Blank Contract For Deed PDF Template

Exploring the intricacies of a Contract for Deed can be a journey into the heart of real estate transactions, offering a unique pathway for buyers and sellers to seal the deal on property sales. At its core, this agreement serves as a bridge between the seller, designated as the 'SELLER', and the buyer, referred to as the 'PURCHASER', outlining the conditions under which property ownership will change hands. Ingeniously structured to facilitate the sale of property for a specified purchase price, the document meticulously details terms including an initial payment, subsequent installments, and, if applicable, interest rates, ensuring clarity and mutual understanding. Crucially, it underscores the importance of timely payments, designating 'time as of the essence', and solidifies the contract itself as a means of security for the payment obligations laid out. Furthermore, it intricately specifies the responsibilities of the purchaser towards the maintenance and condition of the property, insurance and tax responsibilities, and the protocol in case of damage, showcasing a comprehensive approach to safeguarding both parties' interests. Employing a contract for deed, therefore, represents a pivotal decision, embedding the promise of ownership transfer within a framework designed to protect the property in question and the parties' investment therein.

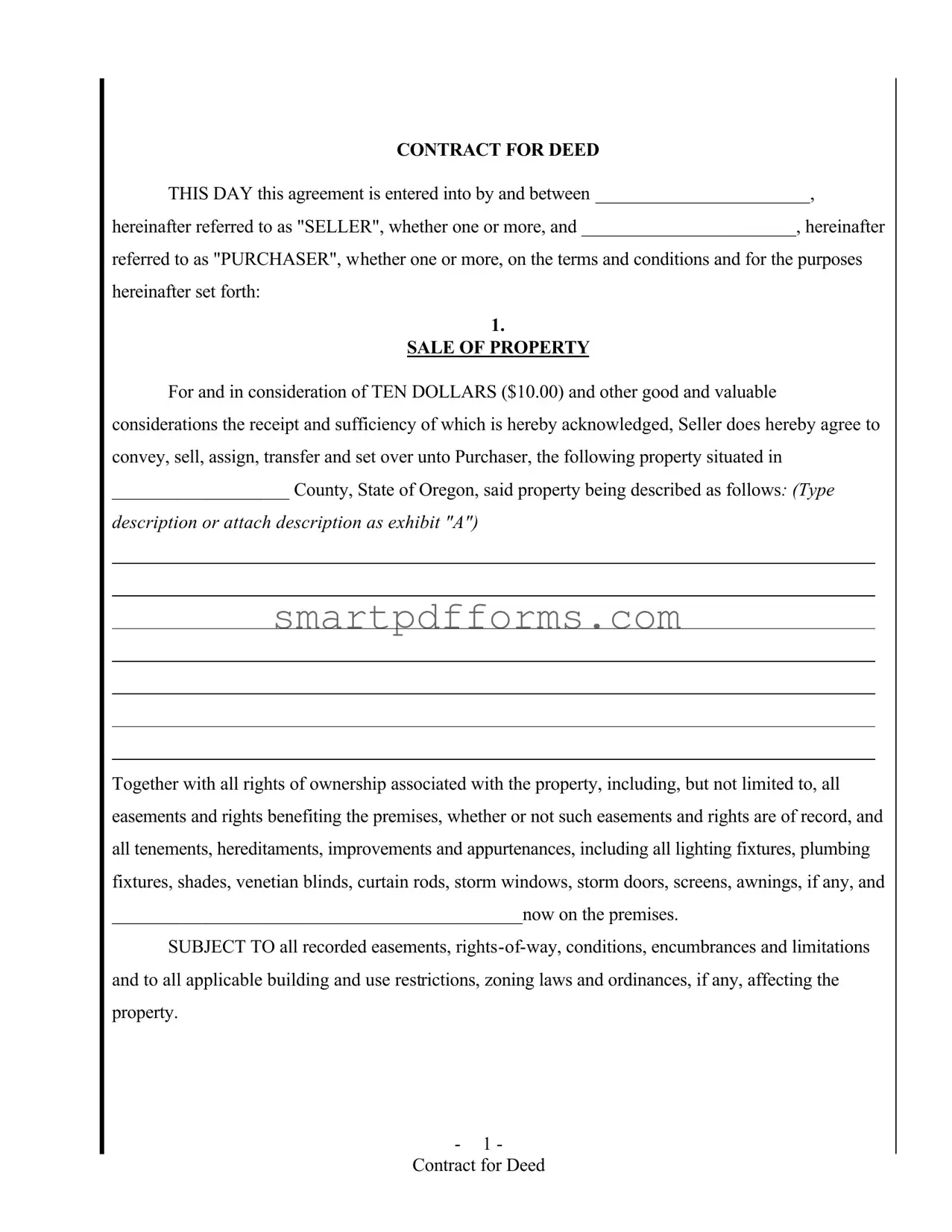

Preview - Contract For Deed Form

CONTRACT FOR DEED

THIS DAY this agreement is entered into by and between _______________________,

hereinafter referred to as "SELLER", whether one or more, and _______________________, hereinafter

referred to as "PURCHASER", whether one or more, on the terms and conditions and for the purposes hereinafter set forth:

1.

SALE OF PROPERTY

For and in consideration of TEN DOLLARS ($10.00) and other good and valuable considerations the receipt and sufficiency of which is hereby acknowledged, Seller does hereby agree to convey, sell, assign, transfer and set over unto Purchaser, the following property situated in

___________________ County, State of Oregon, said property being described as follows: (Type

description or attach description as exhibit "A")

Together with all rights of ownership associated with the property, including, but not limited to, all easements and rights benefiting the premises, whether or not such easements and rights are of record, and all tenements, hereditaments, improvements and appurtenances, including all lighting fixtures, plumbing fixtures, shades, venetian blinds, curtain rods, storm windows, storm doors, screens, awnings, if any, and

____________________________________________now on the premises.

SUBJECT TO all recorded easements,

