Blank Wv Tax Exempt PDF Template

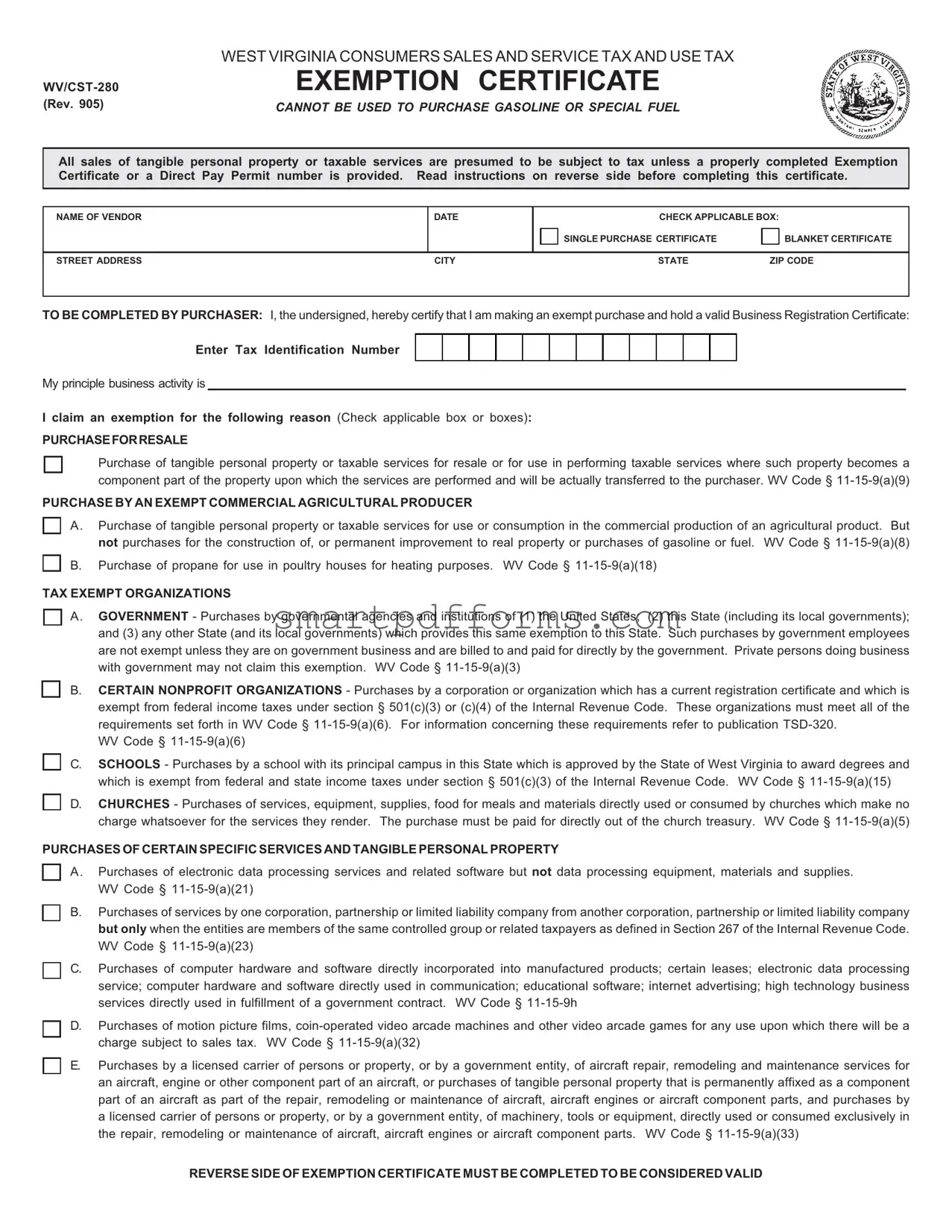

In West Virginia, the Consumers Sales and Service Tax and Use Tax Exemption Certificate, known as the WV/CST-280 form, plays a crucial role in the financial operations of various entities. This form, which has undergone revisions, serves as a declaration that certain purchases are not subject to the state's sales and use tax, a condition that hinges on the purchaser's eligibility and the nature of the purchase. It categorically states that sales of tangible personal property or taxable services are deemed taxable unless exempted under this certificate or through a Direct Pay Permit number. This certificate specifies different eligibility criteria for exemption, including purchases for resale, by certain nonprofit organizations, schools, churches, and in specific agricultural, industrial, or technological contexts. It also outlines conditions for purchases of services and tangible personal property used in various designated activities. However, it strictly emphasizes that it cannot be used for the purchase of gasoline or special fuel. The completion of this certificate requires detailed information from the purchaser, underscoring the importance of accuracy and honesty to avoid potential liabilities, including substantial penalties and interest for misuse. Additionally, it guides both purchasers and vendors on how to correctly handle and document exempt transactions to ensure compliance with West Virginia tax laws. This system is designed to facilitate the legitimate claiming of tax exemptions while preventing abuse, thereby safeguarding public revenue and ensuring that the tax exemptions serve their intended policy goals.

Preview - Wv Tax Exempt Form

|

WEST VIRGINIA CONSUMERS SALES AND SERVICE TAX AND USE TAX |

EXEMPTION CERTIFICATE |

|

(Rev. 905) |

CANNOT BE USED TO PURCHASE GASOLINE OR SPECIAL FUEL |

All sales of tangible personal property or taxable services are presumed to be subject to tax unless a properly completed Exemption Certificate or a Direct Pay Permit number is provided. Read instructions on reverse side before completing this certificate.

NAME OF VENDOR

DATE

CHECK APPLICABLE BOX:

SINGLE PURCHASE CERTIFICATE

BLANKET CERTIFICATE

STREET ADDRESS |

CITY |

STATE |

ZIP CODE |

TO BE COMPLETED BY PURCHASER: I, the undersigned, hereby certify that I am making an exempt purchase and hold a valid Business Registration Certificate:

Enter Tax Identification Number

My principle business activity is

I claim an exemption for the following reason (Check applicable box or boxes):

PURCHASEFORRESALE

Purchase of tangible personal property or taxable services for resale or for use in performing taxable services where such property becomes a component part of the property upon which the services are performed and will be actually transferred to the purchaser. WV Code §

