, which includes marital status, name, social security number, relationship to the patient, birthdate, home address, contact numbers, employment details, and financial information related to employment.

- Provide the complete name (First, Middle, Last), birthdate (mm/dd/yyyy), and relationship to the patient for all legal dependents that can be claimed on your federal tax form.

- Answer whether you have applied for Medicaid and if you qualify for Cobra with a simple "Yes" or "No".

- List all assets and other sources of income accurately, including checking and savings account balances, monthly pension, social security, IRA, CD's, 401K, food stamps, land ownership, rental property income, and whether you own stocks or bonds.

- If applicable, indicate whether you have filed for bankruptcy in the past 3 years, including the date of filing and the value of the related property.

- Read WellStar Health System's commitment statement regarding financial assistance and what is expected from applicants seeking aid.

- Ensure you provide all required documentation as listed in the application: a copy of the prior year's Federal Income Tax Return and W2/1099 forms, or two of the following alternatives if unavailable - recent pay stubs, separation notice or unemployment claim, recent bank statements, award letter from Social Security Office, current Profit and Loss report for self-employed applicants, current CD, 401K, 403B, IRA, and other investment statements, or an asset statement with equity adjustments.

- Sign and date the application to affirm that all provided information is true and correct to the best of your knowledge.

- Include co-guarantor's signature and date, if applicable.

- Mail the completed application form and all required documentation to WellStar Health System at the address provided: P.O Box 670747, Marietta, Georgia, 30066 or contact them via the phone number given for any queries: 770-792-1791.

Following these steps carefully will ensure your application is complete. Submitting accurate and thorough information along with the necessary documentation within 10 business days is crucial. Failure to do so may result in the inability of WellStar Health System to process your request for financial assistance. Upon submission, your application will undergo a review process to verify your eligibility. You're encouraged to cooperate fully and provide any additional information or documentation if requested. This will aid in a favorable determination concerning your application for financial assistance.

Obtain Answers on Wellstar Financial Assistance Application

Who is eligible for Wellstar Health System's Financial Assistance?

Eligibility for financial assistance at Wellstar Health System is tailored for patients who have received medically necessary care but are unable to pay for it, due to limited or no financial means. Both U.S. residents and non-residents can apply. Key criteria include the need for cooperation with Wellstar Health to explore all alternative sources of payment or coverage from both public and private programs. All patients, regardless of their eligibility under the Community Financial Assistance Policy, are entitled to receive emergency medical care.

What documents are required for the application process?

To apply for Wellstar's financial assistance, applicants must submit a completed, signed, and accurate application. Additionally, there's a requirement for a copy of the prior year's Federal Income Tax Return and W2/1099 forms, including all schedules. If the applicant is unable to provide the most recent Federal Income Tax Return, they must supply two of the following: three recent pay stubs or certification of unemployment, a separation notice or unemployment claim if unemployed, three current bank statements for all checking and savings accounts, a Social Security Office award letter, a current Profit and Loss report for self-employed individuals, current statements for CDs, 401Ks, 403Bs, IRAs, and other investments, or an asset statement covering rental property, land, secondary homes, with equity adjustments.

What happens if the required documents are not submitted within the given timeframe?

If the required documentation is not returned within 10 business days, Wellstar Health System will not be able to process the application for Community Financial Assistance approval. It's crucial for applicants to adhere to this timeframe to ensure their application is considered. Should there be any questions or concerns during this period, applicants are encouraged to contact Wellstar Health System directly at the provided contact number to seek clarification or assistance.

What are the implications of submitting false information on the application?

Submitting false information on the Wellstar Financial Assistance Application form can lead to a denial of eligibility for financial assistance. The information reported regarding annual income and family size is subject to verification to ensure accuracy and fairness in the eligibility determination process. Moreover, it is essential for applicants to apply for any other available assistance (such as Medicaid, Medicare, or State Aid) for the payment of their Wellstar account charges. Failure to do so, or to pay any remaining balances after the Community Financial Assistance adjustment, can result in the reversal of financial assistance write-offs, emphasizing the importance of truthfulness and full cooperation throughout the process.

Common mistakes

When filling out the WellStar Financial Assistance Application form, attention to detail is paramount. A slight oversight can lead to a missed opportunity for much-needed assistance. Below are ten common mistakes people make on their applications:

Not verifying U.S. residency status correctly – It's crucial to clearly indicate whether you are a U.S. resident, as this can impact eligibility.

Failing to provide accurate and complete Patient Information – This includes the patient’s full name, Social Security number, and birthdate, which are critical for identification purposes.

Omitting or incorrectly filling out Guarantor and Spouse Information – Details about marital status, employment, and income are necessary to assess financial need properly.

Leaving the section on Legal Dependents blank or incomplete – Dependents can significantly impact the financial assistance available, but only if their information is properly listed and verified.

Neglecting to answer questions about Medicaid, Cobra, and bankruptcy history – These factors can influence the determination process for financial aid eligibility.