- 1 -

Contract for Deed

2.

PURCHASE PRICE AND TERMS

The purchase price of the property shall be $____________________. The purchaser does

hereby agree to pay to the order of the Seller the sum of ___________________ Dollars

($_______________) upon execution of this agreement, with the balance of $__________________

being due and payable as follows:(Select one)

(a) Balance payable in __________ (_______) monthly installments of ______________

Dollars ($_________) each, with the first installment being due and payable on the ____ day of

_______________, 20____ and a like payment on the first day of each month thereafter until the

______ day of ________________, 20____, when the final payment shall be due. No interest.

(b) Balance payable, together with interest on the whole sum that shall be from time to time unpaid at the rate of _______ per cent, per annum, payable in the amount of $____________

dollars per month beginning on the _____ day of ____________, 20____ and continuing on the

same day of each month thereafter until fully paid.

(c) Balance payable, together with interest on the whole sum that shall be from time to time unpaid at the rate of _______ per cent, per annum, payable in the amount of

_____________________ dollars per month beginning on the ________ day of

_______________, 20____, and continuing on the same day of each month thereafter until the

______ day of _______________, 20____, when all remaining principal and interest shall be

paid. (Balloon payment)

If interest is charged, interest shall be computed monthly and deducted from payment and the balance of payment shall be applied on principal.

3.

TIME OF THE ESSENCE

Time is of the essence in the performance of each and every term and provision in this agreement by Purchaser.

- 2 -

Contract for Deed

4.

SECURITY

This contract shall stand as security of the payment of the obligations of Purchaser.

5.

MAINTENANCE OF IMPROVEMENTS

All improvements on the property, including, but not limited to, buildings, trees or other improvements now on the premises, or hereafter made or placed thereon, shall be a part of the security for the performance of this contract and shall not be removed there from. Purchaser shall not commit, or suffer any other person to commit, any waste or damage to said premises or the appurtenances and shall keep the premises and all improvements in as good condition as they are now.

6.

CONDITION OF IMPROVEMENTS

Purchaser agrees that the Seller has not made, nor makes any representations or warranties as to the condition of the premises, the condition of the buildings, appurtenances and fixtures locate thereon, and/or the location of the boundaries. Purchaser accepts the property in its

7.

