Blank Wire Transfer PDF Template

In today's fast-paced financial environment, the Wire Transfer form plays a pivotal role in enabling swift and secure transactions across borders. This form, a crucial document for initiating wire transfers, requires meticulous completion to ensure accuracy in fund transfer processes. Essentials covered in the form include the provision for attaching it to payment requests, a necessary step for processes such as Toolkit and TravelND submissions. It also emphasizes the importance of contacting Accounts Payable for assistance, highlighting two key contacts: Julie Unger and Johnna Grenert-Taff, for personalized support. The form accommodates various international banking requirements, such as the CLABE number for Mexico, the bank account and Sort Code for Great Britain, and specific needs for transfers to China, underscoring the global nature of financial operations. It meticulously captures details about the beneficiary and intermediary banks, including names, locations, and critical banking information like ABA/Routing numbers and IBANs, ensuring that the wire transfer targets the correct destination. Submission details at the end of the form, including the submitter's name and contact information, further facilitate streamlined communication and accountability. This integral document, therefore, embodies the detailed planning and international considerations necessary for executing flawless financial transfers.

Preview - Wire Transfer Form

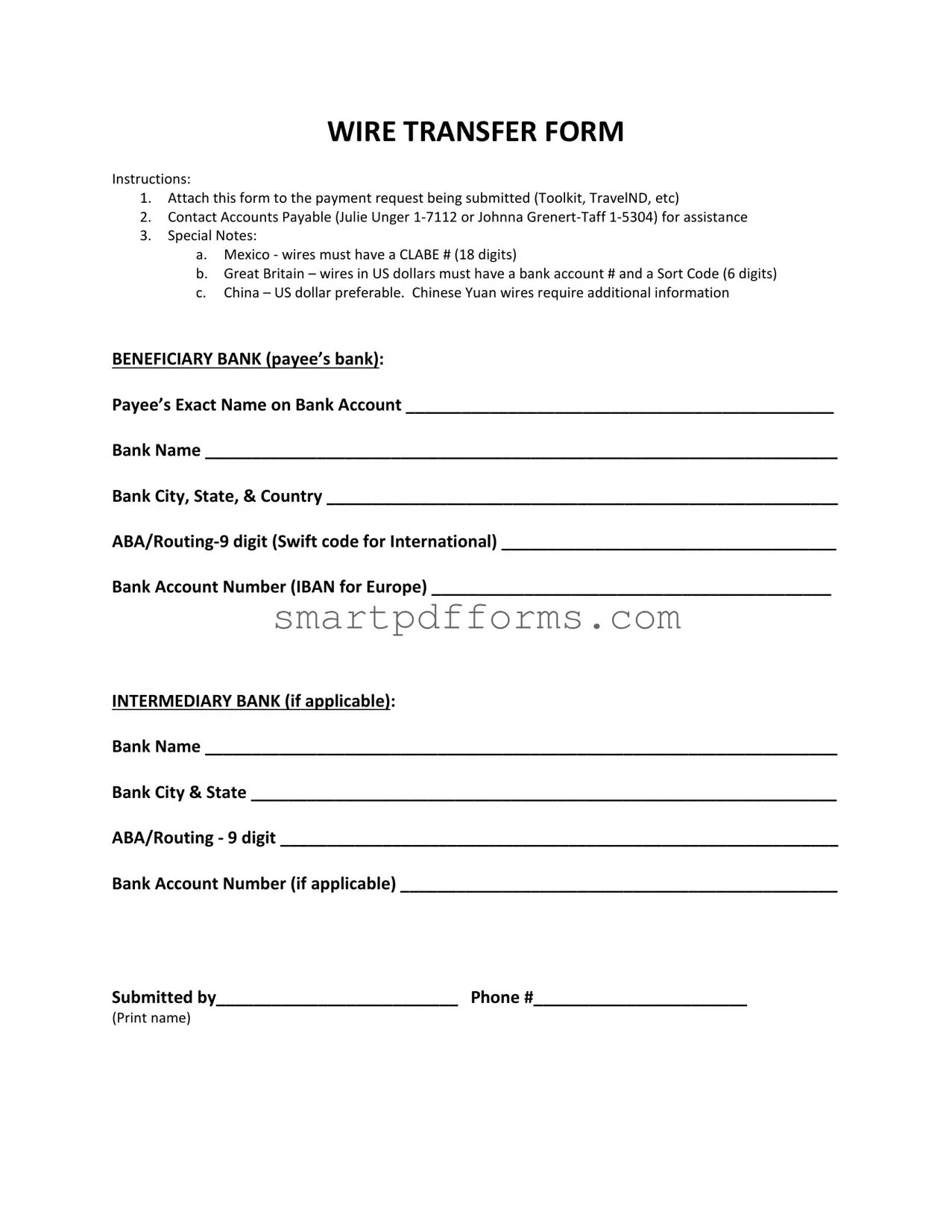

WIRE TRANSFER FORM

Instructions:

1.Attach this form to the payment request being submitted (Toolkit, TravelND, etc)

2.Contact Accounts Payable (Julie Unger

3.Special Notes:

a.Mexico - wires must have a CLABE # (18 digits)

b.Great Britain – wires in US dollars must have a bank account # and a Sort Code (6 digits)

c.China – US dollar preferable. Chinese Yuan wires require additional information

BENEFICIARY BANK (payee’s bank):

Payee’s Exact Name on Bank Account ______________________________________________

Bank Name ____________________________________________________________________

Bank City, State, & Country _______________________________________________________

Bank Account Number (IBAN for Europe) ___________________________________________

INTERMEDIARY BANK (if applicable):

Bank Name ____________________________________________________________________

Bank City & State _______________________________________________________________

ABA/Routing - 9 digit ____________________________________________________________

Bank Account Number (if applicable) _______________________________________________

Submitted by__________________________ Phone #_______________________

(Print name)

Form Data

| Fact Number | Description |

|---|---|

| 1 | All wire transfer requests must be accompanied by a completed form. |

| 2 | Accounts Payable must be contacted for assistance with the form. |

| 3 | For wires to Mexico, an 18-digit CLABE number is necessary. |

| 4 | Wires to Great Britain in USD require both a bank account number and a 6-digit Sort Code. |

| 5 | Transfers to China in USD are preferred, while Chinese Yuan transfers require additional information. |

| 6 | The beneficiary bank's details must be precisely provided, including the name on the bank account, the bank’s name, and its location. |

| 7 | The ABA/Routing number is required for domestic transfers, while a SWIFT code is necessary for international wires. |

| 8 | For European transfers, the IBAN number of the beneficiary is required. |

| 9 | An intermediary bank’s information may be needed depending on the wire transfer route. |

| 10 | The form must be submitted with the requester’s printed name and phone number for contact purposes. |

Instructions on Utilizing Wire Transfer

Wire transfers are a reliable way to send money directly from one bank account to another, both domestically and internationally. The process might seem complex at first, but it's relatively straightforward once you understand what each section of the form requires. Following these steps will help ensure that your money reaches its intended recipient without any issues. Here's how to fill out the wire transfer form correctly:

- Attach the form to the payment request you are submitting. This could be through Toolkit, TravelND, or another designated system or procedure your organization uses.

- Contact Accounts Payable for assistance if needed. You can reach out to Julie Unger at 1-7112 or Johnna Grenert-Taff at 1-5304 for support or clarification on any parts of the form you find confusing.

- Under SPECIAL NOTES, pay close attention to the specific requirements based on the destination country of the wire transfer. For example:

- If sending to Mexico, make sure to include a CLABE number, which should be 18 digits long.

- For Great Britain, if sending in US dollars, you'll need the bank account number and a 6-digit Sort Code.

- When wiring to China, US dollars are preferred, but if sending Chinese Yuan, additional information will be required.

- Fill out the BENEFICIARY BANK section with the exact name on the payee’s bank account, the bank name, city, state, and country. Also, include the ABA/Routing number (or Swift code for international transfers) and the bank account number (or IBAN for European transfers).

- If there is an INTERMEDIARY BANK involved, provide its name, city, state, the ABA/Routing number, and account number if applicable.

- Lastly, ensure that you print your name and provide your phone number at the bottom of the form where indicated.

Completing the wire transfer form accurately is crucial for the successful transfer of funds. Be sure to double-check all the information you've entered, especially the bank account numbers and routing numbers, to prevent delays or issues with the wire transfer. If you're ever uncertain about a field on the form, don't hesitate to reach out to Accounts Payable or your banking institution for guidance.

Obtain Answers on Wire Transfer

What information is required to submit a Wire Transfer request?

To successfully submit a Wire Transfer request, the form necessitates detailed information that includes the beneficiary bank details (payee's exact name on the bank account, bank name, city, state, and country, ABA/Routing or SWIFT code, and the bank account number or IBAN for Europe). If an intermediary bank is involved, its details (name, city, state, ABA/Routing, and account number if applicable) must also be provided. Additionally, the submitter must include their name and phone number.

How do I attach this form to a payment request?

