Blank Wt 7 PDF Template

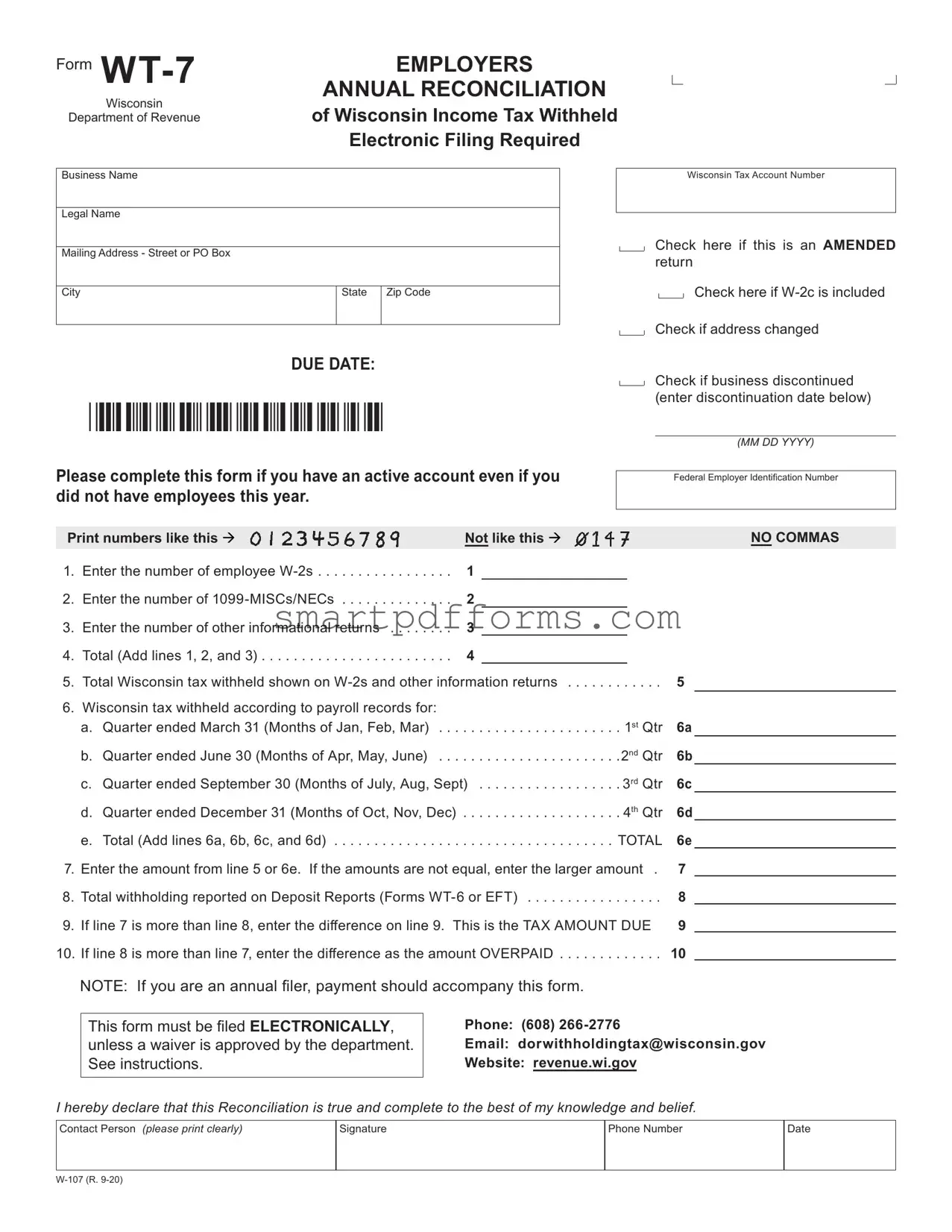

The relevance of the Form WT-7 cannot be understated for those navigating the complexities of annual employer reconciliation in Wisconsin. Tasked with summarizing the Wisconsin income tax withheld from employees over the fiscal year, it is a critical document for the Department of Revenue, necessitating precise and accurate completion. The form demands the business's name, contact details, and the essential Wisconsin Tax Account Number, accompanied by checks for amendments or discontinuations. It outlines the requirement to report the number of W-2s, 1099-MISCs/NECs, and other informational returns filed throughout the year, in addition to the total Wisconsin tax withheld. Moreover, it details the withheld tax according to payroll records for each quarter, underlining the importance of meticulous record-keeping. The comparison between total withholding reported and amounts actually withheld highlights discrepancies that need to be addressed, either as taxes due or overpayments. Significantly, the mandatory electronic filing unless a waiver is obtained, underscores the state's push towards modernizing and streamlining tax reporting processes. This form, by bridging the employer's payroll information with the state's taxation requirements, becomes indispensable in ensuring compliance and facilitating a smoother reconciliation process at the year-end.