POSSESSION OF PROPERTY

Purchaser shall take possession of the property and all improvements thereon upon execution of this contract and shall continue in the peaceful enjoyment of the property so long as all payments due under the terms of this contract are timely made. Purchaser agrees to keep the property in a good state of repair and in the event of termination of this contract, Purchaser agrees to return the property to Seller in substantially the same condition as it now exists, ordinary wear and tear excepted. Seller reserves the right to inspect the property at any time with or without notice to Purchaser.

8.

TAXES, INSURANCE AND ASSESSMENTS

Taxes and Assessments: During the term of this contract:(Select one)

- 3 -

Contract for Deed

(a) Purchaser shall pay all taxes and assessments levied against the property.

(b) Seller shall pay all taxes and assessments levied against the property. In the event that Seller pays the taxes and insurance, Purchaser shall reimburse Seller for same upon 30 days notice to purchaser.

Content Insurance: Purchaser shall be solely responsible for obtaining insurance of the contents, insuring contents owned by Purchaser. Seller shall be solely responsible for obtaining insurance on all contents owned by Seller.

Liability and Hazard Insurance: Liability insurance shall be maintained by Purchaser during the term of this contract naming Seller as an additional insured, in the amount of not less than $________________.

Fire, Hazard and Windstorm insurance: Fire, hazard and windstorm insurance shall be maintained as follows: (Select one)

(a) Purchaser shall obtain fire, hazard and windstorm insurance in the amount not less than $_______________, on a policy of insurance naming Seller as additional insured.

(b) Seller shall obtain and pay for hazard, fire and windstorm insurance in an amount not less than $ _________________. In the event Seller elects this option, Purchaser shall repay the

amount so paid by Seller within thirty (30) days of demand for same by Seller.

Should the Purchaser fail to pay any tax or assessment, or installment thereof, when due, or keep said buildings insured, Seller may pay the same and have the buildings insured, and the amounts thus expended shall be a lien on said premises and may be added to the balance then unpaid, or collected by Seller, in the discretion if Seller with interest until paid at the rate of the ______________ per cent per

annum.

In case of any damage as a result of which said insurance proceeds are available, the Purchaser may, within sixty (60) days of said loss or damage, give to the Seller written notice of Purchaser’s election to repair or rebuild the damaged parts of the premises, in which event said insurance proceeds shall be used for such purpose. The balance of said proceeds, if any, which remain after completion of said repairing or rebuilding, or all of said insurance proceeds if the Purchaser elects not to repair or rebuild, shall be applied first toward the satisfaction of any existing defaults under the terms of this contract, and then as a prepayment upon the principal balance owing. No such prepayment shall defer the time for payment of any remaining payments required by said contract. Any surplus of said proceeds

- 4 -

Contract for Deed

in excess of the balance owing hereon shall be paid to the Purchaser.

- 5 -

Contract for Deed

9.

DEFAULT

If the Purchaser shall fail to perform any of the covenants or conditions contained in this contract on or before the date on which the performance is required, the Seller shall give Purchaser notice of default or performance, stating the Purchaser is allowed fourteen (14) days from the date of the Notice to cure the default or performance. In the event the default or failure of performance is not cured within the

14 day time period, then Seller shall have any of the following remedies, in the discretion of Seller:

(a)give the Purchaser a written notice specifying the failure to cure the default and informing the Purchaser that if the default continues for a period of an additional fifteen (15) days after service of the notice of failure to cure, that without further notice, this contract shall stand cancelled and Seller may regain possession of the property as provided herein; or

(b)give the Purchaser a written notice specifying the failure to cure the default and informing the Purchaser that if the default continues for a period of an additional fifteen (15) days after service of the notice of failure to cure, that without further notice, the entire principal balance and unpaid interest shall be immediately due and payable and Seller may take appropriate action against Purchaser for collection of same according to the laws of the State of

____________________.

In the event of default in any of the terms and conditions or installments due and payable under

the terms of this contract and Seller elects 9(a), Seller shall be entitled to immediate possession of the property.

In the event of default and termination of the contract by Seller, Purchaser shall forfeit any and all payments made under the terms of this contract including taxes and assessments as liquidated damages, Seller shall be entitled to recover such other damages as they may be due which are caused by the acts or negligence of Purchaser.

The parties expressly agree that in the event of default not cured by the Purchaser and termination of this agreement, and Purchaser fails to vacate the premises, Seller shall have the right to obtain possession by appropriate court action.

