Blank Wv Nrw 4 PDF Template

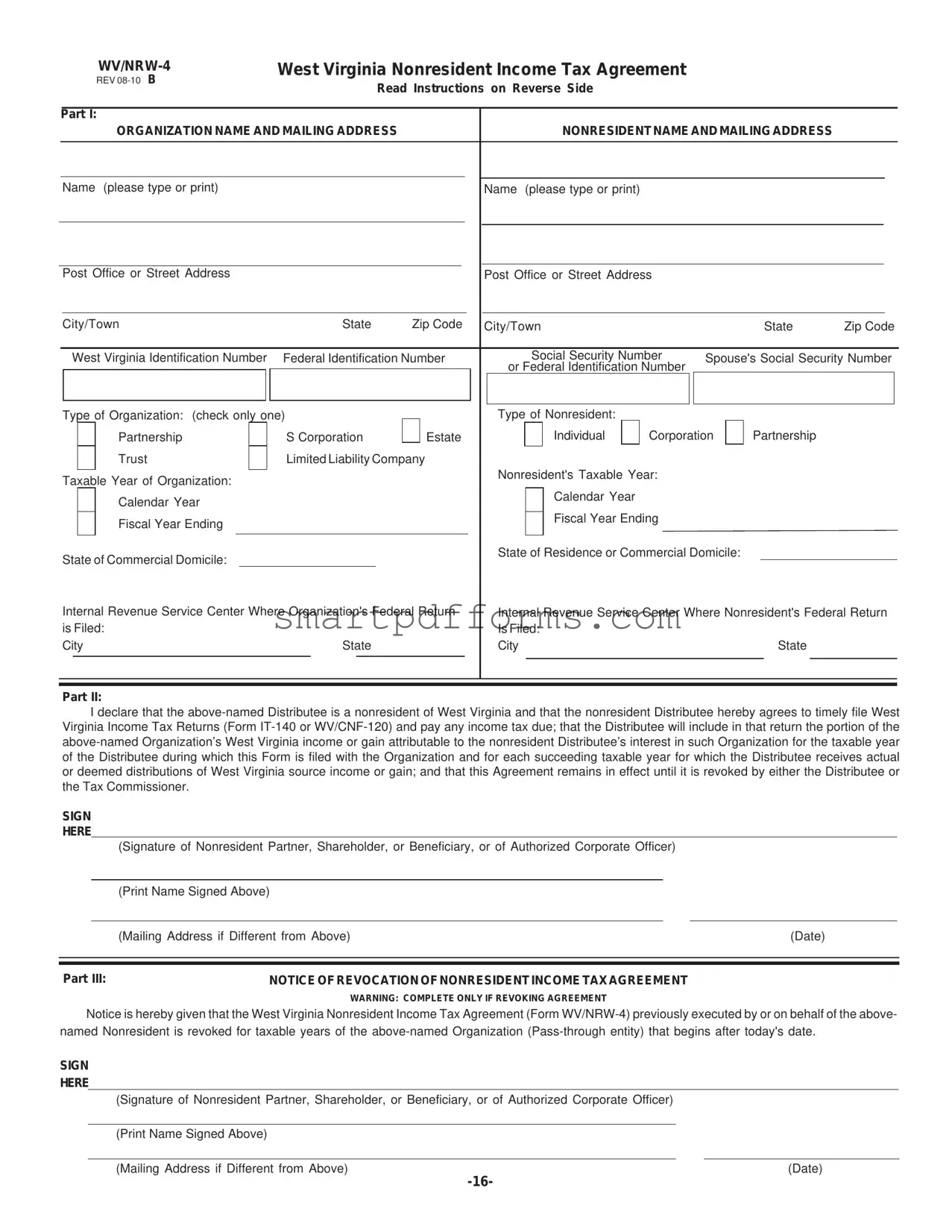

In the realm of tax obligations for nonresident individuals and entities generating income in West Virginia, the WV/NRW-4 form serves as a cornerstone document designed to streamline the process of income declaration and tax liability settlement within the state. This form, officially titled the West Virginia Nonresident Income Tax Agreement, provides a structured framework through which nonresidents can agree to file West Virginia income tax returns, thus opting out of mandatory withholding by the payer organization. It covers various organization types, including partnerships, S corporations, estates, trusts, and limited liability companies, allowing these entities to distribute West Virginia source income to nonresident distributees without withholding state income tax, under specific conditions. The form must be filed in adherence to the stipulated timeline, typically by the end of the organization's taxable year, to ensure compliance and avoid unnecessary withholding. Additionally, the agreement established by the form remains effective until revoked either by the nonresident or the West Virginia Tax Commissioner, a mechanism that affords a measure of flexibility to the parties involved. However, the execution and continual validity of this agreement hinge on the nonresident's steadfast allegiance to timely tax return filings and payment obligations, underscoring the importance of compliance as a core tenet of the nonresident income tax arrangement in West Virginia.