Preview - Wt 7 Form

Form |

EMPLOYERS |

|

|

ANNUAL RECONCILIATION |

|

|

Wisconsin |

|

|

of Wisconsin Income Tax Withheld |

|

Department of Revenue |

||

Electronic Filing Required

Business Name

Legal Name

Mailing Address - Street or PO Box

City |

State |

Zip Code |

|

|

|

DUE DATE:

Wisconsin Tax Account Number

Check here if this is an AMENDED return

Check here if

Check if address changed

Check if business discontinued (enter discontinuation date below)

Please complete this form if you have an active account even if you did not have employees this year.

(MM DD YYYY)

Federal Employer Identification Number

Print numbers like this |

Not like this |

|

|

|

NO COMMAS |

||

1. |

Enter the number of employee |

1 |

|

|

|

|

|

2. |

Enter the number of |

2 |

|

|

|

|

|

3. |

Enter the number of other informational returns |

3 |

|

|

|

|

|

4. |

Total (Add lines 1, 2, and 3) |

4 |

|

|

|

|

|

5. |

Total Wisconsin tax withheld shown on |

. . . . . . |

5 |

|

|||

6. |

Wisconsin tax withheld according to payroll records for: |

|

|

|

|

|

|

|

a. Quarter ended March 31 (Months of Jan, Feb, Mar) . . . |

. . . . . . . . . . . . . . . . . . . |

. 1st Qtr |

6a |

|

||

|

b. Quarter ended June 30 (Months of Apr, May, June) . . . |

. . . . . . . . . . . . . . . . . . . |

.2nd Qtr |

6b |

|

||

|

c. Quarter ended September 30 (Months of July, Aug, Sept) |

6c |

|

||||

|

d. Quarter ended December 31 (Months of Oct, Nov, Dec) |

. . . . . . . . . . . . . . . . . . . |

. 4th Qtr |

6d |

|

||

|

e. Total (Add lines 6a, 6b, 6c, and 6d) |

. . . . . . . . . . . . . . . . . . . |

TOTAL |

6e |

|||

7. |

Enter the amount from line 5 or 6e. If the amounts are not equal, enter the larger amount . |

7 |

|

||||

8. |

. . . . . . . . . . .Total withholding reported on Deposit Reports (Forms |

. . . . . . |

8 |

|

|||

9. |

If line 7 is more than line 8, enter the difference on line 9. This is the TAX AMOUNT DUE |

9 |

|

||||

. . . . . . .10. If line 8 is more than line 7, enter the difference as the amount OVERPAID |

. . . . . . |

10 |

|

||||

NOTE: If you are an annual filer, payment should accompany this form.

This form must be filed ELECTRONICALLY, unless a waiver is approved by the department. See instructions.

Phone: (608)

Email: dorwithholdingtax@wisconsin.gov

Website: revenue.wi.gov

I hereby declare that this Reconciliation is true and complete to the best of my knowledge and belief.

Contact Person (please print clearly)

Signature

Phone Number

Date

Form Data

| Fact Name | Detail |

|---|---|

| Form Type | WT-7 Employers Annual Reconciliation of Wisconsin Income Tax Withheld |

| Agency | Wisconsin Department of Revenue |

| Filing Requirement | Electronic Filing Required |

| Who Must File | All businesses with an active account, regardless of whether they had employees that year |

| Due Date | Not specified in the provided details but must be filed annually |

| Governing Laws | Wisconsin Income Tax Laws |

Instructions on Utilizing Wt 7

Once a year, employers are tasked with the responsibility of reconciling the Wisconsin income tax they have withheld from their employees' wages. This crucial step helps ensure that the amount withheld matches what was actually paid to the state, promoting transparency and compliance with tax laws. The Form WT-7, otherwise known as the Employer's Annual Reconciliation of Wisconsin Income Tax Withheld, serves as the vehicle for this process. While the task might seem daunting at first glance, breaking it down into manageable steps can simplify the process.

