Blank Wh 3 PDF Template

The WH-3 form serves as a cornerstone document for businesses operating within Indiana, encapsulating the annual reconciliation of state and county income tax withheld from employees' earnings. This critical piece of paperwork, officially known as the Annual Withholding Tax Form, requires precision and attention to detail, as it summarizes the total amount of tax withheld throughout the tax year, broken down by state and county levels. Accuracy in completing the WH-3 is paramount, as it directly impacts the reconciliation process, ensuring that the amounts withheld from employees align with the state's records. For employers, the form also includes sections to amend or correct previously submitted information, which is a testament to the ever-evolving nature of tax records and the occasional need for adjustments. Intricately linked to this form are others like the WH-1U, used specifically for remitting any underpaid taxes, highlighting the interconnectedness of tax documentation. The WH-3 form's significance is further underscored by the mandate for electronic filing for employers who issue a substantial number of W-2, WH-18, W-2G, and 1099 forms, illustrating a shift towards digital efficiency and security in tax administration. As such, navigating the complexities of the WH-3 form is not just a matter of regulatory compliance but a critical aspect of maintaining accurate and transparent financial records.

Preview - Wh 3 Form

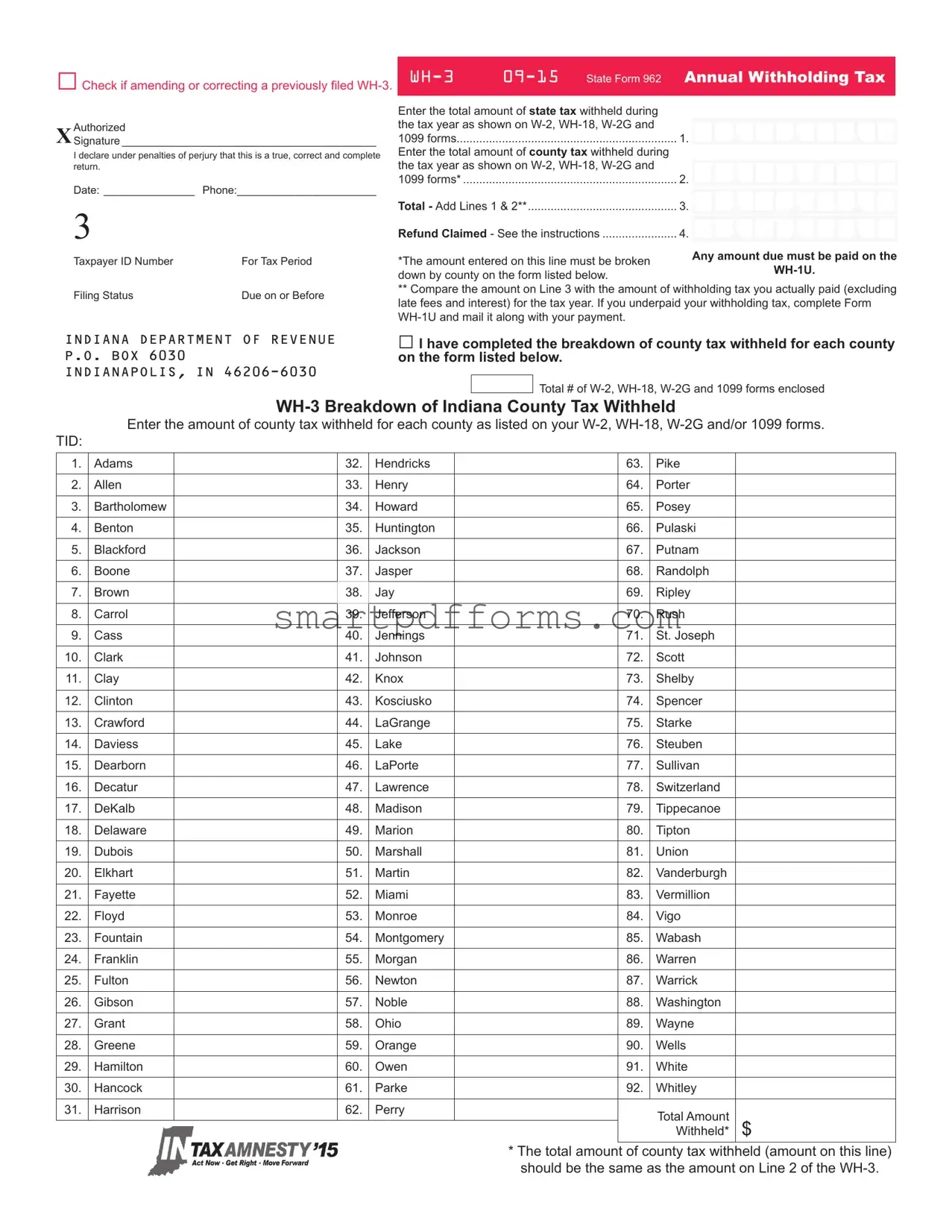

□Check if amending or correcting a previously filed |

Authorized

XSignature __________________________________________

I declare under penalties of perjury that this is a true, correct and complete return.

Date: _______________ Phone:_______________________

Enter the total amount of state tax withheld during |

|

the tax year as shown on |

|

1099 forms |

1. |

Enter the total amount of county tax withheld during |

|

the tax year as shown on |

2. |

1099 forms* |

3

Taxpayer ID Number |

For Tax Period |

Filing Status |

Due on or Before |

INDIANA DEPARTMENT OF REVENUE P.O. BOX 6030 INDIANAPOLIS, IN

Total - Add Lines 1 & 2** |

3. |

Refund Claimed - See the instructions |

4. |

*The amount entered on this line must be broken down by county on the form listed below.

** Compare the amount on Line 3 with the amount of withholding tax you actually paid (excluding late fees and interest) for the tax year. If you underpaid your withholding tax, complete Form

□ I have completed the breakdown of county tax withheld for each county on the form listed below.

Total # of

Total # of

Enter the amount of county tax withheld for each county as listed on your

TID:

1. |

Adams |

32. |

Hendricks |

63. |

Pike |

2. |

Allen |

33. |

Henry |

64. |

Porter |

3. |

Bartholomew |

34. |

Howard |

65. |

Posey |

4. |

Benton |

35. |

Huntington |

66. |

Pulaski |

5. |

Blackford |

36. |

Jackson |

67. |

Putnam |

6. |

Boone |

37. |

Jasper |

68. |

Randolph |

7. |

Brown |

38. |

Jay |

69. |

Ripley |

8. |

Carrol |

39. |

Jefferson |

70. |

Rush |

9. |

Cass |

40. |

Jennings |

71. |

St. Joseph |

10. |

Clark |

41. |

Johnson |

72. |

Scott |

11. |

Clay |

42. |

Knox |

73. |

Shelby |

12. |

Clinton |

43. |

Kosciusko |

74. |

Spencer |

13. |

Crawford |

44. |

LaGrange |

75. |

Starke |

14. |

Daviess |

45. |

Lake |

76. |

Steuben |

15. |

Dearborn |

46. |

LaPorte |

77. |

Sullivan |

16. |

Decatur |

47. |

Lawrence |

78. |

Switzerland |

17. |

DeKalb |

48. |

Madison |

79. |

Tippecanoe |

18. |

Delaware |

49. |

Marion |

80. |

Tipton |

19. |

Dubois |

50. |

Marshall |

81. |

Union |

20. |

Elkhart |

51. |

Martin |

82. |

Vanderburgh |

21. |

Fayette |

52. |

Miami |

83. |

Vermillion |

22. |

Floyd |

53. |

Monroe |

84. |

Vigo |

23. |

Fountain |

54. |

Montgomery |

85. |

Wabash |

24. |

Franklin |

55. |

Morgan |

86. |

Warren |

25. |

Fulton |

56. |

Newton |

87. |

Warrick |

26. |

Gibson |

57. |

Noble |

88. |

Washington |

27. |

Grant |

58. |

Ohio |

89. |

Wayne |

28. |

Greene |

59. |

Orange |

90. |

Wells |

29. |

Hamilton |

60. |

Owen |

91. |

White |

30. |

Hancock |

61. |

Parke |

92. |

Whitley |

31. |

Harrison |

62. |

Perry |

|

Total Amount |

|

|

|

|

|

|

|

|

|

|

|

Withheld* $ |

|

|

|

|

* The total amount of county tax withheld (amount on this line) |

|

|

|

|

|

should be the same as the amount on Line 2 of the |

|

For Amnesty Filing Only

Instructions for Completing Annual Reconciliation Form

Line 1 − Enter the total Indiana state income tax withheld as shown on Forms

Line 2 − Enter the total Indiana county income tax withheld as shown on Forms

All entries on this line must be broken down on Form

Line 3 − Add Lines 1 and 2; and enter the total here. If your account has been overpaid, continue to Line 4. If you have underpaid the withholding tax, see instructions for underpayment of Indiana withholding.

Line 4 − Complete this line only if your account has been overpaid and you are claiming a refund. Enter the amount of your overpayment on Line 4. No refund will be issued unless all areas of the Form

Note: Remittance must be made with the

together.

Underpayment of Indiana Withholding Filing Instructions

If you have underpaid the withholding tax, you must remit the amount due. If you normally remit by check, you must use

Form

If you are making the underpayment remittance late, penalty and interest are due. If you are paying the underpayment by check, include the penalty and interest on Line B. *Penalty is 10 percent of Line A or $5, whichever is greater. The total Does Not Apply

amount due should be entered on Line C. Call (317)

If you normally remit by EFT, make a supplemental payment for the final period of the year. Your supplemental payment together with all your other credits should equal the amount on Line 3 of the

State of Indiana Electronic Filing Instructions |

Filing Status ALL |

Any employer that files more than 25

For more than 3,500

Note: If you are under the mandated threshold of 25

An external label must be affixed to each CD or DVD containing the following information:

External Label for CDs or DVDs −File Name: W2REPORT

−State Taxpayer Identification Number (TID) −Submitter or Company Name −Complete Mailing Address

−Contact Name and Phone Number

Underpayment of Withholding Tax

State Form 49170

_______________________________________________________ |

|

|

|

Signature of Officer |

Title |

W |

|

Date: _____________ Telephone Number ____________________ |

Underpayment Amount...........A. |

||

Taxpayer ID Number |

Due Date |

|

|

Calendar Year Ending

INDIANA DEPARTMENT OF REVENUE P.O. BOX 6030 INDIANAPOLIS, IN

Penalty & Interest Due |

B. |

Amount Being Paid |

C. |

s,

s,

s,

s.

s.

Does, Not, Apply.

s s

s

s

s,

s,

s,

.

.

Form Data

| Fact Name | Description |

|---|---|

| Form Identification | The form discussed is the WH-3, a state-specific form for Indiana, referenced as State Form 962 (Annual Withholding Tax). |

| Governing Law | This form is governed by the laws and regulations overseen by the Indiana Department of Revenue. |

| Primary Purpose | The WH-3 form is designed for the annual reconciliation of Indiana state and county income tax withheld as reported on Forms W-2, WH-18, W-2G, and 1099. |

| Electronic Filing Requirement | Any employer that files more than 25 W-2, WH-18, W-2G, and 1099 forms in a calendar year is required to submit those forms and the WH-3 electronically, according to www.in.gov/dor/4455.htm. |

Instructions on Utilizing Wh 3

Filling out the WH-3 form accurately is a crucial step in ensuring compliance with state tax obligations. Before proceeding with the steps, it’s important to gather all necessary documents, including W-2, WH-18, W-2G, and 1099 forms, to accurately report state and county tax withholdings for the tax year. After the form has been completed, if any underpayment is detected, addressing this through the proper channels, such as the WH-1U form, becomes essential to avoid penalties. Below are the steps for filling out the WH-3 form.