Preview - Wv Nrw 4 Form

|

|

West Virginia Nonresident Income Tax Agreement |

||||||

|

|

REV |

Read Instructions on Reverse Side |

|||||

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

Part I: |

|

|

|

|

|

|

|

|

|

ORGANIZATION NAME AND MAILING ADDRESS |

NONRESIDENT NAME AND MAILING ADDRESS |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name (please type or print) |

|

|

|

Name |

(please type or print) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Post Office or Street Address |

|

|

|

|

|

|

|

|

|

|

|

Post Office or Street Address |

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City/Town |

|

|

State |

Zip Code |

City/Town |

|

|

|

|

|

|

State |

Zip Code |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

West Virginia Identification Number |

|

Federal Identification Number |

|

|

Social Security Number |

Spouse's Social Security Number |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

or Federal Identification Number |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type of Organization: (check only one) |

|

|

|

|

|

|

|

Type of Nonresident: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

Partnership |

|

|

S Corporation |

|

Estate |

|

|

|

Individual |

|

Corporation |

|

Partnership |

|

|

|

|

||||||||||||||

|

|

|

|

Trust |

|

|

Limited Liability Company |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonresident's Taxable Year: |

|

|

|

|

|

|

|

|

|

|

|||||

Taxable Year of Organization: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

Calendar Year |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Calendar Year |

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Fiscal Year Ending |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fiscal Year Ending |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

State of Commercial Domicile: |

|

|

|

|

|

|

|

|

|

|

|

|

|

State of Residence or Commercial Domicile: |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Internal Revenue Service Center Where Organization's Federal Return |

|

Internal Revenue Service Center Where Nonresident's Federal Return |

|||||||||||||||||||||||||||||||||

is Filed: |

|

|

|

|

|

|

|

|

|

|

|

|

Is Filed: |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

City |

|

|

State |

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

State |

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part II:

I declare that the

SIGN

HERE

|

|

(Signature of Nonresident Partner, Shareholder, or Beneficiary, or of Authorized Corporate Officer) |

|

|

|

|

|

|

|

|

|

|

|

(Print Name Signed Above) |

|

|

|

|

|

|

|

|

|

|

|

(Mailing Address if Different from Above) |

(Date) |

|

|

|

|

|

|

||

|

|

|

|

||

Part III: |

NOTICE OF REVOCATION OF NONRESIDENT INCOME TAX AGREEMENT |

|

|

||

WARNING: COMPLETE ONLY IF REVOKING AGREEMENT

Notice is hereby given that the West Virginia Nonresident Income Tax Agreement (Form

SIGN

HERE

(Signature of Nonresident Partner, Shareholder, or Beneficiary, or of Authorized Corporate Officer)

(Print Name Signed Above)

(Mailing Address if Different from Above) |

(Date) |

WEST VIRGINIA NONRESIDENT INCOME TAX AGREEMENT

INSTRUCTIONS

Who May File: Any Nonresident individual or C corporation who has West Virginia source income derived from a partnership, S corporation, estate, trust, or limited liability company (“Organization”) who desires to not have West Virginia income tax withheld by that Organization as provided in W.Va. Code §

When and Where to File: This Form must be completed and filed with the Organization on or before the last day of the Organization’s taxable year. If the Distributee receives West Virginia source income from more than one such Organization, a separate Form WV/NRW- 4 must be filed with each Organization in order to avoid withholding by that Organization. The Organization may copy this form or use a facsimile to distribute as follows: (1) one copy to be filed with the Organization's West Virginia income tax return, (2) one copy to be retained by the

West Virginia Income Tax Withholding for Nonresidents: Every Organization distributing West Virginia source income to a nonresident distributee is required to withhold West Virginia income tax on the amount thereof distributed to Nonresident Distributee unless the Nonresident Distributee timely files this Form with the Organization and the Organization attaches a copy of it to its West Virginia income tax return filed for the taxable year of its receipt. The withholding tax rate is 6.5% of distributions of West Virginia source income (whether actual or deemed distributions). The amount of tax withheld and remitted by the Organization is allowed as a credit against the Distributee’s West Virginia income tax liability for that taxable year.