This form should be attached to the payment request you're submitting, whether it be for Toolkit, TravelND, or any other payment system your institution uses. Ensure that the form is filled out completely and attached according to the specific instructions or mechanisms provided by your payment system or software.

Who can I contact for assistance with Wire Transfer?

For assistance with the Wire Transfer process, you can contact Accounts Payable. The points of contact are Julie Unger at 1-7112 or Johnna Grenert-Taff at 1-5304. They can provide guidance and answers to any specific questions related to wire transfers.

Are there any special requirements for wire transfers to Mexico, Great Britain, or China?

Yes, there are specific regional requirements for wire transfers to these countries:

- Mexico: Wires must include a CLABE number, which is 18 digits long.

- Great Britain: For wires in US dollars, a bank account number and a Sort Code (6 digits) are needed.

- China: Wires in US dollars are preferable. However, for Chinese Yuan wires, additional information is required.

What is an ABA/Routing number, and when is it needed?

An ABA/Routing number is a 9-digit code used primarily within the United States to identify financial institutions. It is required for domestic wire transfers. For international transfers, a SWIFT code of the beneficiary bank is used instead.

What is a SWIFT code and when do I need it?

A SWIFT code is an international bank code that identifies particular banks worldwide. It's necessary for international wire transfers to help ensure the money is sent to the right bank.

What is an IBAN, and is it necessary for all wire transfers?

An IBAN (International Bank Account Number) is a string of characters that uniquely identifies a customer's bank account in international transactions. It is required for wire transfers within Europe but not for all wire transfers globally.

When would I need to include details of an intermediary bank?

Details of an intermediary bank are required when the sending or receiving bank does not have a direct relationship. The intermediary bank acts as a facilitator for the wire transfer, ensuring it reaches the beneficiary's bank. If your wire transfer involves an intermediary bank, its information including name, city, state, ABA/Routing number, and account number (if applicable) must be included.

Can wire transfer requests be submitted electronically, or do they require a physical form?

While the specific process may vary depending on your institution or bank, many allow for wire transfer requests to be submitted electronically through online banking platforms or payment systems. It's important to check with your institution's guidelines to see if a physical form is necessary or if electronic submission is preferred.

Common mistakes

When filling out a Wire Transfer form, individuals often make several mistakes that can delay or prevent the transfer of funds. Being aware of these common errors can help ensure that the process goes smoothly. Here are six mistakes to watch out for:

Incorrect Beneficiary Information: One of the most crucial components of the wire transfer form is the beneficiary's exact name on the bank account. It must match the records of the beneficiary's bank precisely. Any discrepancies between the name on the account and the name provided on the form can result in the transfer being rejected.

Missing Bank Details: Omitting essential bank details such as the bank name, city, state, and country can lead to processing delays. For international transfers, the Swift code is a critical piece of information that should not be overlooked.

Incorrect Account Numbers: Entering an incorrect Bank Account Number or IBAN (for transfers to Europe) is a common mistake. For certain countries like Mexico, an 18-digit CLABE number is required, while transfers to Great Britain need both a bank account number and a Sort Code. Ensuring these numbers are accurate is vital for successful wire transfers.

Failing to Contact Accounts Payable: The wire transfer form instructions suggest contacting Julie Unger or Johnna Grenert-Taff for assistance. Overlooking this step might mean missing out on crucial assistance and guidance, increasing the likelihood of errors.

Overlooking Intermediary Bank Information: For some transfers, an intermediary bank may need to be involved. Failing to provide the intermediary bank's name, city, state, and, if applicable, account number can complicate or impede the transfer process, especially if the primary beneficiary bank cannot directly receive international wires.

Ignoring Special Notes: The form includes special notes for transfers to specific countries like Mexico, Great Britain, and China. Each of these notes contains crucial information such as the need for a CLABE number for Mexico or a Sort Code for Great Britain. Ignoring these special requirements can lead to unsuccessful transfers.

By paying attention to these details and ensuring that all the provided information is correct and complete, users can avoid the most common pitfalls associated with filling out Wire Transfer forms.

Documents used along the form

When initiating a wire transfer, it’s crucial to understand that this process often involves more than just filling out the Wire Transfer Form. There are several other forms and documents that may be needed to ensure the transaction is processed smoothly and complies with all regulatory requirements. Here, we delve into some of these essential documents, providing a brief overview of each.

- Payment Request Form: This form typically accompanies the Wire Transfer Form, detailing the purpose of the payment, the amount, and the payee's information. It serves as an official request for the payment to be made.

- Invoice: For transactions paying for goods or services, the invoice from the vendor or service provider is often required. It provides a detailed account of what is being paid for, including prices and quantities.