Forgetting to disclose all Assets and Other Income Sources – Transparency regarding assets and income ensures a fair assessment by the WellStar Health System.

Inaccurate or incomplete disclosures about property – Whether it's real estate, land, or rental properties, the value and income generated need accurate reporting.

Not submitting the required documentation for income verification – Without proper documentation like tax returns, pay stubs, or bank statements, the application cannot be processed.

Misunderstanding the deadline for submission – Applications and supporting documents must be submitted within 10 business days for the application to be considered.

Failing to sign the application – An unsigned application is incomplete and will not be processed, as the signature verifies the accuracy of the provided information and the agreement to the terms.

Being mindful of these potential pitfalls and ensuring that all information is accurate, complete, and submitted on time will significantly increase your chances of receiving financial assistance from the WellStar Health System. Approaching the application process with the seriousness it deserves can make a substantial difference in the outcome.

Documents used along the form

Applying for financial assistance through WellStar Health System's Financial Assistance Program requires a thorough process, which includes providing a range of documents and forms. Apart from the core application form, there are several other important documents often required to complete the application process. Understanding what each document is for can greatly streamline the process, ensuring applicants have all the necessary paperwork prepared ahead of time.

- Prior Year Federal Income Tax Return and W2/1099 Forms: These documents provide comprehensive details about an applicant’s annual income, crucial for determining their eligibility for financial assistance.

- Pay Stubs: Recent pay stubs, generally from the past three months, are required if the most recent tax return cannot be provided. They offer a snapshot of the applicant's current financial situation.

- Unemployment Documents: For those currently not employed, documents such as a Separation Notice or unemployment claim benefits summary are needed to verify income status or lack thereof.

- Bank Statements: To give a complete picture of an applicant's financial health, current bank statements from all checking and savings accounts over the past three months are necessary.

- Award Letter from Social Security Office: If the applicant receives Social Security benefits, an award letter is required to confirm these details.

- Profit and Loss Statement: For applicants who are self-employed, a recent Profit and Loss statement can help assess their true earnings and financial standing.

- Investment Statements: Documents verifying any investments, including CDs, 401(k)s, 403(b)s, IRAs, and other assets, are needed to fully understand the applicant’s financial resources.

- Asset Statements for Non-Liquid Assets: This includes statements for rental properties, land, second homes, or any significant assets, which help determine an applicant’s net worth and eligibility for assistance.

Collecting and submitting these documents alongside the WellStar Financial Assistance Application form is a critical step in determining one's eligibility for aid. It's essential for applicants to provide accurate and up-to-date information to facilitate a smooth review process. By understanding and preparing each of these documents, applicants can ensure that their request for assistance is evaluated efficiently and fairly, paving the way for much-needed support.

Similar forms

Medicaid Application Forms: Similar to the Wellstar Financial Assistance Application, Medicaid application forms require detailed personal, financial, and family information to assess eligibility for health coverage benefits. Both applications request information on income, employment, legal dependents, and other assets to determine financial need.

Free Application for Federal Student Aid (FAFSA): The FAFSA, used by students to apply for federal financial aid for college, shares similarities with the Wellstar form in its requirement for comprehensive financial information from applicants and their families. This includes income, tax returns, and other financial assets, with the goal of determining the applicant’s financial need.

Supplemental Nutrition Assistance Program (SNAP) Application: SNAP application forms, which are used to apply for food assistance benefits, also collect detailed information about household income, size, and expenses, similar to the Wellstar Application. Both forms assess the economic status of an individual or family to provide assistance.

Subsidized Housing Applications: Applications for subsidized housing or Section 8 vouchers require detailed personal and financial information to qualify individuals based on their income levels. Like the Wellstar form, they necessitate disclosures about income, family size, and financial assets to evaluate eligibility for housing benefits.

Unemployment Benefit Applications: These applications gather personal information, employment history, and reasons for unemployment to determine eligibility for unemployment benefits. Like the Wellstar Financial Assistance Application, they involve comprehensive assessments of one’s financial situation and potential benefits from various programs.

Insurance Subsidy Applications through Healthcare Marketplaces: When applying for insurance subsidies under the Affordable Care Act (ACA), individuals must provide detailed personal, income, and family information, similar to the Wellstar form. Both aim to evaluate the financial situation of an applicant to offer financial relief or subsidies.

Dos and Don'ts

Filling out the Wellstar Financial Assistance Application form correctly is crucial for getting the financial aid you need for medical expenses. Below are key dos and don'ts to keep in mind:

Do:- Ensure all information provided is true and accurate. This includes personal identification, financial information, and any required documents.

- Sign and complete the application form to confirm your understanding and agreement with its terms.

- Attach a copy of your most recent Federal Income Tax Return and W2/1099 forms, as these are crucial for verifying your annual income.