PURCHASE BY AN EXEMPT COMMERCIAL AGRICULTURAL PRODUCER

A. Purchase of tangible personal property or taxable services for use or consumption in the commercial production of an agricultural product. But not purchases for the construction of, or permanent improvement to real property or purchases of gasoline or fuel. WV Code §

B. Purchase of propane for use in poultry houses for heating purposes. WV Code §

TAX EXEMPT ORGANIZATIONS

A. GOVERNMENT - Purchases by governmental agencies and institutions of (1) the United States; (2) this State (including its local governments); and (3) any other State (and its local governments) which provides this same exemption to this State. Such purchases by government employees are not exempt unless they are on government business and are billed to and paid for directly by the government. Private persons doing business with government may not claim this exemption. WV Code §

B. CERTAIN NONPROFIT ORGANIZATIONS - Purchases by a corporation or organization which has a current registration certificate and which is exempt from federal income taxes under section § 501(c)(3) or (c)(4) of the Internal Revenue Code. These organizations must meet all of the requirements set forth in WV Code §

WV Code §

C. SCHOOLS - Purchases by a school with its principal campus in this State which is approved by the State of West Virginia to award degrees and which is exempt from federal and state income taxes under section § 501(c)(3) of the Internal Revenue Code. WV Code §

D. CHURCHES - Purchases of services, equipment, supplies, food for meals and materials directly used or consumed by churches which make no charge whatsoever for the services they render. The purchase must be paid for directly out of the church treasury. WV Code §

PURCHASES OF CERTAIN SPECIFIC SERVICES AND TANGIBLE PERSONAL PROPERTY

A. Purchases of electronic data processing services and related software but not data processing equipment, materials and supplies. WV Code §

B. Purchases of services by one corporation, partnership or limited liability company from another corporation, partnership or limited liability company but only when the entities are members of the same controlled group or related taxpayers as defined in Section 267 of the Internal Revenue Code. WV Code §

C. Purchases of computer hardware and software directly incorporated into manufactured products; certain leases; electronic data processing service; computer hardware and software directly used in communication; educational software; internet advertising; high technology business services directly used in fulfillment of a government contract. WV Code §