Nonresident Agreement: Once this agreement is executed, it must be filed with the Organization to avoid having withholding tax deducted from further distributions (actual or deemed). This agreement first applies to the taxable year of the Organization during which the Organization receives a properly executed agreement from the Nonresident Distributee.

Duration of Agreement: Once this Agreement is filed with the Organization, it remains in effect until it is revoked by the Nonresident Distributee, or by the Tax Commissioner.

Revocation:

1.A Nonresident Distributee may revoke this Agreement by completing this Form and filing it with the Organization through which it receives West Virginia source income. Revocation applies prospectively, meaning that it first applies to taxable years of the Organization which begin after revocation is filed with that Organization.

2.The Tax Commissioner may revoke this Agreement if the Nonresident Distributee fails to file a West Virginia income tax return

Form Data

| Fact Name | Description |

|---|---|

| Purpose | This form enables nonresident individuals and C corporations, with West Virginia source income from specific organizations, to avoid West Virginia income tax withholding by agreeing to file their own West Virginia income tax returns. |

| Filing Requirement | The WV/NRW-4 form must be filed with the relevant organization on or before the last day of the organization's taxable year to avoid withholding. Separate forms are required for income from multiple organizations. |

| Governing Law | The requirement for this form and its stipulations are governed by West Virginia Code § 11-21-71a, which addresses the nonresident income tax agreements and withholding requirements. |

| Duration and Revocation | Once filed, the agreement remains in effect until it is revoked either by the Nonresident Distributee or the Tax Commissioner, with revocations applying prospectively to future taxable years. |

Instructions on Utilizing Wv Nrw 4

Filling out the WV/NRW-4 form is a straightforward process designed to ensure nonresident individuals or corporations with income from West Virginia sources can comply with state tax laws without having tax withheld by the entity distributing the income. This agreement, once filed, remains effective until explicitly revoked by either the nonresident or the Tax Commissioner. It's essential to complete this form accurately to avoid unnecessary tax withholdings and ensure compliance with West Virginia tax obligations. Here's a simple guide to help you through each step of filling out the form.

- Start with Part I: Fill in the organization's name and mailing address, including the West Virginia Identification Number and Federal Identification Number.

- Under the NONRESIDENT NAME AND MAILING ADDRESS section, provide the nonresident's details, such as name, address, Social Security Number, and if applicable, the spouse's Social Security Number or Federal Identification Number.

- Indicate the type of organization that is distributing the income by checking the appropriate box. For nonresidents, specify the type by checking the correct category, such as Individual, Corporation, Partnership, or Trust.

- Fill in the nonresident's taxable year and the taxable year of the organization. Indicate whether it's a calendar or fiscal year and provide the ending date for fiscal years.

- Specify the state of commercial domicile for both the organization and the nonresident.

- Include the Internal Revenue Service Center locations where both the organization and the nonresident file their federal returns.

- Move to Part II: This is the agreement and declaration section. The nonresident should sign here to agree to file West Virginia Income Tax Returns and pay any due tax. Include the signature, printed name, mailing address (if different), and date.

- If you are revoking a previous agreement, complete Part III by providing the necessary information and signature, similar to Part II.

After completing the form, ensure to make the required copies as stated in the instructions. One copy should be filed with the organization's West Virginia income tax return, another retained by the organization, and a copy given to the nonresident distributee. Remember, this agreement serves to simplify compliance with state tax requirements for nonresidents earning income from West Virginia sources. Completing it accurately and on time helps avoid unnecessary withholding and ensures proper tax filing.

Obtain Answers on Wv Nrw 4

-

What is the WV/NRW-4 form?

The WV/NRW-4 form, known as the West Virginia Nonresident Income Tax Agreement, is a document that nonresident individuals or C corporations with West Virginia source income from partnerships, S corporations, estates, trusts, or limited liability companies must complete. This form is used to avoid West Virginia income tax withholding on that income by the entity generating the income. The agreement outlined in the form requires nonresidents to agree to file West Virginia income tax returns and pay any taxes due on their West Virginia source income.