- Provide alternative documents if you’re unable to submit a recent tax return. These can be recent pay stubs, bank statements, or an award letter from Social Security, among others listed on the form.

- Contact Wellstar at 678-838-5750 if you have any questions or need clarification about the application process or the documents required.

- Act promptly and return the completed application and all necessary documents within 10 business days to ensure your application is processed without delay.

- Apply for any other assistance programs you may be eligible for, such as Medicaid, Medicare, or state aid, and report this information on your application.

- Agree to pay any balance remaining after the financial assistance adjustment is made, to avoid reversal of the assistance provided.

- Leave sections incomplete. Every question and section is designed to help assess your financial situation and needs accurately.

- Submit the form without reviewing all the provided information for mistakes or omissions. This can delay the processing or result in denial of assistance.

- Withhold information or documents related to your financial status. This includes income from all sources, assets, and dependents that can impact your eligibility.

- Forget to update Wellstar if your financial situation changes after you have submitted your application. This ensures your information remains accurate and up-to-date.

- Ignore deadlines for submitting documentation or responding to requests for additional information. Timeliness is critical in the approval process.

Filling out the Wellstar Financial Assistance Application with care and honesty is crucial in obtaining the help you need. If you take these steps seriously, the process can be straightforward and lead to a successful outcome.

Misconceptions

One common misconception is that only U.S. residents can apply for WellStar Financial Assistance. In reality, the form does indeed ask whether the applicant is a U.S. resident, but this question is part of a broader understanding of the applicant's background and does not automatically disqualify non-residents from applying or receiving assistance.

Many people mistakenly believe that being married or having a certain marital status can negatively impact their eligibility for financial assistance. The form requests information on marital status and spouse details merely to comprehensively assess the household's financial situation, not to determine eligibility based on marital status alone.

Another false assumption is that applicants must have dependents to qualify for financial assistance. While the application form asks for information about legal dependents, this is to accurately assess financial need and household size, not to set a requirement for having dependents.

Some think that if they have applied for Medicaid and were denied, they cannot apply for WellStar Financial Assistance. This is incorrect. The form does ask whether the applicant has applied for Medicaid, but this is to ensure all other potential sources of coverage have been explored, not to exclude those who have applied or been denied.

There's a belief that owning assets or property automatically disqualifies an applicant from receiving financial assistance. The truth is, WellStar requires disclosure of assets and property to evaluate the applicant's complete financial situation. Ownership does not necessarily disqualify one from assistance.

Some applicants may fear that not having filed a recent tax return or having a complex financial situation will prevent them from qualifying. However, the form outlines various documents that can be submitted in lieu of a tax return to verify income, showcasing flexibility in the documentation required.

A significant misunderstanding is about the impact of filing for bankruptcy on eligibility for financial help. Although the application asks if the applicant has filed for bankruptcy in the past 3 years, this information is used to understand the applicant's financial history better, not automatically to deny assistance.

Lastly, many believe that the process of applying for WellStar Financial Assistance is final and binding. However, the statement at the end of the application emphasizes that applicants agree to pursue any other available assistance, showing that the process is collaborative and dynamic, aiming to find all possible means to assist the patient financially.

Key takeaways

Here are eight key takeaways regarding the WellStar Health System Financial Assistance Application form:

- Applicants must be thorough in providing personal, guarantor, and financial information, including Social Security numbers, employment details, and income sources, to ensure accurate assessment for financial aid eligibility.

- It's imperative for applicants to detail their legal dependents accurately, as this information directly influences the evaluation of financial need and assistance eligibility.

- Previous attempts to secure government aid, such as Medicaid or Cobra, are pertinent details that need to be disclosed in the application, potentially impacting the applicant's eligibility for WellStar's financial assistance.

- Disclosing assets and other income sources is crucial; this includes balances in checking and savings accounts, property ownership, and other investments, which are considered in the financial assistance review process.

- To process the application effectively, applicants are required to submit specific documents, including the previous year's Federal Income Tax Return and W2/1099 forms, or, if unavailable, alternative documents like pay stubs or bank statements.

- WellStar Health System mandates that all provided information be true and accurate, and reserves the right to deny assistance if submitted information is found to be false.

- Applicants are encouraged to actively pursue other forms of assistance (e.g., Medicaid, Medicare, State Aid) and may need to assign or pay any recovered amounts to WellStar for services rendered.

- Failure to submit the requested documentation within a 10-business-day timeframe will result in the non-processing of the Community Financial Assistance application, emphasizing the importance of timely and complete submissions.

Understanding and following these guidelines can significantly enhance an applicant's chance of receiving financial assistance from WellStar Health System, thereby ensuring necessary healthcare services are accessible to those in financial need.

Popular PDF Forms

Probate Limit California - Helps to demystify the process of claiming real property, making legal requirements accessible to successors.

How Much Does It Cost to Change Your Last Name in Colorado - The form contains sections for both the applicant's and any co-resident's financial data to assess the household's financial situation.