- Bank Confirmation Letter: This document might be requested to confirm the bank account details of the payee, including the bank name, address, and account numbers. It serves as a verification tool to prevent fraud.

- Contract or Agreement: When the wire transfer is for a contract payment, the original contract or agreement showing the terms of payment, including any wire transfer instructions, is usually necessary.

- Foreign Exchange (FX) Contract: For wire transfers involving currency conversion, an FX contract may be required. This document outlines the exchange rate, the currencies involved, and the terms of the exchange.

- Compliance Forms: Depending on the nature of the transaction and the jurisdictions involved, various compliance forms may be needed to adhere to anti-money laundering (AML) and know your customer (KYC) regulations.

- Authorization Forms: In some cases, especially for businesses, an authorization form signed by an authorized representative of the company is required to authorize the transaction.

- Tax Documents: For international wire transfers, tax documents may be needed to comply with tax withholding and reporting requirements in either the sender's or receiver's country.

- Proof of Identity: Personal identification, such as a passport or driver's license, might be requested to verify the identities of the individuals involved in the transaction.

Each of these documents plays a vital role in facilitating a successful wire transfer. They ensure that all transactions are processed efficiently, legally, and comply with both the financial institutions' policies and international regulatory standards. Individuals and businesses should prepare these documents in advance to ensure a smooth and uninterrupted transaction process.

Similar forms

Check Request Form: Like the Wire Transfer form, a Check Request Form is used to initiate a payment. Both require detailed beneficiary bank information and are often accompanied by instructions for processing. They serve to communicate necessary details to the accounting or finance department to execute a transaction.

Direct Deposit Authorization Form: This form shares similarities with the Wire Transfer Form in that it collects banking information such as bank name, account number, and routing number to transfer funds. However, while a Direct Deposit Authorization is typically for recurring payments, a Wire Transfer Form is often used for one-time transactions.

Payment Request Form: The Wire Transfer Form and a Payment Request Form are used in the financial processing of transactions. Both require the submission of payment details and approval before the transaction can be completed. They are crucial in the steps needed to ensure the payment is made to the correct party and for the correct amount.

International Money Transfer Form: This document is similar to the Wire Transfer Form in that it focuses on transferring money across borders. Both forms necessitate details like the Swift code for international transfers and might require intermediary bank information, depending on the destination country and bank policies.

Electronic Funds Transfer (EFT) Authorization Form: Similar to the Wire Transfer form, an EFT Authorization Form is used to move money between accounts electronically. Both forms collect detailed banking information and are used to authorize the transaction, ensuring the funds are correctly transferred.

Vendor Setup Form: This form, used for adding a new vendor into a payment system, often requires bank information similar to what is requested on the Wire Transfer Form. It's needed to set up payment processes, including wire transfers, to the vendor’s bank account.

Bank Draft Request Form: Similar to the Wire Transfer Form, a Bank Draft Request Form requires detailed information about the beneficiary's bank, including routing numbers and account numbers. Both serve the purpose of transferring funds, but a bank draft is a specific type of bank transfer initiated by the payer.

Dos and Don'ts

When filling out a Wire Transfer form, it is crucial to adhere to specific do's and don'ts to ensure the process is smooth and error-free. Given the complexity and security required in wire transfers, it is vital to pay close attention to the details provided in the form and the instructions accompanying it.

Do's:

- Double-check all the numbers entered, including the CLABE number for Mexico, the bank account number and sort code for Great Britain, and the appropriate details for China, ensuring they are accurate and in the correct format.

- Contact Accounts Payable for assistance if there are any questions or uncertainties. Julie Unger and Johnna Grenert-Taff are available for support and can provide valuable guidance through the process.

- Make sure to attach the Wire Transfer form to the payment request being submitted. This form is an essential part of various payment requests, such as Toolkit and TravelND, and should not be overlooked.

- Verify the beneficiary’s exact name on their bank account matches the one provided on the transfer form to avoid any issues with the transfer.

- For international transfers, ensure the SWIFT code is correctly written if required, considering it's crucial for the successful processing of the wire transfer.

- Review all the details thoroughly before submission. This includes the intermediary bank information, if applicable, to ensure all information is complete and correct.

Don'ts:

- Do not approximate or guess any numbers or codes, such as the ABA/Routing number or SWIFT code. Incorrect information can lead to transfer errors or delays.

- Avoid overlooking special notes regarding specific countries listed in the instructions. Each country may have unique requirements that are important for the successful completion of the transfer.

- Do not leave any sections incomplete, especially those requiring the bank’s name, city, state, and country. Incomplete information can result in the rejection of the wire transfer request.