-

Who needs to file the WV/NRW-4 form?

Any nonresident individual or C corporation that derives income from a West Virginia source and wishes not to have West Virginia income tax withheld by the organization distributing the income needs to file this form. The term "nonresident" refers to entities or individuals whose commercial or personal domicile is located outside West Virginia.

-

When and where should the WV/NRW-4 form be filed?

This form must be completed and filed with the organization distributing West Virginia source income before the last day of the organization’s taxable year. If the nonresident receives income from more than one such organization, a separate WV/NRW-4 must be filed with each organization. The form or its facsimile should be distributed by the organization as follows: one copy filed with its West Virginia income tax return, one retained by the organization, and one copy given to the nonresident distributee.

-

What are the implications of not filing the WV/NRW-4 form?

If a nonresident distributee does not file the WV/NRW-4 form with the organization from which they receive income, the organization is required to withhold West Virginia income tax at a rate of 6.5% on distributions of West Virginia source income. This withholding tax will be taken from the amount distributed, whether these are actual or deemed distributions, and the withheld amount will be credited against the nonresident’s West Virginia income tax liability for that tax year.

-

How does one revoke the WV/NRW-4 agreement?

To revoke the WV/NRW-4 agreement, a nonresident distributee must complete the notice of revocation section of the form and file it with the organization from which they receive West Virginia source income. The revocation is effective for taxable years of the organization that begin after the revocation is filed. Additionally, the Tax Commissioner can revoke the agreement if the nonresident fails to file a West Virginia income tax return or to pay the income tax due for more than 60 days after the due date, including extensions.

Common mistakes

When completing the West Virginia Nonresident Income Tax Agreement (Form WV/NRW-4), individuals often make several mistakes that can complicate or delay the processing of their submission. It is essential to fill out this form accurately to ensure compliance with tax regulations and avoid potential issues. Below are five common mistakes to watch out for:

- Incorrect or Incomplete Name and Address Information: Both the nonresident's and the organization's name and mailing address sections should be filled out completely and accurately. Omitting details or providing inaccurate information may cause unnecessary delays or miscommunication.

- Failure to Check the Correct Type of Organization or Nonresident Status: The form requires checking a box to identify the type of organization (e.g., S Corporation, Partnership, etc.) and the nonresident status (e.g., Individual, Trust, etc.). Incorrectly identifying the entity type can lead to processing errors.

- Not Including the Correct Identification Numbers: It's required to provide both the organization's West Virginia Identification Number and the nonresident's Social Security Number or Federal Identification Number. Missing or incorrect identification numbers can complicate identity verification and tax processing.

- Overlooking the Signature and Date: The form must be signed and dated by the nonresident or an authorized corporate officer to be valid. A missing signature or date can render the form invalid, requiring resubmission.

- Incorrect Filing Timing or Not Filing With Each Organization: This form must be filed on or before the last day of the organization's taxable year. Additionally, if the nonresident receives West Virginia source income from more than one organization, a separate Form WV/NRW-4 must be filed with each. Overlooking this requirement can result in the necessary withholding not being waived.

Avoiding these mistakes ensures that the nonresident income tax agreement process is smooth, helping nonresidents fulfill their tax obligations without unnecessary complications. Careful attention to detail and adherence to filing requirements contribute significantly to the accurate and timely processing of Form WV/NRW-4.

Documents used along the form

When handling the WV/NRW-4 form, several other documents are often used by entities and individuals to fulfill their tax obligations in West Virginia. These documents help ensure compliance with state tax regulations, guiding through various aspects of income reporting and tax payment for nonresidents. Understanding each document and its purpose can simplify the process significantly.

- Form IT-140: West Virginia Personal Income Tax Return - This is the primary document used by individuals to file their personal income taxes in West Virginia. It's crucial for nonresidents who earn income from West Virginia sources to use this form to report their earnings and calculate their tax dues, potentially including income reported through the WV/NRW-4 agreement.

- Form WV/CNF-120: West Virginia Corporation Net Income Tax Return - For corporations including S corporations that operate within West Virginia, this form is used to file their corporate income taxes. It details the income earned and taxes owed to the state and is necessary for corporations partaking in nonresident agreements to ensure proper reporting and payment of taxes.