- Begin by entering the total amount of Indiana state income tax withheld as shown on Forms W-2, WH-18, W-2G, and 1099 at the end of the given tax year.

- Report the total Indiana county income tax withheld as evidenced on your Forms W-2, WH-18, W-2G, and 1099. It's necessary to break down this total by county on the provided sections within the form.

- Add the amounts from lines 1 and 2 together and enter this total. This step confirms the overall tax withheld for both state and county levels.

- If your account indicates an overpayment, complete line 4 by entering the amount you are claiming as a refund. Ensure all required sections of the WH-3 form are duly filled and all supporting documents are attached to facilitate the refund process.

- For any discrepancies where you identify underpayment in your withheld taxes, refer to instructions specific to underpayment situations and prepare to submit the necessary adjustment through Form WH-1U, along with the required payment.

- If you are amending or correcting a previously filed WH-3, ensure to check the appropriate box at the top of the form to indicate this.

- Complete the authorized signature section, declaring under penalties of perjury that the information provided is accurate. Include the date and a contact phone number.

- For electronic filers, remember that any employer issuing more than 25 of the specified form types in a calendar year is mandated to submit these documents and the WH-3 electronically. Review the specific requirements if you are submitting a large volume of forms.

Following the submission of the WH-3 form and any necessary adjustments through the WH-1U, ensure that all forms are accurately completed and supplemented with the required documentation. This adherence to detailed and precise filing contributes significantly to maintaining compliance with tax regulations, thereby preventing potential legal and fiscal complications. Should there be questions or uncertainties at any step of this process, seeking clarification from the Indiana Department of Revenue or a tax professional is advisable.

Obtain Answers on Wh 3

What is the purpose of the WH-3 form?

The WH-3 form serves as an annual reconciliation statement for employers in Indiana. It documents the total state and county income tax withheld from employees' earnings throughout the tax year. This form is crucial for ensuring that the amounts withheld match the employer's payroll records and the taxes remitted to the Indiana Department of Revenue.

Who needs to file the WH-3 form?

Any employer who has withheld Indiana state and/or county income taxes from employees' wages must file the WH-3 form. This applies to all forms of compensation reported on W-2, WH-18, W-2G, and 1099 forms.

How do I fill out the WH-3 form?

- Enter the total Indiana state income tax withheld as reflected on Forms W-2, WH-18, W-2G, and 1099 in Line 1.

- Enter the total Indiana county income tax withheld, as detailed by county, in Line 2. A breakdown by county is required, and the total must match the amount entered on this line.

- Add Lines 1 and 2 and report the sum in Line 3.

- If you have overpaid, complete Line 4 to claim a refund.

What do I do if I discover an underpayment in the tax withheld?

In the case of underpayment, you must complete Form WH-1U to report the due amount. Include any late fees and interest if applicable. The total due amount including penalties and interest must be remitted to the Indiana Department of Revenue to correct the underpayment.

Can I amend a previously filed WH-3 form?

Yes, amendments are possible. On the WH-3 form, check the box indicating that you are amending or correcting a previously filed WH-3. Ensure that all corrected information is accurate and complete to avoid penalties.

How do I claim a refund for overpayment?

If your account shows an overpayment, complete Line 4 on the WH-3 form to claim a refund. Note that no refund will be processed unless the WH-3 form is fully completed and all required W-2, WH-18, W-2G, and 1099 forms are included.

What is required for electronic filing of the WH-3 form?

Employers submitting more than 25 W-2, WH-18, W-2G, and 1099 forms in a calendar year are mandated to file these forms and the WH-3 electronically. Visit the Indiana Department of Revenue website for detailed instructions on electronic submission. Employers filing fewer than this threshold may submit documents on a CD or DVD, but a completed WH-3 form must accompany the digital media.

What are the penalties for failing to file or incorrectly filing the WH-3 form?

Failure to file the WH-3 form, late filing, or inaccuracies in filed forms may result in penalties. The penalty for underpayment is 10 percent of the owed amount or $5, whichever is greater. Interest may also be charged on late payments.

Where can I get further assistance or information about filling out the WH-3 form?