- 6 -

Contract for Deed

10.

DEED AND EVIDENCE OF TITLE

Upon total payment of the purchase price and any and all late charges, and other amounts due Seller, Seller agrees to deliver to Purchaser a Warranty Deed to the subject property, at Seller’s expense, free and clear of any liens or encumbrances other than taxes and assessments for the current year.

11.

NOTICES

All notices required hereunder shall be deemed to have been made when deposited in the U. S. Mail, postage prepaid, certified, return receipt requested, to the Purchaser or Seller at the addresses listed below. All notices required hereunder may he sent to:

Seller:

Purchaser:

and when mailed, postage prepaid, to said address, shall be binding and conclusively presumed to be served upon said parties respectively.

12.

ASSIGNMENT OR SALE

Purchaser shall not sell, assign, transfer or convey any interest in the subject property or this agreement, without first securing the written consent of the Seller.

- 7 -

Contract for Deed

13.

PREPAYMENT

Purchaser to have the right to prepay, without penalty, the whole or any part of the balance remaining unpaid on this contract at any time before the due date.

14.

ATTORNEY FEES

In the event of default, Purchaser shall pay to Seller, Seller's reasonable and actual attorneys' fees and expenses incurred by Seller in enforcement of any rights of Seller. All attorney fees shall be payable prior to Purchaser's being deemed to have corrected any such default.

15.

LATE PAYMENT CHARGES

If Purchaser shall fail to pay, within fifteen (15) days after due date, any installment due hereunder, Purchaser shall be required to pay an additional charge of five (5%) percent of the late installment. Such charge shall be paid to Seller at the time of payment of the past due installment.

16.

CONVEYANCE OR MORTGAGE BY SELLER

If the Seller's interest is now or hereafter encumbered by mortgage, the Seller covenants that Seller will meet the payments of principal and interest thereon as they mature and produce evidence thereof to the Purchaser upon demand. In the event the Seller shall default upon any such mortgage or land contract, the Purchaser shall have the right to do the acts or make the payments necessary to cure such default and shall be reimbursed for so doing by receiving, automatically, credit to this contract to apply on the payments due or to become due hereon.

The Seller reserves the right to convey, his or her interest in the above described land and such conveyance hereof shall not be a cause for rescission but such conveyance shall be subject to the terms of this agreement.

- 8 -

Contract for Deed

The Seller may, during the lifetime of this contract, place a mortgage on the premises above described, which shall be a lien on the premises, superior to the rights of the Purchaser herein, or may continue and renew any existing mortgage thereon, provided that the aggregate amount due on all outstanding mortgages shall not at any time be greater than the unpaid balance of the contract.

17.

ENTIRE AGREEMENT

This Agreement embodies and constitutes the entire understanding between the parties with respect to the transactions contemplated herein. All prior or contemporaneous agreements, understandings, representations, oral or written, are merged into this Agreement.

18.

AMENDMENT – WAIVERS

This Agreement shall not be modified, or amended except by an instrument in writing signed by all parties.

No delay or failure on the part of any party hereto in exercising any right, power or privilege under this Agreement or under any other documents furnished in connection with or pursuant to this Agreement shall impair any such right, power or privilege or be construed as a waiver of any default or any acquiescence therein. No single or partial exercise of any such right, power or privilege shall preclude the further exercise of such right, power or privilege, or the exercise of any other right, power or privilege. No waiver shall be valid against any party hereto unless made in writing and signed by the party against whom enforcement of such waiver is sought and then only to the extent expressly specified therein.

19.

SEVERABILITY

If any one or more of the provisions contained in this Agreement shall be held illegal or unenforceable by a court, no other provisions shall be affected by this holding. The parties intend that in the event one or more provisions of this agreement are declared invalid or unenforceable, the remaining

- 9 -

Contract for Deed

provisions shall remain enforceable and this agreement shall be interpreted by a Court in favor of survival of all remaining provisions.

20.

HEADINGS

Section headings contained in this Agreement are inserted for convenience of reference only, shall not be deemed to be a part of this Agreement for any purpose, and shall not in any way define or affect the meaning, construction or scope of any of the provisions hereof.

21.