- Form SPF-100: West Virginia Income Tax Return for S Corporations and Partnerships - This form serves S corporations and partnerships, providing a means to report their income, gains, losses, and deductions to the West Virginia State Tax Department. It is essential for accurately documenting the flow-through income to shareholders or partners, including nonresidents covered by the WV/NRW-4 form.

- West Virginia Schedule A: Adjustments to Federal Adjusted Gross Income - This schedule is often accompanying the IT-140 form, allowing individuals to make necessary adjustments to their federal adjusted gross income for state tax purposes. It ensures that the income taxed by West Virginia reflects state-specific exclusions, additions, or deductions that may affect the tax calculation.

Altogether, these forms work in conjunction to provide a comprehensive tax filing solution for nonresidents and organizations dealing with West Virginia source income. Their accurate completion and timely filing are essential to fulfilling tax obligations and ensuring compliance with West Virginia's tax laws. Understanding how each form interacts and supports the other can greatly ease the complexities of tax preparation and filing for nonresident individuals and entities operating in West Virginia.

Similar forms

The Form IT-140, which is the West Virginia Personal Income Tax Return, bears similarity to the WV/NRW-4 form in that both are crucial for nonresidents who possess West Virginia source income and are required to declare this income for tax purposes. Specifically, the IT-140 form is the document nonresident individuals would file to report and pay taxes, a process the WV/NRW-4 form facilitates by exempting individuals from withholding when they agree to file IT-140.

WV/CNF-120, known as the West Virginia Corporate Net Income Tax Return, aligns with the WV/NRW-4 form in its focus on addressing income tax responsibilities for corporations with income stemming from West Virginia sources. Similar to how individual nonresidents use WV/NRW-4 to avoid withholding, corporations may use it in conjunction to WV/CNF-120 to affirm their commitment to reporting state income themselves.

The WV/SPF-100, or West Virginia S Corporation & Partnership Income Tax Return, parallels the WV/NRW-4 in its relevance to entities operating within the state but composed of nonresident members. These forms ensure that entities like S corporations and partnerships accurately report income attributed to their nonresident members, who, in turn, promise through WV/NRW-4 to file their returns directly.

Form 1099-MISC, a widely recognized federal document used to report various types of income besides wages, salaries, and tips, shares a functional similarity with the WV/NRW-4 form. The connection lies in the requirement for income reporting: while 1099-MISC records income paid to independent contractors, WV/NRW-4 facilitates a pathway for nonresidents to report and take responsibility for state income tax.

ID W-8BEN, the Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding, although it operates in the federal domain and primarily for foreign individuals and entities, connects with WV/NRW-4 by its goal to address tax liabilities properly. Both forms articulate a process wherein the filers declare their status to mitigate or clarify tax withholding obligations, focusing on ensuring tax compliance while acknowledging the filer's resident or nonresident status.

W-9 Request for Taxpayer Identification Number and Certification, is a federal form used extensively by individuals and entities to provide their taxpayer identification number to entities that will pay them income. The essence of form W-9 in ensuring proper identification and status for tax reporting purposes shares a familiar goal with WV/NRW-4, which also seeks to clarify the tax reporting responsibilities of nonresidents with West Virginia source income.

Dos and Don'ts

When filling out the WV/NRW-4 form, a West Virginia Nonresident Income Tax Agreement, there are specific steps participants should follow to ensure accuracy and compliance. Here's a list of do's and don'ts that can help streamline the process:

Things You Should Do:

- Read the instructions carefully before you start filling out the form. They provide critical information on who should file, when, and where.

- Print clearly and legibly or type your information to ensure that every detail can be easily read, thus avoiding processing delays.

- Make sure to include all required personal information, such as your full name, mailing address, Social Security Number, and the type of nonresident you are, e.g., individual, partnership, S corporation.

- Check the appropriate boxes that apply to your status, the type of organization, and the taxable year information.

- Sign and date the form. A form without the nonresident distributor’s signature, or that of an authorized corporate officer, will not be processed.

Things You Shouldn't Do:

- Don't overlook the deadline for filing the form with the organization. It must be completed and filed on or before the last day of the Organization’s taxable year.