For additional guidance and the most up-to-date information regarding the WH-3 form and filing requirements, contact the Indiana Department of Revenue directly at (317) 233-4016. Technical support for electronic filing can be reached at (317) 233-5656 or via email at IDORB2BSupport@dor.in.gov.

Common mistakes

Filling out the WH-3 form, an essential document for reporting annual withholding taxes to the Indiana Department of Revenue, involves careful attention to detail. Unfortunately, a variety of common errors can occur during this process, complicating tax filings and potentially leading to penalties. Here are ten mistakes to avoid:

Overlooking the precise amounts: Failure to accurately report the total amount of state and county tax withheld as shown on W-2, WH-18, W-2G, and 1099 forms can result in discrepancies and issues with the tax authorities.

Not completing the breakdown of county tax withheld for each county, when this detailed information is crucial for accurate tax processing.

Inaccurate Taxpayer ID Number entries, leading to processing delays or misapplied filings.

Incorrect filing status, which could affect the perceived obligations and rights under the tax law.

Missing the deadline, as the form is due on or before a specific date that varies depending on the tax period in question.

Failing to check the box if amending or correcting a previously filed WH-3, which helps the Department of Revenue understand the context of the filing.

Leaving the authorized signature area blank, as the declaration under penalties of perjury is a legal requirement for the form’s submission.

Forgetting to include the total number of W-2, WH-18, W-2G, and 1099 forms enclosed, which verifies the completeness of the tax information provided.

Omitting the date and phone number, thereby reducing the avenues for contact between the filer and the Department of Revenue if clarification is needed.

Not using Form WH-1U for underpayment remittance, especially when acknowledging an underpayment on the WH-3 form.

Avoiding these mistakes not only streamlines the process but ensures compliance with Indiana’s tax reporting requirements. Here's a brief overview highlighting key takeaways:

- Ensure the accuracy of all quantitative data related to state and county tax withheld.

- Complete all sections, including the breakdown by county and taxpayer identification.

- Adhere to the given deadlines to prevent penalties.

- Understand the importance of an authorized signature and accurate contact information on the form.

- Utilize additional forms as required, such as the WH-1U for underpayments.

In summary, a thorough and careful approach to completing the WH-3 form can prevent common pitfalls, facilitating a smoother interaction with the Indiana Department of Revenue.

Documents used along the form

When managing and submitting the WH-3 form for state and county tax withholdings, understanding and organizing the necessary paperwork is crucial for compliance and efficiency. Alongside the WH-3, several other forms and documents are commonly used to ensure accurate reporting and payment of taxes. Below is a brief description of these forms and documents, providing insight into their purpose and importance in the tax filing process.

- W-2 Form: This crucial document reports an employee's annual wages and the amount of taxes withheld from their paycheck. It's necessary for both federal and state tax filings.

- WH-18 Form: Similar to the W-2, this form is specifically for reporting amounts withheld from non-resident employees in Indiana.

- W-2G Form: Used to report gambling winnings and any federal or state tax withholding on those winnings. It's essential for filers who have received significant winnings over the tax year.

- 1099 Forms: There are several types of 1099 forms, each for reporting different types of income other than salaries, such as independent contractor earnings (1099-NEC), interest and dividends (1099-INT, 1099-DIV), and other income sources.

- WH-1U Form: This form is specifically for reporting and paying any underpayment of withheld taxes. It is used when the amount withheld and reported on the WH-3 form falls short of the actual tax liability.

- Amended Forms: If a mistake was made on any of the original filings, amended forms (such as the 1040-X for individuals) would need to be filed to correct the discrepancy.

- Electronic Filing Requirements: For employers who submit a large number of W-2, WH-18, W-2G, and 1099 forms, understanding the electronic filing requirements is vital to ensure compliance and streamline the submission process.

- Payment Vouchers: For taxpayers who owe additional taxes beyond what was withheld, payment vouchers are used to submit the balance due to the state revenue department.

- Extension Forms: If more time is needed to gather documents and file accurately, extension forms provide taxpayers with additional months to submit their full and complete tax documents.