PRONOUNS

All pronouns and any variations thereof shall be deemed to refer to the masculine, feminine, neuter, singular, or plural, as the identity of the person or entity may require. As used in this agreement:

(1)words of the masculine gender shall mean and include corresponding neuter words or words of the feminine gender, (2) words in the singular shall mean and include the plural and vice versa, and (3) the word "may" gives sole discretion without any obligation to take any action.

22.

JOINT AND SEVERAL LIABILITY

All Purchasers, if more than one, covenants and agrees that their obligations and liability shall be joint and several.

23.

PURCHASER’S RIGHT TO REINSTATE AFTER ACCELERATION

If Purchaser defaults and the loan is accelerated, then Purchaser shall have the right of reinstatement as allowed under the laws of the State of Oregon, provided that Purchaser: (a) pays Lender all sums which then would be due under this agreement as if no acceleration had occurred; (b) cures any default of any other covenants or agreements; and (c) pays all expenses incurred in enforcing this agreement, including, but not limited to, reasonable attorneys' fees, and other fees incurred for the purpose of protecting Seller's interest in the Property and rights under this agreement. Seller may require that Purchaser pay such reinstatement sums and expenses in one or more of the following forms, as

- 10 -

Contract for Deed

Form Data

| Fact Name | Description |

|---|---|

| Contract Purpose | This agreement is made for the sale and transfer of specified real property from the seller to the purchaser, detailing the conditions and obligations of both parties. |

| Governing Law | The form specifies that the property involved is situated in the State of Oregon, implicating that Oregon state laws govern the terms and conditions of this contract. |

| Payment and Terms | The form outlines several options for the payment process, including a no-interest option, a regular installment option with interest, and a balloon payment option, catering to varied financial arrangements between the seller and purchaser. |

| Property Condition and Insurance | The purchaser accepts the property "as-is" without any warranty from the seller regarding its condition. The contract also delineates responsibilities related to taxes, insurance, and maintenance, emphasizing the purchaser's role in ensuring the property is well-kept and adequately insured. |

Instructions on Utilizing Contract For Deed

When embarking on completing a Contract For Deed, it's essential to approach the process with attention to detail. This document is crucial for spelling out the specifics of a property transaction where the seller provides financing to the buyer. Here’s a step-by-step guide to ensure that each section is filled out correctly and accurately to safeguard both parties involved in the transaction.

- Start by inserting the date of the agreement where indicated at the beginning of the contract.

- Enter the full legal name(s) of the seller(s) where the contract indicates “SELLER,” ensuring to include all parties if more than one.

- Input the full legal name(s) of the purchaser(s) in the space provided for “PURCHASER,” again including all parties if there is more than one purchaser.

- Describe the property being sold in detail in the space provided, including its location (county and state) and a thorough description of the property. If the space is insufficient, attach a separate sheet labeled as Exhibit "A" with the full description.

- Under “SALE OF PROPERTY,” enter the agreed-upon total purchase price.

- In the section labeled “PURCHASE PRICE AND TERMS,” fill in the initial payment amount. Then choose the appropriate payment option (a, b, or c) and fill in the corresponding details, such as installment amounts, interest rates (if applicable), and due dates.

- Specify who will be responsible for property taxes, insurance, and assessments by selecting the appropriate option and filling in any required details, such as the amount of liability insurance and who will maintain hazard, fire, and windstorm insurance.

- Ensure all other sections of the contract, including maintenance of improvements, condition of improvements at the time of possession, and the procedure for inspections, are reviewed for completeness and accuracy.

- Both the seller and purchaser must sign and date the contract in the designated areas at the end of the document.

- If applicable, attach any additional documents referred to in the contract, such as Exhibit "A" for the property description or insurance certificates.

After completing the Contract For Deed, it's advisable for both parties to review the document thoroughly before signing. This ensures that all terms and conditions are understood and agreed upon. Proper legal advice or consultation might be beneficial to ensure that all aspects of the contract are in compliance with local laws and regulations. Once signed, a copy should be kept by each party for their records and any required legal filings to be made, such as recording the contract with local county records if applicable.

Obtain Answers on Contract For Deed

What is a Contract for Deed?