D. Purchases of motion picture films,

E. Purchases by a licensed carrier of persons or property, or by a government entity, of aircraft repair, remodeling and maintenance services for an aircraft, engine or other component part of an aircraft, or purchases of tangible personal property that is permanently affixed as a component part of an aircraft as part of the repair, remodeling or maintenance of aircraft, aircraft engines or aircraft component parts, and purchases by a licensed carrier of persons or property, or by a government entity, of machinery, tools or equipment, directly used or consumed exclusively in the repair, remodeling or maintenance of aircraft, aircraft engines or aircraft component parts. WV Code §

REVERSE SIDE OF EXEMPTION CERTIFICATE MUST BE COMPLETED TO BE CONSIDERED VALID

I understand that this certificate may not be used to make tax free purchases of items or services which are not for an exempt purpose and that I will pay the Consumers Sales or Use Tax on tangible personal property or services purchased pursuant to this certificate and subsequently used or consumed in a taxable manner. In addition, I understand that I will be liable for the tax due, plus substantial penalties and interest, for any erroneous or false use of this certificate.

NAME OF PURCHASER |

STREET ADDRESS |

|

|

|

|

SIGNATURE OF OWNER, PARTNER, OFFICER OF CORPORATION, ETC. |

CITY |

|

|

|

|

TITLE |

STATE |

ZIP CODE |

|

|

|

GENERALINSTRUCTIONS

An Exemption Certificate may be used only to claim exemption from tax upon a purchase of tangible personal property or services which will be used for an exempt purpose as stated on the front of this form.

ApurchasermayfileablanketExemptionCertificatewiththevendortocoveradditionalpurchasesofthesamegeneraltypeofproperty or service. However, each subsequent sales slip or purchase invoice evidencing a transaction covered by a blanket Exemption Certificate must show the purchaser’s name, address and Business Registration Certificate Number for purposes of certification.

INSTRUCTIONSFORPURCHASER

To purchase tangible personal property or services tax exempt, you must possess a valid Business Registration Certificate and you must properly complete this Exemption Certificate and present it to your supplier. To be properly completed, all entries on this Exemption Certificate must be filled in.

Your Business Registration Certificate (and any duplicates) may be suspended or revoked if you or someone acting on your behalf willfully issues this certificate for the purpose of making a tax exempt purchase of tangible personal property and/or services that is not used in a tax exempt manner (as stated on the front of this form).

When property or services are purchased tax exempt with an Exemption Certificate, but later used or consumed in a non exempt manner, the purchaser must pay Sales or Use Tax on the purchase price.

The willful issuance of a false or fraudulent Exemption Certificate with the intent to evade Sales or Use Tax is a misdemeanor.

Your misuse of this Certificate with intent to evade the Sales or Use Tax shall also result in your being subject to:

A penalty of fifty percent of the tax that would have been due

had there not been a misuse of such certificate.

This is in addition to any other penalty imposed by the Law.

In the event you make false or fraudulent use of this Certificate with intent to evade the tax, you may be assessed for the tax at any time subsequent to such use.

INSTRUCTIONSFORVENDOR

At the time the property is sold or the service is rendered, you must obtain from your customer this Certificate, properly completed, (or a Direct Pay Permit number issued by the West Virginia Department of Tax and Revenue), or the sale will be deemed a taxable sale, unless the property or service sold is exempt per se from Sales Tax. Your failure to collect tax on such taxable sale will make you personally liable for the tax, plus penalties and interest.

Additionalinformationmayberequiredtosubstantiatethatthesalewasforexemptpurposes. InorderforthisCertificatetobeproperly completed, it must be issued by a purchaser who has a valid Business Registration Certificate and must have all entries completed by the purchaser.

A timely received certificate which contains a material deficiency will be considered satisfactory if such deficiency is subsequently corrected.

You must keep this certificate for at least three years after the due date of the last return to which it relates, or the date when such return was filed, if later.

You must maintain a reasonable method of associating a particular exempt sale to a customer with the Exemption Certificate you have on file for such customer.