Filling out the Form WT-7 involves several key steps:

- Start by entering your Business Name and Legal Name in the designated areas.

- Provide the Mailing Address, City, State, and Zip Code of your business.

- Indicate if the form is an AMENDED return, if the business address has changed, if W-2c forms are included, or if the business has been discontinued by checking the appropriate box. If discontinuing, enter the date of discontinuation.

- Fill in your Wisconsin Tax Account Number and Federal Employer Identification Number in the spaces provided, paying close attention to the formatting guidelines for numbers.

- Under the section for tax withheld information, enter the number of employee W-2s, 1099-MISCs/NECs, and other informational returns you are reporting.

- Calculate the Total Wisconsin tax withheld as shown on W-2s and other information returns and enter this total.

- Document the Wisconsin tax withheld for each quarter of the fiscal year, then add these amounts to get the total amount of Wisconsin tax withheld according to payroll records.

- Enter the larger amount from either the total tax withheld as per the information returns or the total according to payroll records.

- Record the Total withholding reported on Deposit Reports (Forms WT-6 or EFT).

- If the amount calculated in step 7 is more than what you reported on your Deposit Reports, enter the difference as the TAX AMOUNT DUE. Conversely, if the Deposit Reports show a greater amount than what you've calculated, list this difference as the amount OVERPAID.

- After reviewing the form for accuracy, the contact person should print their name clearly, sign, and date the form. Be sure to include a contact phone number. Remember, this form must be filed electronically unless you have received a waiver from the department.

Accurately completing and submitting the Form WT-7 is a vital part of staying compliant with Wisconsin's tax laws. By following these steps, employers can help ensure they meet their tax obligations efficiently and effectively. It's important to note that the form requires electronic submission, a rule that streamlines the process and helps maintain the accuracy of records. Should you have questions or require assistance, the Wisconsin Department of Revenue offers resources and contact information to guide employers through the process.

Obtain Answers on Wt 7

What is the WT-7 form?

The WT-7 form is recognized as the "Employer's Annual Reconciliation of Wisconsin Income Tax Withheld." Employers use this form to reconcile the total Wisconsin state income tax they withheld from their employees' wages throughout the year with the amounts they actually deposited. This reconciliation helps ensure that the correct amount of tax has been paid to the state. It's a way for businesses to report their yearly summary of wages paid and taxes withheld.

Who needs to file the WT-7 form?

Any business that has an active Wisconsin Tax Account Number and withheld income tax from their employees' wages must file the WT-7 form. This requirement also applies to businesses even if they did not have employees during the year. Therefore, if you're an employer with a registered business in Wisconsin and you've withheld income taxes, filing this form is obligatory.

When is the WT-7 form due?

The form must be submitted by employers annually. The due date is typically at the end of January for the previous tax year. For example, for tax year 2020, the due date would generally be January 31, 2021. It's important to file by this date to avoid any potential penalties for late submission.

Is electronic filing mandatory for the WT-7 form?

Yes, the WT-7 form must be filed electronically unless an employer receives a waiver from the Department of Revenue. The requirement for electronic filing ensures a quicker and more secure submission process. Employers can use the Wisconsin Department of Revenue’s website or other authorized e-file software to file this form electronically.

What should I do if I need to amend my WT-7 form?

If an employer discovers that the original WT-7 form filed contains errors or incorrect information, an amended return must be submitted. To do this, the employer must check the "AMENDED return" box on the form and include any W-2c forms if corrections to wage and tax statements are necessary. The amended form corrects any previously reported information and ensures accurate tax records.

How do I calculate the totals required for the WT-7 form?

To complete the WT-7 form, you'll need to add up the total Wisconsin tax withheld as shown on employee W-2s and other information returns. This total is then compared with the Wisconsin tax withheld according to your payroll records, broken down by quarter. If there's a discrepancy between these totals, you use the larger amount for final reporting. Ensuring these calculations are accurate is crucial for compliance.

What happens if I overpaid or underpaid based on the WT-7 form's results?