A Contract for Deed is an agreement between a seller and purchaser where the seller finances the buyer's purchase of property without going through a traditional lender. The purchaser agrees to pay the seller the purchase price in installments, and the seller retains the title to the property until the full purchase price has been paid.

How does the purchase price work in a Contract for Deed?

The purchase price of the property is agreed upon by the seller and purchaser. It includes an initial payment made upon executing the agreement, followed by a balance that is typically paid in monthly installments. The balance can be paid in several ways, including equal monthly installments, with interest, or as a balloon payment.

What does "time is of the essence" mean in a Contract for Deed?

This phrase means that the timelines for making payments and fulfilling other terms of the contract are crucial. Delays or missed deadlines by the purchaser could lead to breaches of the contract and potential legal consequences.

How is the property secured in a Contract for Deed?

The contract itself serves as security for the purchaser’s obligation to pay. The seller retains legal title to the property until the purchaser completes all payments as per the contract’s terms, ensuring the seller has legal recourse if the purchaser defaults.

What are the maintenance obligations under a Contract for Deed?

The purchaser is responsible for maintaining the property and any improvements on it, ensuring everything is in good condition. The agreement specifically prohibits the purchaser from causing damage or allowing the property to deteriorate.

What does "as-is" condition mean?

When a purchaser agrees to accept the property "as-is," they are agreeing to take the property in its current state without expecting any further repairs, improvements, or warranties concerning the property’s condition from the seller.

What are the terms regarding possession of the property?

The purchaser is entitled to take possession of the property upon executing the contract, continuing as long as they adhere to the payment schedule and other terms. The seller reserves the right to inspect the property, ensuring it is well-maintained.

Who is responsible for paying taxes, insurance, and assessments?

Responsibilities for taxes, insurance, and assessments can vary based on the contract's terms:

- The purchaser may be responsible for all such expenses.

- The seller may initially cover these costs, with the purchaser reimbursing the seller within a specified period.

What happens if the purchaser cannot make payments as agreed?

If the purchaser fails to make timely payments, the seller can choose to pay necessary expenses like taxes or insurance on the purchaser’s behalf, adding these costs to the balance owed, potentially securing a lien on the property. Defaulting on payments may result in the seller terminating the contract and reclaiming possession of the property.

Common mistakes

When it comes to filling out a Contract for Deed, attention to detail is critical. However, many people make mistakes that could lead to complex problems down the line. Below are nine common errors:

Not fully identifying both parties - It's important to include full legal names and contact information for both the seller and purchaser to avoid any confusion about who is bound by the contract.

Failing to accurately describe the property - The property should be described in detail, including its physical address and any legal descriptions. Attaching an exhibit for the property description and ensuring it's accurately referenced in the contract is crucial.

Omitting terms of the sale - Every aspect of the financial transaction, including the total purchase price, down payment, installment plans, and interest rates (if applicable), must be clearly stated.

Ignoring the maintenance clause - Maintenance responsibilities should be clearly outlined, emphasizing what the purchaser is responsible for to avoid disputes over property condition and upkeep.

Overlooking default remedies - The contract should specify what happens if the purchaser defaults on payments, including any grace periods or penalties.

Inadequate details on taxes, insurance, and assessments - Explicitly stating who is responsible for paying taxes, insurance, and any assessments on the property can prevent future disagreements.

Skipping over possession details - Clearly state when the purchaser will take possession of the property and under what conditions this might change.

Not addressing interest properly - If the agreement includes interest on the remaining balance, the method of calculating that interest should be specified.

Leaving out signatures and dates - Ensure that all parties sign and date the contract. This formalizes the agreement, making it legally binding and enforceable.

By avoiding these common pitfalls, both the seller and purchaser can create a Contract for Deed that is clear, concise, and legally sound, protecting the interests of all parties involved.

Documents used along the form

When entering into a Contract for Deed, it's not just about signing a single document and calling it a day. This type of transaction, where the seller finances the buyer's purchase of property and holds the deed until the contract terms are fully met, often requires additional forms and documents to ensure a smooth and legally sound process. Here's a look at some key documents that may be used alongside a Contract for Deed.

- Promissory Note: This is a formal promise in writing where the purchaser commits to pay back a certain amount of money to the seller under specified terms. It details the loan amount, interest rate, repayment schedule, and consequences of non-payment.