INSTRUCTIONSFORVENDORANDPURCHASER

If you, as vendor or as a purchaser, engage in any business activity in West Virginia without possessing a valid Business Registration Certificate (and you do not clearly qualify for an exemption), you shall be subject to a penalty in an amount not exceeding $100 for the first day on which such sales or purchases are made, plus an amount not exceeding $100 for each subsequent day on which such sales or purchases are made.

Please begin using this Certificate immediately.

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The form is specifically used for claiming exemption from Consumers Sales and Service Tax and Use Tax in West Virginia. |

| 2 | It cannot be used to purchase gasoline or special fuel. |

| 3 | All tangible personal property or taxable services purchases are presumed taxable unless an Exemption Certificate or Direct Pay Permit number is properly provided. |

| 4 | There are specific boxes to check for whether the certificate is for a single purchase or for blanket use over a period of time. |

| 5 | Purchasers must have a valid Business Registration Certificate and enter their Tax Identification Number on the form. |

| 6 | There are various specific exemptions listed on the form, including purchases for resale, by certain nonprofit and governmental entities, educational institutions, and for specific agricultural or industrial uses. |

| 7 | The reverse side of the exemption certificate must be completed for the certificate to be considered valid. |

| 8 | Misuse of the exemption certificate, such as using it to evade tax, could result in penalties including a fifty percent penalty of the would-be due tax, on top of any other imposed penalties. |

Instructions on Utilizing Wv Tax Exempt

Filling out the West Virginia Tax Exempt form, officially known as WV/CST-280, is crucial for any entity seeking exemption from consumers sales and service tax and use tax for qualified purchases. This document is necessary for entities like nonprofit organizations, schools, and agricultural producers to buy goods or services without paying state sales tax, under specific conditions. The following steps will guide you through the form completion process, making it straightforward and compliant with state regulations.

- Start by reading the entire form, including the instructions on the reverse side, to ensure a clear understanding of the exemption criteria and documentation requirements.

- Enter the Name of Vendor from whom you are purchasing goods or services at the top of the form.

- Fill in the Date of the transaction next to the vendor's name.

- Choose the type of certificate applicable to your purchase: Single Purchase Certificate for a one-time exemption or Blanket Certificate for ongoing purchases.

- Under the purchaser's section, write your entity’s name where it says NAME OF PURCHASER.

- Provide your Street Address, including City, State, and ZIP Code.

- Enter your Tax Identification Number and describe your principal business activity in the provided fields.

- Identify the reason for claiming tax exemption by checking the appropriate box or boxes that apply to your purchase. Be sure to understand each exemption category properly to ensure compliance with West Virginia Code references listed.

- Complete the reverse side of the exemption certificate as instructed to validate the exemption request. This includes any additional information that may be necessary according to the selected reason for exemption.

- Sign the form at the bottom, indicating your role (e.g., Owner, Partner, Officer of Corporation, etc.) along with the printed name and address of the purchaser.

- Review the entire form to ensure all information is complete and accurate to avoid any potential issues or delays with your tax-exempt status.

After filling out the form, submit it to the vendor from which you are making the purchase. Keep a copy for your records, along with any related purchase documents. Remember, misuse of this certificate, such as claiming exemption for non-eligible products or services, can lead to penalties including payment of taxes owed plus interest and fines. Staying informed about the regulations and maintaining proper documentation is essential for valid tax-exempt transactions.

Obtain Answers on Wv Tax Exempt

Frequently Asked Questions about the West Virginia Tax Exempt Form (WV/CST-280 Exemption Certificate)

- What is the purpose of the West Virginia Tax Exempt Form?

The West Virginia Tax Exempt Form, officially known as the WV/CST-280 Exemption Certificate, is designed for use by individuals, businesses, or organizations that are eligible to purchase tangible personal property or taxable services without paying the state sales tax. This exemption applies only if the purchases are for exempt purposes as outlined in the form, such as for resale, use in agricultural production, or use by certain nonprofits and governmental agencies.

- Who can use this exemption certificate?

The form can be used by:

- Businesses purchasing goods for resale.

- Exempt commercial agricultural producers.

- Government agencies and institutions, including federal, state, and local entities.

- Certain nonprofit organizations that meet specific qualifications.

- Schools, churches, and other eligible organizations as specified in the form.