If the reconciled total withholding tax reported is more than what was actually deposited, you owe an additional tax amount to the state. This difference should be calculated on line 9 and paid with your filing. Conversely, if you've deposited more than what the reconciliation shows, you'll report this as an overpayment on line 10, which may result in a refund or credit towards the next tax period.

Who can I contact for assistance with the WT-7 form?

If you need help filling out the WT-7 form or have any questions, you can contact the Wisconsin Department of Revenue directly. They provide assistance via phone at (608) 266-2776 or email at dorwithholdingtax@wisconsin.gov. Their website also offers resources and guidance for employers to accurately complete and file their annual reconciliation.

Common mistakes

Filling out the Form WT-7, the Employers' Annual Reconciliation of Wisconsin Income Tax Withheld, is a crucial task for businesses, and mistakes can lead to unnecessary complications. Let's dive into the eight common errors people tend to make:

Not filing electronically unless specifically waived by the department. This form is required to be submitted online, and missing this requirement can lead to delays and possible penalties.

Providing incomplete or inaccurate business information, such as an incorrect Wisconsin Tax Account Number or Federal Employer Identification Number. Accuracy in these details is vital for proper processing.

Forgetting to check the box if it's an amended return, if address changed, if W-2c is included, or if the business was discontinued. These indicators are crucial for the Department of Revenue to process your form appropriately.

Entering numbers incorrectly by including commas, despite the clear instruction to print numbers without commas. This could lead to misunderstanding or misprocessing of your reported amounts.

Miscalculating the total Wisconsin tax withheld shows on W-2s and other information returns. Ensuring that this total matches your records is key to a correct reconciliation process.

Incorrectly reported quarterly Wisconsin tax withheld, leading to discrepancies in the annual total. This can signal errors in record-keeping or misunderstanding of taxable periods.

Not accurately entering the larger amount between the total Wisconsin tax withheld according to payroll records and the total withholding reported on Deposit Reports. This comparison is crucial for determining if there is tax owed or an overpayment.

Omitting the signature, contact person details, or date at the bottom of the form. These elements are essential for the form's validity and the department's ability to reach out if there are issues.

By steering clear of these common pitfalls, businesses can ensure a smoother reconciliation process with the Wisconsin Department of Revenue, minimizing the risk of errors and the hassle of having to amend submissions.

Documents used along the form

The Form WT-7, known as the Employers' Annual Reconciliation of Wisconsin Income Tax Withheld, is a critical document for businesses operating in Wisconsin, ensuring that the total tax withheld from employees is accurately reported to the Wisconsin Department of Revenue. However, this form doesn't exist in isolation. To complete the reconciliation process effectively and comply fully with tax obligations, several other forms and documents often accompany the Form WT-7, each serving a specific function in the broader context of tax filing and employer payroll responsibilities.

- Form W-2, Wage and Tax Statement: This is a necessary document for reporting an employee's annual wages and the amount of taxes withheld from their paycheck. It's essential for both employers, who must file it with the IRS, and employees, who need it for their personal tax returns.

- Form 1099-MISC/NEC: These forms are used to report payments made to non-employees, such as independent contractors. The 1099-MISC covers various types of income, while the 1099-NEC is specifically for reporting non-employee compensation.

- Form WT-6, Withholding Tax Deposit Report: This form is used by employers to report withholding tax amounts and make any necessary payments on a quarterly basis. It's a precursor to the yearly reconciliation done with Form WT-7.

- Form W-3, Transmittal of Wage and Tax Statements: This form accompanies the W-2 forms sent to the Social Security Administration. It summarizes the total earnings, Social Security wages, Medicare wages, and withholding for all employees for the year.

- Form W-4, Employee's Withholding Certificate: Though not directly submitted with the Form WT-7, the W-4 is critical for employers to determine the correct amount of federal income tax to withhold from employees' paychecks.

- Employer's Quarterly Federal Tax Return (Form 941): This form reports the federal withholdings from employees' paychecks, including income tax, Social Security, and Medicare taxes, on a quarterly basis.

- State Unemployment Tax Forms: While specific forms vary by state, these forms report the wage and tax information for state unemployment purposes. In Wisconsin, employers would use Form UCT-101, Employer's Quarterly Wage Report, to report this information.