- Amortization Schedule: This document outlines each payment on a loan over time, showing how much of each payment goes towards the principal amount and how much goes towards interest, adjusting the loan balance accordingly after each payment.

- Property Disclosure Statement: A document where the seller provides information on the condition of the property, including any known defects or problems. It's a crucial piece of information that helps the purchaser make an informed decision.

- Title Insurance Policy: This policy protects the buyer (and the lender, if applicable) from future claims against the title of the property, such as outstanding liens, legal judgments, or discrepancies in the property's legal description that were not discovered during the initial title search.

- Home Inspection Report: A report generated by a professional home inspector, detailing the condition of the property, including its structure, construction, and mechanical systems. This document can reveal issues that might not be visible during a casual walkthrough, potentially influencing the purchase decision or terms of the Contract for Deed.

Understanding and properly executing these documents can significantly affect the rights and obligations of both the seller and purchaser. Each serves a specific purpose, providing assurances and protections, managing expectations, and enforcing commitments on both sides of the transaction. Navigating through these documents correctly ensures that the property transaction under a Contract for Deed arrangement proceeds smoothly and without unexpected legal complications.

Similar forms

A Land Contract shares similarities with a Contract for Deed, as both involve private financing arrangements for the purchase of real estate. In both instances, the seller finances the purchase but retains the legal title until the buyer completes all payments, at which point the deed is transferred to the buyer.

A Mortgage Agreement is akin to a Contract for Deed in that it outlines the terms and conditions under which a property is financed. However, in a mortgage, the buyer holds the deed to the property while the loan is being repaid, but the lender has a lien on the property as security for the loan repayment.

The Lease-Purchase Agreement resembles a Contract for Deed since it combines elements of a lease with an option to buy at the end of the lease term. Although the immediate rights and obligations are more akin to a rental, there's a clear path to eventual ownership, much like the promise of a deed transfer after payments are complete in a Contract for Deed.

A Trust Deed, or Deed of Trust, parallels a Contract for Deed regarding the presence of a third-party trustee. While the Contract for Deed involves a direct agreement between buyer and seller, a Trust Deed involves a trustee who holds the property's title until the loan is paid off, at which point the title is conveyed to the borrower.

An Owner Financing Agreement encompasses the core essence of a Contract for Deed by offering the buyer a means to purchase a property directly from the seller without a traditional mortgage lender. Both agreements allow the seller to finance the purchase, with terms and conditions set between the buyer and seller, leading to eventual ownership.

The Installment Sale Agreement mirrors a Contract for Deed in its structure of payments over time. This similarity lies in dividing the total purchase price into periodic payments. Upon completion of all scheduled payments under either agreement, the ownership of the property is transferred to the buyer.

Dos and Don'ts

When completing a Contract For Deed form, it is essential to approach the task with diligence and attention to detail to ensure that all parties are protected and that the agreement is legally valid. Following are ten dos and don'ts that should guide you through this process:

Do:- Review the entire form carefully before beginning to fill it out, to understand all the terms and sections.

- Ensure all parties’ names are spelled correctly and match their legal identification.

- Complete every section with accurate and detailed information; if a section does not apply, write “N/A” (not applicable).

- Include a comprehensive description of the property being sold, attaching additional sheets (exhibit "A") if the space provided is insufficient.

- Be clear about the payment terms, including the total purchase price, down payment, interest rate (if applicable), installment amounts, and due dates.

- Use a calculator to ensure that all numerical figures, especially those related to financial terms, are correct.

- Detail the responsibilities for taxes, insurance, and assessments as agreed upon between the seller and purchaser.

- Clarify the condition in which the property is being sold (e.g., “as-is”) and the purchaser's acknowledgment of the same.

- Have all parties sign and date the contract to validate it, including witnesses or a notary public as required by state law.

- Retain copies of the completed Contract For Deed for all parties involved for record-keeping and reference.

- Leave any sections blank unless they are truly not applicable to your agreement.

- Rush through filling out the form without verifying the information provided.

- Forget to specify the legal description of the property being sold; a street address alone may not be sufficient.

- Omit details regarding who will maintain, insure, and pay for taxes on the property during the contract period.

- Assume any terms are standard or implied; all terms should be explicitly stated in the contract.