- Can this form be used for any type of purchase?

No, there are restrictions on the use of this exemption certificate. It cannot be used for personal purchases or for items like gasoline or special fuel. The form is intended solely for items that are used or consumed in a manner consistent with the purchaser’s exempt status. For example, goods for resale, items used in agricultural production, or purchases by tax-exempt nonprofit organizations for their exempt functions.

- What are the penalties for misuse of the West Virginia Tax Exempt Form?

Using the WV/CST-280 Exemption Certificate to make exempt purchases fraudulently is a misdemeanor. Misuse of the form, with intent to evade tax, can result in being liable for the tax owed plus a penalty of fifty percent of the tax due. This is in addition to any other penalties imposed by law. False or fraudulent use may also lead to suspension or revocation of the purchaser's Business Registration Certificate.

- What are the responsibilities of the purchaser and vendor regarding the exemption certificate?

The purchaser must provide a properly completed exemption certificate to the vendor at the time of purchase to claim the tax exemption. It’s the purchaser's responsibility to ensure that all information on the form is correct and that the purchases are for eligible exempt purposes. The vendor must keep the certificate on file for at least three years following the purchase and ensure that the sale fulfills the requirements for tax exemption. Failure to comply can result in tax liabilities, penalties, and interest for the vendor.

Common mistakes

Filling out the West Virginia Tax Exempt Form correctly is crucial for ensuring that transactions are processed legally and efficiently. However, there are common mistakes individuals make when completing this form. It is essential to pay close attention to detail and thoroughly understand the criteria for exemptions to avoid potential legal complications.

- Not Providing Complete Information:

- Individuals often overlook or inaccurately fill in crucial details such as the "Name of Vendor," "Date," and specific "Tax Identification Number." It’s important that each section is carefully reviewed to ensure all necessary information is provided.

- Incorrectly Identifying the Exemption Reason:

- There are several categories under which one can claim exemption, such as "PURCHASE FOR RESALE" or "TAX EXEMPT ORGANIZATIONS." Misidentification or unchecked boxes that do not accurately represent the purpose of the exemption can lead to the rejection of the certificate.

- Failure to Sign the Certificate:

- A common oversight is the absence of the signature from the "owner, partner, officer of corporation, etc." The form is not valid without the authorizing signature, thereby potentially nullifying the exemption claim.

- Using the Certificate for Inappropriate Exemptions:

- The certificate explicitly states that it cannot be used for the purchase of gasoline or special fuel, yet individuals sometimes attempt to use it for such non-qualifying purposes. Understanding the specific restrictions and permissible uses of the exemption certificate is essential for compliance.

To avoid potential penalties, interest, or the revocation of business registration certificates, individuals must give due diligence when completing the West Virginia Tax Exempt Form. They must ensure that all provided information is accurate and that the exemption claimed strictly adheres to the guidelines stipulated by law. Being thorough and compliant not only facilitates smoother transactions but also upholds the integrity of one’s business practices.

Documents used along the form

When handling tax exemptions in West Virginia, especially with the WV/CST-280 Exemption Certificate, it's important to be equipped with additional forms and documents to ensure compliance and ease of processing. These documents not only support the exemption claim but also help in maintaining proper records and adhering to the state's tax laws.

- Business Registration Certificate: This document is evidence that a business is registered with the State of West Virginia. It's necessary for entities attempting to claim tax exemptions, as per the prerequisites outlined in the WV/CST-280 form. The certificate must be valid and reflect the current status of the business.

- Direct Pay Permit: A Direct Pay Permit allows businesses to purchase goods and services without paying sales tax at the point of purchase. Instead, the business calculates and pays use tax directly to the state. This document is crucial for businesses that prefer to manage their tax liabilities directly and is often used in conjunction with the exemption certificate for specific transactions.

- Purchase Invoices: Retaining copies of purchase invoices that detail transactions covered by the tax exemption certificate is essential. These invoices should clearly mention the purchaser's name, address, and Business Registration Certificate Number, ensuring they match the information on the Exemption Certificate. Invoices provide a transactional record, supporting the claim of tax-exempt purchases.