While the Form WT-7 is vital for reconciling Wisconsin income tax withheld from employees, understanding and properly utilizing these accompanying forms ensures that employers can maintain accurate and compliant payroll processes. Each document plays a unique role, from reporting wages and taxes withheld to detailing payments to non-employees and summarizing quarterly tax deposits, streamlining the comprehensive picture of a business's tax responsibilities.

Similar forms

The Form WT-7, Employers Annual Reconciliation of Wisconsin Income Tax Withheld, shares similarities with several other tax and informational documents that are essential in various tax reporting and reconciliation contexts. Here are some documents that bear resemblance to the WT-7 form in purpose, structure, or function:

- Form W-3, Transmittal of Wage and Tax Statements: This form serves a similar purpose at the federal level, summarizing the information from all Forms W-2 issued by an employer. Both forms are summary or reconciliation documents used for reporting total income taxes withheld from employees.

- Form 941, Employer's Quarterly Federal Tax Return: Similar to the WT-7's focus on reconciling income tax withheld, the 941 reconciles federal income tax, along with social security and Medicare taxes withheld by employers each quarter. Both forms ensure the employer's tax withholding aligns with payroll records.

- Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return: Although dealing with unemployment tax, Form 940 is akin to Form WT-7 in that it provides a yearly summary, in this case for federal unemployment tax responsibilities, contrasting WT-7's annual reconciliation of income tax withheld.

- Form W-2c, Corrected Wage and Tax Statement: Specifically mentioned within the WT-7 form, the Form W-2c is used for correcting information previously reported on Form W-2. The relation here is direct, as corrections impacting the total tax withheld might necessitate amendments to the WT-7 filing.

- Form 1096, Annual Summary and Transmittal of U.S. Information Returns: Functionally similar to Form WT-7, Form 1096 serves as a transmittal document for various types of 1099 forms at the federal level, summarizing non-employee compensation and other payments that may also require tax withholding reconciliation.

- State-specific Quarterly Unemployment Insurance (UI) Tax Forms: Many states have their own forms for quarterly reporting of unemployment insurance contributions. These share a similarity with WT-7's quarterly element of tax withholding reconciliation, despite focusing on different types of taxes.

- Form W-2, Wage and Tax Statement: Directly related to the WT-7, every W-2 issued by an employer contributes to the aggregated data required in the WT-7 form. Each W-2 reflects individual employee income and tax withholding that the WT-7 then summarizes on an annual basis.

Each of these forms, while tailored to specific tax duties—be it federal income, unemployment, social security and Medicare taxes, or correcting previously submitted information—integrates into the broader framework of tax reporting and reconciliation for businesses, akin to the role played by Form WT-7 in Wisconsin.

Dos and Don'ts

When filling out the Form WT-7, Employers' Annual Reconciliation of Wisconsin Income Tax Withheld, there are several important practices to follow to ensure the process goes smoothly and accurately. Here is a guide to help you with what you should and shouldn't do:

Things You Should Do

Double-check the business and legal names, ensuring they match the records with the Wisconsin Department of Revenue.

Accurately enter the Wisconsin tax account number, avoiding any transposition errors or omissions.

Report the total number of W-2s, 1099-MISCs/NECs, and other informational returns precisely, as these figures are crucial for reconciliation.

Verify the total Wisconsin tax withheld according to the records for each quarter, adding these up correctly to ensure the annual total is accurate.

Ensure the form is filed electronically unless you have received a waiver from the department, in compliance with the filing requirements.

Things You Shouldn't Do

Do not leave any fields blank that are applicable to your business situation. Complete all sections accurately.

Avoid using commas when entering numbers. Follow the format guidelines provided in the form to prevent processing delays.

Do not forget to check the boxes that apply, such as if this is an amended return, if the business address changed, or if the business was discontinued.

Refrain from submitting the form without double-checking all amounts and entries. Mistakes can lead to discrepancies and potential fines.

Avoid waiting until the last minute to file. Processing times and potential technical issues could lead to delays in submission.

By following these guidelines, you can ensure that your Form WT-7 submission is both accurate and compliant, avoiding common pitfalls and ensuring a smoother process for your annual reconciliation.

Misconceptions

When dealing with the Form WT-7, Employers' Annual Reconciliation of Wisconsin Income Tax Withheld, several misconceptions commonly arise. By clarifying these, employers can ensure compliance with the Wisconsin Department of Revenue and avoid potential issues.