- Sign the contract without reading and understanding every part of it, including the small print.

- Disregard state-specific requirements or provisions that might need to be included in the contract.

- Use vague language that could lead to misunderstandings or disputes in the future.

- Forget to check if additional documentation is required to accompany the Contract For Deed.

- Overlook the need for professional advice if there are any uncertainties about the contract's terms or legal implications.

Misconceptions

Contracts for Deed, often misunderstood, provide a unique path towards homeownership, but it's not without its misconceptions. Let's shed some light on the most common misunderstandings:

- It's the same as traditional ownership. A common misconception lies in equating a Contract for Deed with immediate homeownership. In reality, the purchaser does not obtain full legal title until the entire purchase price has been paid, differing significantly from traditional mortgage financing where ownership is transferred immediately.

- No legal protections for buyers. Some people mistakenly believe that buyers are left without protections under a Contract for Deed. Although it's true that these contracts can offer less protection than traditional mortgages, buyers are not entirely without recourse. For instance, many states have specific laws designed to protect Contract for Deed buyers, including those that offer a grace period to catch up on overdue payments before facing eviction.

- Sellers can evict buyers easily for missed payments. The belief that sellers can immediately evict purchasers with minimal notice upon a missed payment is not entirely accurate. While it's true that contracts for deed allow sellers to retain legal title until the contract's terms are fulfilled, most states require sellers to undergo a judicial process to terminate the contract, providing buyers with an opportunity to remedy the default.

- Contracts for Deed are only for buyers with bad credit. Although these contracts can be an option for those unable to secure traditional financing, it’s not their sole purpose. For some, a Contract for Deed might be appealing due to its potentially lower closing costs, quicker possession, or the ability to negotiate flexible terms directly with the seller.

- Interest rates are always competitive. Another misconception is that the financing terms, including interest rates, of a Contract for Deed are always on par with or better than traditional loans. The reality is, interest rates, like many aspects of these contracts, are negotiable and can sometimes be higher than those offered by banks, reflecting the potentially higher risk the seller is assuming.

Understanding these aspects of Contracts for Deed can help buyers and sellers navigate their transactions more effectively, setting realistic expectations from the beginning.

Key takeaways

Understanding the Contract for Deed form is crucial for both sellers and purchasers. This legal agreement facilitates the sale of property by allowing the buyer to pay the seller over time, essentially offering an alternative financing method. Here are six key takeaways to help guide you through filling out and using this form effectively:

- The Basics Are Fundamental: At its core, a Contract for Deed details a sale of property where the seller agrees to transfer the title to the buyer once the full purchase price has been paid, often through an installment plan.

- Property Description Is Key: A comprehensive description of the property being sold, along with any associated rights and improvements, must be clearly outlined. Remember, the more specific, the better to avoid future disputes.

- Payment Terms Need Clarity: Payment arrangements, including down payment, installment amounts, interest rates (if applicable), and the schedule for payments, should be explicitly stated. This clarity safeguards both parties' interests and sets clear expectations.

- Time Is Of The Essence: Emphasizing the importance of timely payments underscores the seriousness of the contract's terms. Missed or late payments can lead to consequences outlined in the agreement.

- Maintenance And Improvements: The buyer typically agrees to maintain the property and not remove any improvements. This ensures the property's value is preserved until the deed is transferred.

- Taxes, Insurance, And Other Assessments: The contract should specify who is responsible for taxes, insurance, and assessments during the term. This includes who will carry liability and property insurance, and how taxes are to be handled to prevent liens against the property.

Whether you're a buyer looking to understand your obligations, or a seller aiming to secure your interests, a well-structured Contract for Deed can pave the way for a smooth transaction. Always consider consulting with a legal professional to tailor the agreement to your specific situation and to ensure all local legal requirements are met.

Popular PDF Forms

Commercial Invoice - Crucial for calculating the total value of shipped goods, influencing tax and customs duty calculations.

Escort Service Employment Contract - Emphasizes the escort's warranty on not having any felons or legal issues that could affect their work or the agency's reputation.

Alaska 809 - The form facilitates the replacement of vehicle titles, helping to maintain accurate and up-to-date records within the state’s motor vehicle department.