- County Tax Withholding Documents: Specific forms might be required for detailing tax withholdings on a county level, complementing the state-level reporting on the WH-3.

Each of these documents plays a specific role in ensuring that employers and individuals comply with tax requirements efficiently and effectively. Whether it's for reporting income, correcting past mistakes, or paying owed taxes, understanding each form's purpose aids in a smoother tax filing process. Ensuring accurate and timely submissions of these forms, along with the WH-3, contributes to responsible tax compliance and financial management.

Similar forms

The WH-1U form, closely linked with the WH-3 form, is designed for employers to remit any underpayment of withheld state taxes. This connection is vital as the WH-3 form helps employers tally the total amount of state and county tax withheld, while the WH-1U is the next step for addressing any discrepancies uncovered during that reconciliation process.

W-2 forms represent annual wage and tax statements that employers must send to employees and the Internal Revenue Service (IRS). The WH-3 form necessitates the total state tax withheld information from these forms, showcasing their interdependence for accurate state income tax reporting and compliance.

The WH-18 is another form used in conjunction with the WH-3 to report miscellaneous income and the withholding tax associated with it. Its figures contribute to the WH-3’s comprehensive tally of annual withholding, underscoring the intricate relationship between detailed reporting and summarizing withheld taxes on various earnings.

Similarly, the W-2G form, used for reporting gambling winnings and any federal income tax withheld, highlights its relevance to the WH-3 by providing necessary details on gambling withholding that must be accounted for in the annual tax reconciliation process.

The 1099 form series, which reports various forms of income from self-employment earnings to interest and dividends, plays a significant role in WH-3 preparation. Employers include withholdings from these forms on the WH-3, emphasizing the holistic approach to tax reconciliation and the inclusivity of various income sources.

For those who exceed withholding tax obligations, the process for claiming a refund is detailed within the WH-3 instructions, showing a procedural connection. This facet of the form caters to the settlement phase, where an overpayment discovered through the WH-3's use initiates a refund procedure, aligning closely with the broader tax adjustment mechanisms.

The requirement for electronic filing, as stated for companies submitting a significant number of W-2, WH-18, W-2G, and 1099 forms, mirrors the broader trend towards digital tax administration. The WH-3 form adheres to this transition by obligating larger employers to file electronically, reflecting the evolving dynamics of tax submission practices.

Dos and Don'ts

When filling out the WH-3 form, it is crucial to ensure accuracy and compliance with the guidelines to avoid any potential issues. Below is a list of things you should and shouldn't do:

- Do verify that all the information, including the Taxpayer ID Number and total amounts of state and county tax withheld, is accurate and matches the information on W-2, WH-18, W-2G, and 1099 forms.

- Do check the box if you are amending or correcting a previously filed WH-3 form to ensure your adjustments are processed correctly.

- Do sign the form and include your phone number. Your signature verifies that the information is true, correct, and complete under penalties of perjury.

- Do enter the breakdown of county tax withheld for each county as required.

- Do compare the amount on Line 3 with the withholding tax you actually paid. If you underpaid, complete Form WH-1U and mail it with your payment.

- Don't leave any required fields blank. Incomplete forms may be returned or may not be processed, leading to delays.

- Don't staple documents together when submitting your WH-3 form and related documents. This can cause processing delays.

- Don't neglect to include all W-2, WH-18, W-2G, and 1099 forms if claiming a refund. No refund will be issued unless all required documents are enclosed.

- Don't send the WH-1U form or payment with the WH-3 form if making an underpayment remittance. These should be sent as instructed on the WH-1U form or electronic filing instructions.

By following these do’s and don’ts, you can help ensure that the WH-3 form is correctly filled out and submitted, facilitating a smoother processing of your annual reconciliation for Indiana withholding taxes.

Misconceptions

Understanding the complexities of tax forms can often lead to misconceptions. Below are eight common misunderstandings about the WH-3 form, debunked for clarity:

- The WH-3 form is for everyone. The WH-3 form is specifically designed for employers in the state of Indiana who are reporting state and county withholding taxes. It's not a universal form for all taxpayers or businesses outside Indiana.