Misconception 1: Paper filing is an option. The requirement for electronic filing often leads to confusion. Some believe that like other tax forms, the WT-7 can be filed on paper. However, the form must be filed electronically unless a specific waiver has been approved by the department.

Misconception 2: It is only for businesses with employees. Even if a business did not have employees during the year, they are still required to complete this form if they have an active account with the Wisconsin Department of Revenue. This ensures that all potential withholding tax obligations are correctly reported.

Misconception 3: Address changes are irrelevant for this form. There's a specific box to check if the business's address changed. Accurate and current information is crucial for maintaining proper communication and compliance with the Wisconsin Department of Revenue.

Misconception 4: Only W-2s need to be accounted for. While the form does require information about W-2s issued, it also asks for details on 1099-MISCs/NECs and other informational returns. This comprehensive approach ensures that all sources of income tax withholding are accurately reported.

Misconception 5: Amended returns are uncommon. If errors are discovered after the original filing, an amended return is not just an option but a requirement to correct the information. The form includes a checkbox specifically for indicating an amendment.

Misconception 6: Exact withheld tax amounts aren't crucial. The forms require detailed reconciliation of Wisconsin tax withheld as shown on W-2s and other informational returns against the payroll records. Accuracy here is vital to avoid underpayment or overpayment of taxes.

Misconception 7: Only totals for the year are needed. The form requires breakdowns by quarter, ensuring that the Department of Revenue can track withholding compliance throughout the year, not just in an annual lump sum.

Misconception 8: Overpayments and underpayments don't need immediate attention. Depending on the reconciliation of taxes withheld versus amounts actually reported on deposit reports, actions such as paying the tax amount due or reporting the amount overpaid are required. This ensures that discrepancies are addressed promptly.

Misconception 9: The contact person's details are optional. Filling in the contact person's details is crucial for any follow-up required by the Wisconsin Department of Revenue. This ensures they can contact the correct person directly for any clarifications or additional information needed.

Understanding these misconceptions and accurately completing the Form WT-7 is essential for all businesses operating in Wisconsin. Proper compliance not only adheres to legal requirements but also simplifies the process of reconciling income tax withheld on behalf of employees.

Key takeaways

Filing the Form WT-7, Employers' Annual Reconciliation of Wisconsin Income Tax Withheld, requires careful attention to detail and adherence to specific instructions to ensure compliance with the Wisconsin Department of Revenue. Here are six key takeaways for accurately completing and using the form:

- Electronic filing is mandatory for submitting Form WT-7, unless a waiver has been explicitly approved by the Department of Revenue, emphasizing the state's push towards digital submissions for efficiency and environmental reasons.

- The form serves a critical function in reconciling the total Wisconsin income tax withheld from employees' wages with the amounts reported and deposited throughout the year, ensuring that employers accurately report and submit withholdings.

- Employers must include the total number of employee W-2s, 1099-MISCs/NECs, and other informational returns filed during the year to provide a comprehensive overview of all withholdings managed by the business.

- Completion of the form requires a detailed breakdown of Wisconsin tax withheld by quarter, allowing the Department of Revenue to verify consistent and timely tax withholding and remittance throughout the fiscal year.

- If an employer discovers discrepancies between the total tax withheld shown on W-2s (and other informational returns) and the tax withheld according to payroll records, the larger amount must be reported on the form, potentially leading to additional tax liability.

- In cases of overpayment or underpayment, Form WT-7 facilitates adjustments through line entries for TAX AMOUNT DUE or the amount OVERPAID, with instructions for annual filers to accompany payment with this form if taxes are owed, thereby streamlining the reconciliation process.

It is crucial for employers to review the form thoroughly before submission, ensuring that all information is accurate and complete to the best of their knowledge. Failure to comply with the instructions or submit accurate information could result in penalties or additional scrutiny from the Wisconsin Department of Revenue. Careful adherence to the filing requirements and deadlines helps maintain compliance and facilitates a straightforward reconciliation process.

Popular PDF Forms

Reefer Load - Assesses the coolant level and protection within the reefer unit, verifying the radiator cap’s condition and coolant protection levels.

Smc Resident Visa - Immigration advisers must be licensed under the Immigration Advisers Licensing Act 2007, unless they are exempt, such as lawyers.