- Refrain from submitting the wire transfer form without attaching it to the corresponding payment request. The two documents should always be submitted together.

- Do not ignore the intermediary bank section if applicable. Sometimes, intermediary banks are necessary for completing international wire transfers, and neglecting this section can disrupt the transaction.

- Do not rush through filling out the form without verifying all the details. Taking the time to double-check information can prevent mistakes and ensure the wire is processed efficiently.

Misconceptions

Understanding wire transfer forms is crucial for ensuring successful transactions. However, there are several misconceptions that can cause confusion. Here are some common misunderstandings:

Wire transfers are instant: While faster than many other forms of payment, wire transfers can still take several hours or up to a few days to be processed, depending on the banks and countries involved.

Wire transfers are irrevocable: Though it's difficult, wire transfers can sometimes be reversed, but this requires action shortly after the transaction is initiated and depends on the policies of the involved banks.

Any bank information is sufficient for a wire transfer: Specific information, such as IBAN for European transfers and a CLABE number for Mexico, is required for international wire transfers. Incomplete or incorrect information can delay or block the transfer.

All wire transfers require an intermediary bank: Not all wire transfers necessitate an intermediary bank; this depends on the route the funds will take between the originating and beneficiary banks.

Wire transfers are free: Both sending and receiving banks may charge fees for wire transfers. These fees can vary significantly, making some wire transfers relatively costly.

Wire transfer forms are uniform: The form and the required information can vary by bank. It's imperative to use the correct form and fill out all required fields accurately for the specific institutions involved in the transfer.

Personal information is not necessary for wire transfers: To comply with anti-money laundering regulations, banks must collect personal information from both the sender and the receiver.

Wire transfers are only for international transactions: Wire transfers can be used for both domestic and international transactions. They are a common method for transferring funds within the same country as well.

A routing number is always enough for a wire transfer: International transfers may require a SWIFT code instead of the ABA routing number used in the United States. Ensuring the correct code is used is critical for the successful completion of a transfer.

Exchange rates do not affect wire transfers: For international wire transfers involving currency conversion, the exchange rate can significantly affect the final amount received. Banks may use their own exchange rates, which can vary from market rates.

Addressing these misconceptions is key to efficiently managing wire transfers and avoiding common pitfalls. By understanding the specifics of wire transfer requirements and procedures, one can navigate these transactions more smoothly and effectively.

Key takeaways

Wire transfers, a method of sending money from one bank account to another quickly and securely, are commonly used for both domestic and international transactions. Understanding how to properly fill out and use a wire transfer form is essential for ensuring the transaction is processed efficiently and correctly. Here are key takeaways to keep in mind:

- Attach the form correctly: Always attach the wire transfer form to the specific payment request you're submitting. This might be within tools or systems such as Toolkit, TravelND, etc. Ensuring the form is properly attached is crucial for the processing of your payment request.

- Contact Accounts Payable for Assistance: If you find the process confusing or encounter any problems, do not hesitate to reach out to the designated contacts in the Accounts Payable department. They are there to assist you and ensure your wire transfer goes smoothly.

- Country-specific Requirements: Pay special attention to the requirements based on the destination country of the wire. For example, wires to Mexico must include a CLABE number, Great Britain requires a bank account number and a Sort Code for US dollar wires, and transactions to China have different requirements based on the currency sent. Ensuring you have the correct information per the destination country's regulations is vital.

- Provide Complete Beneficiary Bank Information: The form requires detailed information about the beneficiary's bank, including the exact name on the bank account, bank name, city, state, country, and ABA/Routing number or SWIFT code for international transfers. For European destinations, an IBAN may be required. Accurate and complete information is crucial to avoid delays or rejections of the wire transfer.

- Intermediary Bank Information May Be Needed: In some cases, an intermediary bank is involved in the wire transfer. When applicable, information about this bank must also be provided, including the bank's name, city, state, and ABA/Routing number. This helps in ensuring the money reaches its final destination as intended.

Correctly filling out a wire transfer form ensures that your money is sent quickly and arrives at its intended destination without unnecessary delay or complication. Always double-check the details you've entered for accuracy, and don't hesitate to seek assistance if you're unsure about any part of the process.

Popular PDF Forms

How to Fill Out an Application - Questions regarding current employment and permissions to inquire with current employers help organizations respect applicants' current job situations.

Texas Driving Permit - By requiring a clean driving record, the DL 92 form emphasizes the importance of responsible driving habits for instructors.

Irs Form 1310 Instructions - Filers must adhere to specific IRS instructions when completing and submitting Form 1310 to avoid processing delays.