- You can pay your taxes with the WH-3 form. Taxes cannot be paid using the WH-3 form. This form is for reporting purposes only. Any payment due must be made with the WH-1U form or through Electronic Funds Transfer (EFT), not the WH-3.

- Electronic filing is optional. For those who file more than 25 W-2, WH-18, W-2G, and 1099 forms in a calendar year, electronic filing is mandatory. This requirement ensures efficiency and security in processing these forms.

- You can staple documents to the WH-3 form. Documents should never be stapled to the WH-3 form. This instruction is made clear to avoid damage to the documents and to facilitate easier processing by the Department of Revenue.

- Any corrections need a new WH-3 form. If corrections are necessary for a previously filed WH-3, checking the box indicating an amendment or correction on a new WH-3 form is sufficient. This means a completely new form isn’t always necessary for minor corrections.

- Refunds are automatically issued with overpayment. If there’s an overpayment, a refund must be explicitly claimed on the form, and all sections of the WH-3, along with all required W-2, WH-18, W-2G, and 1099 forms, must be complete and enclosed for a refund to be issued.

- Breaking down the county tax withheld isn’t mandatory. It's obligatory to provide a breakdown of the county tax withheld by each county on the form listed below the WH-3. The sum of these amounts must match the total reported on Line 2 of the WH-3.

- Underpayments can be ignored if they are minimal. If you've underpaid your withholding tax, action is required regardless of the amount. You must complete Form WH-1U and include the underpayment along with any assessed penalties and interest, demonstrating the seriousness of accurate tax reporting.

By understanding these key points, employers can better navigate the specifics of the WH-3 form, ensuring accurate and compliant tax reporting.

Key takeaways

Filling out and using the WH-3 form, an annual withholding tax form for the state of Indiana, requires attention to detail and awareness of tax obligations. Here are key takeaways one should consider:

- Accuracy Is Crucial: It is imperative to declare accurately under penalty of perjury that the information provided on the form is true, complete, and correct.

- Understanding Tax Withholding: The form requires the total amount of state and county tax withheld to be reported, which should align with the amounts shown on W-2, WH-18, W-2G, and 1099 forms.

- Breakdown by County: When entering total county tax withheld, a detailed breakdown by county is necessary. This ensures precise allocation of funds and compliance with local tax regulations.

- Dealing with Underpayment: If you've underpaid withholding tax, you must complete Form WH-1U and submit the due amount. This is crucial to avoid penalties and further interest accruals.

- Claiming a Refund: To claim a refund for overpayment, detailed documentation and all relevant forms must be enclosed with the WH-3 form. No refunds are processed without complete information.

- Mandatory Electronic Filing: Entities filing more than 25 W-2, WH-18, W-2G, and 1099 forms within a calendar year are obliged to file these documents and the WH-3 electronically, facilitating efficiency and compliance.

- Physical Media Acceptance Under Threshold: If under the 25 form threshold, employers can submit these forms on CD or DVD, given they are accompanied by a completed WH-3 and adhere to specified labeling requirements.

- Penalty and Interest for Late Payment: If the underpayment is remitted late, the employer is subject to a penalty, which is the greater of 10 percent of the underpaid amount or $5, and interest. This emphasizes the importance of timely compliance.

Properly filling out and understanding the WH-3 form is crucial for employers in Indiana, ensuring tax compliance and avoiding penalties. Paying close attention to the details and instructions can help streamline the process, ensuring all tax responsibilities are met efficiently.

Popular PDF Forms

Tt Form - HSBC's form aids in swift global transactions, ensuring beneficiary banks receive precise and timely funds.

Wells Fargo Beneficiary Form - The effectiveness of this designation hinges on its submission to Wells Fargo prior to the participant’s passing, underscoring urgency and foresight in estate planning.

Dss 5163 - This form is used when adults in North Carolina express their intention to adopt another adult, establishing a legal parent-child relationship.