- Annual Tax Exemption Renewal Notice: For continuous tax-exempt status, most organizations are required to renew their eligibility annually. The renewal notice or document confirms the entity's ongoing qualification for tax exemption under the state laws. It's vital to keep this updated and readily available, as it supports the legitimacy of the exemption certificate.

Ultimately, possessing and correctly using these documents in conjunction with the West Virginia Tax Exempt form will facilitate smoother transactions and compliance with state tax regulations. Organizations should make sure to periodically review and update their documents to ensure they continue to meet the eligibility criteria for tax exemptions.

Similar forms

Resale Certificate: Similar to the WV Tax Exempt form, the Resale Certificate is used by businesses when purchasing goods they intend to resell, thereby exempting them from paying sales tax at the point of purchase. Both documents serve the purpose of avoiding a scenario where sales tax is paid multiple times on the same items - first by the resellers when they buy the products, and then by their customers upon purchase. Resale certificates, like the WV/CST-280, require the purchaser to provide pertinent business and tax identification information.

Direct Pay Permit: Businesses holding a Direct Pay Permit bypass the traditional process of paying sales tax at the time of purchase. Instead, they self-assess and remit the tax directly to the taxing authority. This is akin to the WV Tax Exempt form which allows entities to make tax-exempt purchases by presenting the certificate, rather than paying the tax upfront. Both mechanisms aim at streamlining tax compliance while ensuring that only the end consumer bears the sales tax cost.

Nonprofit Exemption Certificate: Nonprofits can use specific exemption certificates to procure goods and services without paying sales tax, predicated on their tax-exempt status under federal law (e.g., under section 501(c)(3) or (c)(4) of the Internal Revenue Code). The WV Tax Exempt form also caters to certain nonprofit organizations, mirroring the process where eligible entities must present documentation affirming their exemption eligibility during purchases.

Agricultural Exemption Certificate: These certificates enable farmers and others in the agricultural sector to purchase supplies, equipment, and sometimes services without sales tax, given their use in producing agricultural products. This parallels the segment of the WV Tax Exempt form specifically designated for purchases by an exempt commercial agricultural producer, highlighting a shared focus on supporting specific industries by easing the tax burden on essential purchases.

Governmental Exemption Certificate: State and federal agencies use these certificates to buy goods and services without incurring sales tax, recognizing the reciprocal tax-exempt status among government entities. The WV Tax Exempt form extends similar privileges to purchases made by governmental agencies, demonstrating a mutual respect for tax-exempt status across different levels of government, thereby reducing administrative burdens and facilitating public service operations.

Dos and Don'ts

Completing the West Virginia Tax Exempt form requires attention to detail and an understanding of your eligibility for exemption. To ensure the process goes smoothly, here are 5 things you should do, followed by 5 things you shouldn't do.

What You Should Do:

Ensure you hold a valid Business Registration Certificate before attempting to fill out the form. This certificate is crucial for the process.

Read through the instructions on the reverse side of the form carefully to fully understand the requirements and how to properly complete the form.

Clearly indicate your Tax Identification Number as it is a critical piece of information that validates your exemption request.

Select the correct exemption reason that applies to your purchase or activity. This ensures that your claim for exemption is valid and supported by West Virginia law.

Keep a copy of the completed Exemption Certificate for your records. It's important to have proof of your exemption claim and for future reference.

What You Shouldn't Do:

Do not use the Exemption Certificate to make tax-free purchases of items or services that are not intended for an exempt purpose as outlined in the form.

Avoid leaving any section incomplete. An incomplete form may be considered invalid, leading to a denial of your tax exemption claim.

Don't falsify information on the Exemption Certificate. Providing false or misleading information can result in penalties, interest charges, and even criminal charges.

Do not presume all purchases are exempt. Certain items, like gasoline or special fuel, cannot be purchased tax-free with this certificate.

Avoid using the certificate without understanding the exemption clauses. Misuse could lead to substantial penalties and interest on tax dues.

By following these guidelines, you can smoothly navigate the process of claiming a tax exemption in West Virginia, ensuring compliance with state tax laws and avoiding potential legal and financial issues.