- Do not leave parts of the form blank that are applicable to your situation. Incomplete forms may result in processing delays or the form being returned to you.

- Avoid incorrect identification numbers. Double-check your Social Security Number, Federal Identification Number, or your spouse's details are correct to prevent misidentification.

- Refrain from sending the form to the wrong address. The form should be filed with the Organization from which you receive West Virginia source income, not directly to the tax office unless specified.

- Don't forget to make copies for your records. It's important to have a copy of the form for your personal records before you submit it to the respective organization.

Misconceptions

When dealing with the WV/NRW-4 form, there are several common misconceptions that individuals often encounter. Understanding these misconceptions can help in correctly completing and submitting the form according to the requirements of the West Virginia State Tax Department.

Misconception 1: The WV/NRW-4 form is only for individuals. This form is applicable not only to individual nonresidents but also to C corporations that derive income from West Virginia sources through partnerships, S corporations, estates, trusts, or limited liability companies.

Misconception 2: Filing WV/NRW-4 automatically exempts nonresidents from all West Virginia taxes. While submitting this form does avoid withholdings on West Virginia source income, it does not exempt nonresidents from the obligation to file West Virginia income tax returns and pay any taxes due.

Misconception 3: The agreement, once signed, covers income from all West Virginia sources. Each separate organization distributing West Virginia source income to a nonresident requires its own WV/NRW-4 form to be completed and submitted to avoid withholding by that specific organization.

Misconception 4: The form must be submitted by the tax return due date. The WV/NRW-4 must be filed with the relevant organization on or before the last day of the organization’s taxable year, not the individual’s tax return due date.

Misconception 5: Revocation of the agreement is effective immediately upon submission. The revocation applies prospectively, meaning it affects taxable years of the organization that begin after the revocation form is submitted.

Misconception 6: Only the nonresident can revoke the agreement. The agreement can be revoked either by the nonresident distributee or by the Tax Commissioner, under certain conditions such as the failure to file a return or pay taxes due.

Misconception 7: The withholding tax rate is negotiable. The withholding tax rate is fixed at 6.5% of distributions of West Virginia source income. This rate is not subject to adjustment or negotiation by either the nonresident or the distributing organization.

Misconception 8: One copy of the form is sufficient for all purposes. Upon completion, the organization must distribute copies as follows: one for attachment with its West Virginia income tax return, one to be retained by the pass-through entity, and one for the nonresident distributee.

Misconception 9: Completing the WV/NRW-4 is optional for avoiding withholding. For nonresidents who wish to avoid West Virginia income tax withholding on their distributions, filing the WV/NRW-4 form with each applicable organization is mandatory, not optional.

Understanding these key points about the WV/NRW-4 form can assist in ensuring that nonresidents comply with West Virginia tax laws while avoiding unnecessary withholdings on their state-source income.

Key takeaways

Here are key takeaways about filling out and using the WV/NRW-4, the West Virginia Nonresident Income Tax Agreement:

- Nonresident individuals or C corporations deriving income from a West Virginia organization must complete the WV/NRW-4 to avoid income tax withholding by the organization.

- Organizations affected include partnerships, S corporations, estates, trusts, or limited liability companies.

- The form must be filed with the organization before the last day of the organization's taxable year to be effective.

- Separate WV/NRW-4 forms must be filed with each organization from which the nonresident receives West Virginia source income to circumvent withholding by each entity.

- Upon execution and filing of this form with an organization, West Virginia income tax will not be withheld from distributions (actual or deemed) to the nonresident.

- This agreement becomes applicable for the taxable year during which the organization receives the duly completed form from the nonresident.

- Once filed, the agreement remains in effect until revoked by either the nonresident distributee or the Tax Commissioner.

- A nonresident can revoke the agreement by filing a notice of revocation with any organization through which West Virginia source income is received. This revocation applies to taxable years of the organization that begin after the revocation date.

It is crucial for nonresidents earning income from West Virginia sources to carefully complete and timely file the WV/NRW-4 form with each relevant organization to ensure compliance with West Virginia tax laws and avoid unnecessary withholding.

Popular PDF Forms

How to Fill Out an Application - Allowing for the indication of whether the applicant is currently employed provides a nuanced understanding of their employment situation.

Fee Statement - Assists in financial discussions with service providers by clearly itemizing potential charges and fees associated with a loan.