Misconceptions

Many people have misconceptions about the West Virginia Tax Exempt form WV/CST-280, leading to confusion about its use and the benefits it offers. Here's a list of common misunderstandings:

- Gasoline purchases are tax-exempt with this certificate: The form explicitly states that it cannot be used to purchase gasoline or special fuel, showcasing a strict limitation on the exemption's scope.

- Any business can use the exemption certificate: Only businesses with a valid Business Registration Certificate and specific exempt purposes, as mentioned in the form, can use this certificate to make tax-exempt purchases.

- The exemption certificate covers all purchases: The certificate only exempts purchases of tangible personal property or taxable services used for an exempt purpose, such as resale, specific production processes, or services by exempt organizations.

- Government purchases are always exempt: While purchases by governmental agencies are exempt, this exemption does not apply to purchases by government employees unless they are on official government business and the expenses are billed directly to the government.

- Nonprofits automatically qualify for exemptions: Nonprofit organizations need to have current registration certificates and be exempt from federal income taxes under sections § 501(c)(3) or (c)(4) of the Internal Revenue Code, among other requirements, to qualify.

- All school purchases are exempt: Only purchases by schools with their principal campus in West Virginia, which are approved to award degrees and are exempt from federal and state income taxes, qualify for exemptions.

- A blanket certificate covers all future purchases: Although a blanket Exemption Certificate can be filed to cover additional purchases, each sales transaction must still show the purchaser's name, address, and Business Registration Certificate Number.

- Using the exemption negates the need to report use tax: If property or services bought tax-exempt are later used in a non-exempt manner, the purchaser must pay Sales or Use Tax on the purchase price.

- Vendors do not need to verify the exemption certificate: Vendors must obtain a properly completed certificate or a Direct Pay Permit number at the time of sale. Failure to collect tax on taxable sales makes the vendor personally liable for the tax, plus penalties and interest.

Understanding these nuances is crucial for correctly applying the West Virginia Tax Exempt form and ensuring compliance with state tax laws. Misusing the exemption certificate can lead to significant penalties, including a penalty of fifty percent of the due tax, in addition to other penalties imposed by law.

Key takeaways

Filling out and using the West Virginia Tax Exempt Form (WV/CST-280), a vital document for certain purchases within the state, requires attention to detail and an understanding of its provisions. Here are five key takeaways to guide individuals and organizations through the process:

- Understand Eligibility: The form allows for tax exemption on purchases of tangible personal property or taxable services only when such purchases are made for specific exempt reasons, such as for resale, by exempt organizations, or for use in agricultural production. Gasoline and special fuel are notably excluded from exemptions.

- Proper Completion is Crucial: For an exemption to be granted, the form must be accurately and fully completed. This includes checking the appropriate box to indicate if the certificate is for a single purchase or blanket use, and providing all requested details, such as the tax identification number, principal business activity, and the specific exemption reason.

- Exemptions Must Be Justified: The purchaser must certify their eligibility for the tax exemption by selecting the applicable reason from a range of options provided. These reasons correlate with specific sections of the West Virginia Code, highlighting the legal grounds for each exemption.

- Responsibility for Misuse: The form clearly states that if the purchaser uses the exempted goods or services in a way that does not align with the stipulated exempt purpose, they are obligated to pay the applicable Consumers Sales or Use Tax. Moreover, significant penalties and interest can be applied for erroneous or false use of the certificate.

- Vendor and Purchaser Obligations: Both the vendor and purchaser have defined responsibilities regarding the tax exemption certificate. Vendors must ensure that the certificate is properly completed and retained for a minimum of three years, associating each exempt sale with the corresponding certificate. Purchasers, on the other hand, must ensure they have a valid Business Registration Certificate and use the exemption certificate appropriately to avoid penalties.

This form serves as a legal document that facilitates tax-exempt purchases under specific conditions. Both parties involved in the transaction must diligently adhere to the guidelines to ensure compliance with West Virginia tax laws. Understanding and accurately executing the provisions of the WV/CST-280 is essential for maintaining the integrity of the tax exemption process.

Popular PDF Forms

Inspection Palpation Percussion and Auscultation - Investigates a resident's history with substance abuse, including prescription, non-prescription medications, and other substances.

Pa Tint Exemption Form - The form is part of Pennsylvania’s efforts to regulate the use of sun screening in vehicles, ensuring safety and legal compliance.